|

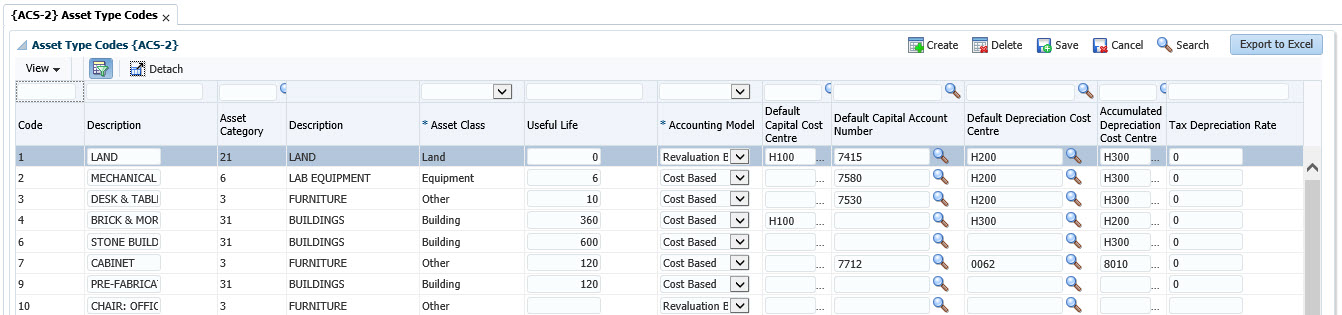

This option is used to define Asset Types and to set default values per asset type. The purpose of Asset Type Codes are to group asset together. Asset Types are linked to an Asset Category, which is a broader grouping of similar Asset Types.

| Field | Type & Length |

Description |

|---|---|---|

| Code | N4 | An unique code for the asset type and a description of the type code. |

| Asset Category | N2 | The asset category linked to the asset type. Asset categories are defined in {ACS-1} . This asset category is not updateable if the asset type has been linked to an asset. |

| Asset Class | A1 | The class of asset linked to the asset type. The following asset classes can be linked to an asset type:

This asset class is not updateable if the asset type has been linked to a asset. |

| Tax Depreciation Rate | N3.2 | The default tax depreciation rate for the asset type is expressed in percentage. |

| Useful Life | N4 | The default useful life of the asset type. Useful life is expressed in months |

| Accounting Model | A1 | The accounting model to be used on the asset type. The system supports the (C)ost Based model and (R)evaluation models. |

| Default Capital Cost Centre | A6 | The default cost centre that will default as the capital cost centre when an asset is created. |

| Default Capital Account Number | A8 | The default account that will default as the capital account when an asset is created. |

| Default Depreciation Cost Centre | A6 | The default depreciation cost centre that will default as the depreciation cost centre when an asset is created. |

| Default Accumulated Depreciation Cost Centre | A6 | The default accumulated depreciation cost centre that will default as the accumulated depreciation cost centre when an asset is created. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 21-AUG-2007 | v01.0.0.0 | Elize de Swardt | t137484 | New manual format. |

| 23-Jan-2008 | v01.0.0.1 | Amanda Nell | t146713 | Add new images |

| 19-JAn-2009 | v01.0,.0.2 | Marchand Hildebrand | t152121 | System Owner Proof Read |

| 09-Jul-2014 |

v04.0.0.0 |

Nokuthula Mafenuka |

t197279 |

Add new image |

| 29-Apr-2016 |

v04.0.0.0 |

Farai Mukwambo |

t197279 |

Changed block to panel box and updated image |

| 20-Jul-2020 |

v04.1.0.0 |

Ndivhanga Mushando |

t244649 |

Update manual to INT 4.1 |