|

Educational institutions do not usually

depreciate their assets in the same way as commercial undertakings do,

and the depreciation facility in this system is intended to be used

only for those assets which belong to other bodies and where

depreciation may be required.

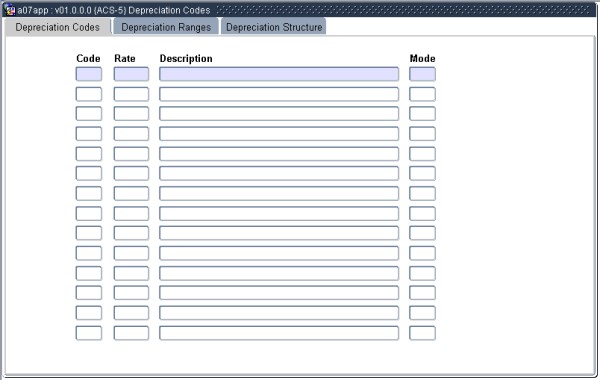

Depreciation code "01" is reserved for zero depreciation, and should be

applied to all the assets owned by the institution. The user may create

other types with varying rates of depreciation.

| Field | Type & Length |

Description |

|---|---|---|

| Code | N2 | A unique code allocated to the particular rate of depreciation. |

| Rate | N2.2 | The percentage depreciation used in the annual calculation. |

| Description | A30 | The type of depreciation. |

| Mode | A1 | Enter whether the asset should be depreciated on a (S)traight-line basis or (R)educing scale balance. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Year | N4 | x |

| Range Code | N2 | |

| Lower Value | N15 | |

| Upper Value | N15 |

|

| Field | Type & Length |

Description |

|---|---|---|

| Asset Category | x | x |

| Asset Category Description | ||

| Standard/Tax Depreciation | ||

| Range Code for Depreciation | ||

| Depreciation Code | ||

| Depreciation Rate | ||

| Method | ||

| Depreciation Code Description |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 20-Oct-2006 | v01.0.0.0 | Amanda Nell | t134002 | New manual format. |