|

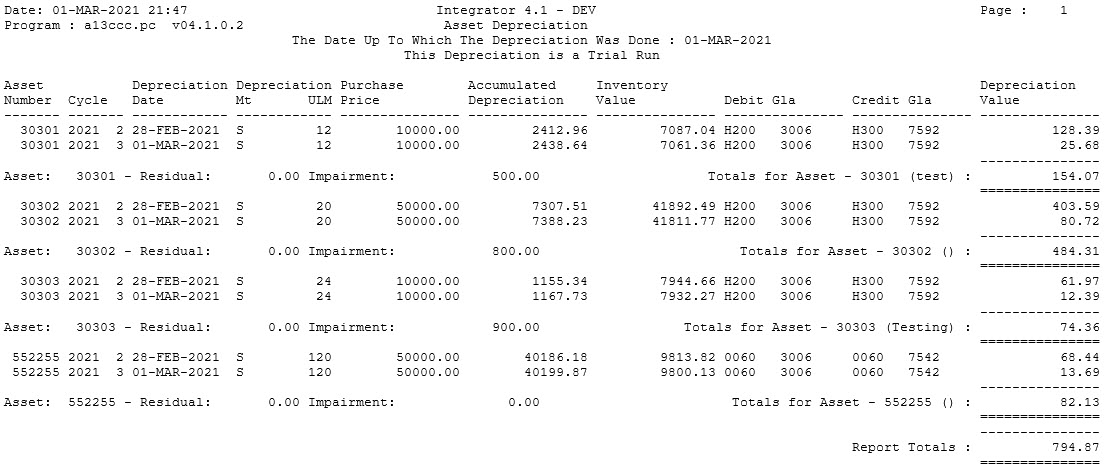

This option calculates and generate depreciation transaction in the asset subsystem up to the up depreciation date.

Assets are depreciated using the useful life of an asset. The asset is depreciated over the number of useful days in the useful life of the asset. Useful life is expressed in months

The depreciation program calculates the number of day in the assets useful life of an asset. Then dividing the depreciable amount by the number of days the program calculates a depreciable amount per day for the asset. Depreciation is calculated by getting the number of days from the previous depreciation date up to the “Up to Depreciation Date” and multiplying the number of days in the period with the daily depreciable amount. In calculating the number of days the use must start on the recognition date adding a day or if the useful life has changed on the date of change taking into account leap years.

The assets inventory value reflects the book value of the asset up to the latest depreciation date and is calculated by subtracting the accumulated depreciation value from the purchase price of the asset. Accumulated depreciation is the sum of all depreciation transaction for the asset. The depreciable value of an asset is the purchase price value of the asset less the residual value of the asset or should the useful life of an asset have changed the net book value or inventory value on date of change less the residual value of the asset.

Depreciation transactions are generated with a financial year and cycle. If the up to deprecation date is logically ahead of the year and cycle of the asset subsystem (AT) all depreciation transaction up to the last day of the month in which the transaction falls that logically corresponds with the AT year and cycle, will be allocated the AT year and cycle. Depreciation transactions where the last day of the month in which the transaction falls correspond with a year and cycle greater than the current AT cycle will be created with the logical year and cycle of the months in which the transaction falls.

Depreciation transactions are created in the subsystem AT and do not automatically created GL depreciation journals. To create GL depreciation journals the subsystem (AT) must be posted to the GL {FGLP-9}.

It is suggest that a trial run be done to verify the depreciation calculation before running depreciation in update.

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| Enter The Date Up To Which The Depreciation Must Be Done | The prompt default is system date | ||

| Is This a (T)rial Run or (F)inal Run ? [T] | A1 | In trail depreciation is calculated but no depreciation transactions are generated, in update mode depreciation transaction are generated |

| Sort Order | Per | Comments |

|---|---|---|

| Asset Number, Financial Year and Financial Cycle |

| System Select | |

|---|---|

| All the assets in the selected range |

|

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 11-Oct-2007 | v01.0.0.0 | Charlene van der Schyff | t145484 | New manual format. |

| 12-Nov-2009 | v01.0.0.0 | Marchand Hildebrand | t158353 | Manual review |

| 23-Feb-2021 |

v04.1.0.0 |

Ndivhanga Mushando |

t247834 |

Update output images |