|

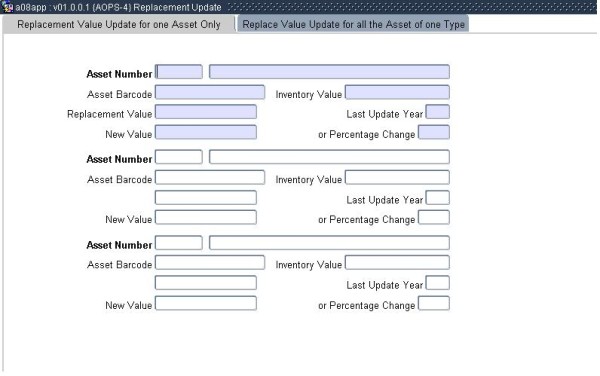

Replacement values for assets must

be updated annually.

| Field | Type & Length |

Description |

|---|---|---|

| Asset Number | N7 | The asset number is entered, and

the following are displayed:

|

| New Value | N16.2 | The user may now enter a new replacement value or a

positive or negative percentage change to the existing replacement

value. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Type Code | N4 | The Type Code is entered,

and the Type Name is displayed. |

| Up to Year | YYYY | The

year of acquisition, prior and up to, for which the update should be

done, must then be entered and the following fields are displayed:

|

| Percentage Change | N3.2 | This information will assist the user in deciding what percentage change should be made to the replacement values. This percentage may be either positive or negative. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 20-Aug-2007 | v01.0.0.0 | Elize de Swardt | t137484 | New manual format for IFRS. |

| 23-Jan-2007 | v01.0.0.0 | Amanda Nell | t146713 | Add new images |

| 05-May-2009 | v01.0.0.1 | Marchand Hildebrand | t158353 | Manual Review |