|

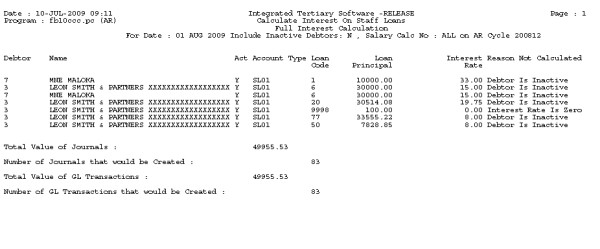

The calculation of interest is “event” FV: “AR - Staff Loans Interest”. Before this program can be executed the first time, the user must create a suitable Transaction Type (TT) via {FCSO-7) and link it to this event. The revenue account to which the interest amount should be credited, as well as the debtors control account, will be retrieved from the Loan Detail in {FARS-2}; they are thus not required in the definition of the TT.

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| Do you want to do a (S)ingle or (F)ull interest calculation. | A1 | |

|

| (T)rial or (F)inal run. | A1 | ||

| If (S)ingle, system requests whether: | |||

| Enter Debtor code to calculate interest for. | N9 | |

|

| Enter Loan code to calculate interest for. | N4 | ||

| Enter date to be inserted with interest transactions (this date will determine the date up to which interest will be calculated). | DD-MON-YYYY | ||

| Include inactive debtors? (Y/N) | A1 | ||

| Enter Salary calculation number (1-9) or ALL | A3 | ||

| If (F)ull, system requests whether (T)rial or (F)inal run. | |||

| Enter date to be inserted with interest transactions (this date will determine the date up to which interest will be calculated) | DD-MON-YYYY | ||

| Include inactive Debtors? (Y/N). | A1 | ||

| Enter salary calculation number (1-9) or ALL. | A3 | ||

| Sort Order | Per | Comments |

|---|---|---|

| System Select | |

|---|---|

| No special system selection |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 29-May-2008 | v01.0.0.0 | Charlene van der Schyff | t145484 | New manual format. |

| 10-Jul-2009 | v01.0.0.1 | Charlene van der Schyff | t158351 | Edit language obtained from proof read language Juliet Gillies. Inserted image. |