|

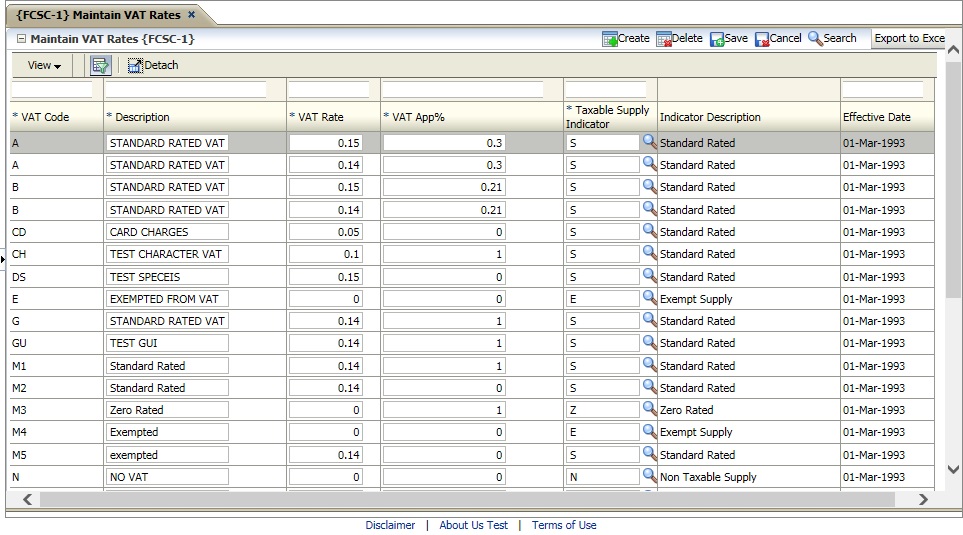

VAT / GST rate codes and attributes such as rate and taxably supply indicator are defined in this option.

During the processing of financial

transactions / documents which relate to the making of a taxable

supply, the VAT / GST processed is calculated using the rate linked to

VAT / GST code entered by the user. For the various financial programs

to do this, the user must supply the VAT code. By entering a VAT / GST

code the user not only selects a rate to be applied but also classifies

the transaction in terms of VAT / GST treatment.

| Field | Type & Length |

Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VAT Code | A2 | Supply a unique code. |

|||||||||||||||

| Name | A40 | Supply a suitable description to describe the code. |

|||||||||||||||

| VAT Rate | N5,3 | The VAT /GST rate applicable to

the code supplied

above. The rates specified here must be the rates as supplied by the

local tax authority. In the event of the local tax authority

changes rates, it is the user's responsibility to contact Adapt

IT ensure that the rates

are changed here accordingly. |

|||||||||||||||

| VAT Apportionment | N5.3 | Supply the apportionment rate to be applied to the VAT

rate. Normally when a vendor makes a taxable supply the full amount of input VAT may be claimed. However, where goods or services are imported or acquired for mixed purposes (taxable standard rated and exempted) input may only be claimed to the extent that the institution is making taxable supplies. Where the expense cannot be directly attributed to either taxable or exempt supplies the input tax, which may be claimed, has to be calculated according to the apportionment percentage obtained, using an approved method. |

|||||||||||||||

| Taxable Supply Indicator | A1 |

Classifies the transaction in terms of VAT / GST treatment. VAT/ GST is an indirect tax levied on transactions rather than persons.

The concept of supply is integral to the application or VAT / GST and can be broken down into:

The application contains the following business rules:

|

|||||||||||||||

| Effective Date | DD-MON-YYYY | The date the rate became effective. The purpose of the effective date is to cater for rate changes should they occur. |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 20-Jul-2006 | v01.0.0.0 | Elsabe | t133454 | New manual format. |

| 29-Jan-2009 | v01.0.0.1 | Ernie van den Berg | t155140 | Review the button. |

| 14-Jul-2009 | v02.0.0.0 | Marchand Hildebrand | t158613 | Add the taxable supply indicator to the VAT rate definition. |

| 09-Nov-2015 | v04.0.0.0 | Marchand Hildebrand | T199722 | ADF conversion |