|

| Field | Type & Length |

Description |

|---|---|---|

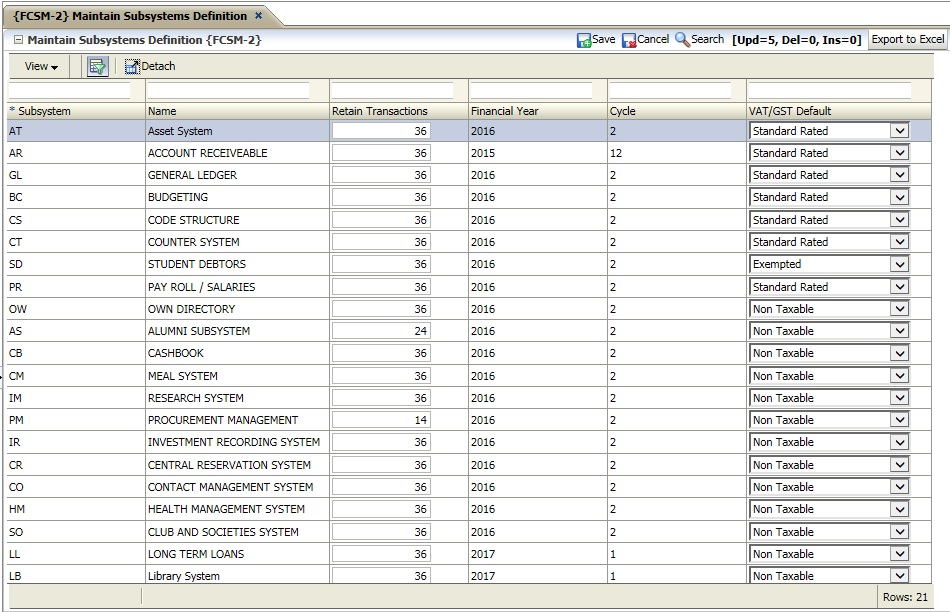

| Code | A2 | Subsystem codes are system defined

and no records can be

inserted or deleted. |

| Name | A30 | Displays the subsystem name. |

| Retain Transactions | N2 | Indicate in cycles how long transactions for the

specific subsystem

should be retained. A maximum of 36 cycles and minimum of 14 cycles are

allowed. The user should note that the minimum cycles for the Payroll

System is 24 cycles. If less than 24 cycles are specified, for the Payroll, the subsystem will automatically default to 24 cycles. |

| Financial Year/Cycle | N4/N2 | The current financial year and cycle of

the subsystem. This fields are not updateable. The financial

year

and cycle is updated when Period end and /or Post to

General

Ledger with the parameter increment cycle are

executed. |

| VAT / GST Default | A1 | The system allows for a tax default on sub system level

for

VAT/GST purposes. Should all the activities in a subsystem

relate

to a specific type of supply, for example, under SA VAT legislation,

supply of educational service are exempted from VAT, setting

the

default to E- Exempted, the supply indicator of Exempted and a rate of

0.00 will default when the user process

any transaction in

the subsystem. Institutions should be cautious when setting the default to non-taxable where the entity is registered for tax. It is suggested that Institutions seek advice form a qualified tax practitioner in this regard. The following tax defaults are available, Standard Rate, Exempted, Zero Rated, Non-taxable and Cost Centre. Valid values are: S - Standard Rated E - Exempted Z - Zero Rated N - Non-taxable C- Cost Centre default - The vat code as defined on the cost centre will be used as a default. |

|

|

Processing

Rules

|

|

|---|---|

|

Open Cycles |

For

reporting and reconciliation purposes transaction are grouped together

based on the financial period to which the transaction relates. Open

cycle’s supports the processing of transactions into the

current

and future financial cycles deriving transactions cycle’s

according to the document or reference date. This is particularly

useful at and after month ends where all transactions relating to the

old month have not yet been processed and there is a need to process

the new month transactions. The Open Cycle concept is driven by the transaction type of a transaction where the Open Cycle indicator on the transaction type determines if the logic is applied. If the “Use Open Cycle” sod is set to yes and the indicator on the transaction type definition is set to yes the cycle is derived from the document / reference date and provided that the derived cycle is equal or greater than the system cycle for the subsystem {FCSM-2} the derived cycle is used as the transaction cycle. If the derived cycle is less than the system cycle for the subsystem, the system cycle is used as the transaction cycle. Once the system cycle has been incremented the old cycle is closed and the current and future cycle in the year is open for transaction processing provided that open cycles are used. |

| New Install | When a new client is installed the fields year, cycle, retention period and tax default are null and should be updated to the appropriate values. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 27-Sep-2006 | v01.0.0.0 | Amanda Nell | t133486 | New manual format. |

| 02-Feb-2009 | v01.0.0.1 | Ernie van den Berg | t155140 | Review the manual. |

| 24-Nov-2011 | v02.0.0.0 | Marchand Hildebrand | t178236 | Apply to Int 2 |

| 25-May-2012 | v02.0.0.1 | Marchand Hildebrand | t182907 | Remove number of approvals from the manual |

| 16-Oct-2014 | v03.0.0.0 | Marchand Hildebrand | t195346 | Add Open Cycles |

| 23-Feb-2016 |

v04.0.0.0 |

Matete Masite |

t209187 |

Updated the image

and changed |