Phase 1: Validate General Ledger

- Control General Ledger Cycles.

- The Primary General Ledger should be in cycle "13", thus indicating

that all "normal" transactions for the year have been finalised and

that the year-end close transactions need to be processed. If not, the system will respond with: "Ledger must be in

cycle 13 to continue year end". The secondary Ledgers should be in

their final cycle.

Report Line - General ledger is in cycle 13 or secondary GL,

- Validate that the fields cost centers and account on all transactions on the GL have a valid values

Report Line - The CC or account fields are not null

- Control Subsystem Cycles.'

- All the sub-systems should

be in the next financial year, thereby ensuring that no further

transactions will be posted from them. If not, the system will respond

with: "The fin year of subsystems must be in next financial year,

before year end process can continue". The system will validate for

transactions against "invalid" GLAs. This action is the same as for

Report {FGLPR1-3}, and will be done for the "present" financial year

only. If "invalid" transactions are found, the report will be printed.

The system will not go past this option until the present year report

is clear.

- All sub-subsystem have been posted for the year being closed.

Report Line - PM Credit has been posted for year

Report Line - Ar has been posted for year

Report Line - PM Stores has been posted for year

Report Line - The fin. years of subsystems are correct,

- Validate that Default Accounts required for Transfer of Surplus / Shortfall to the Fund Balances {FCSM-1 b1}

- During the year-end

process, the system will generate a journal, for the balance of the

difference between the income and revenue in a cost center. The

journal will credit the transfer account in the cost center and debit

the Accumulated Funds account if the net of revenue less

expense is negative or debit the transfer account and

credit the Accumulated Funds account if the net of revenue

less expense is positive. The user is notified of the account

numbers of these accounts.

- SURPLUS / SHORTFALL ACC: Indicate the number of the account in which the system will calculate the net income/expenditure

- TRANSFER TO ACCUMULATED

FUND ACC: Indicate the account number to be used as the opposite for

the net value. This account will still be in the range of Income and

Expenditure accounts: it will, therefore, result in a zero

Income / Expenditure after the journal is processed.

- ACCUMULATED FUND ACC: Indicates the Balance Sheet account to which the net value should be transferred.

- The system will use these

accounts to generate journals "within" cost

center. If a cost centers represent activities that should

be cleared and not transferred to Accumulated Funds then journals should be done manually.

- It is possible to start

the account structure with either revenue or expense accounts or

asset and liability accounts. The income statement (revenue or expense

accounts) and balance sheet ( asset and liability accounts )

of the account structure are separated by the transfer account

identified through its account category 490. Accounts in these sections

may not be mixed, the balance sheet may not contain revenue or expense

accounts and the income statement may not contain asset and

liability accounts.

Report Line - Default accounts in system operational detail

Report Line - Accumulated fund

account is linked to account category 700

Report Line - Transfer to account

fund is linked to account category 490

Report Line - Only one transfer account exists

Report Line - Account structure

defined to start with A and L accounts - No R or E accounts found in

range less than surplus account

Report Line - Account structure defined to start

with A and L accounts - No A or L accounts found in range greater than

surplus account

Report Line - No Account exists where the account category type is not R,E,A or L

Report Line - No Account exists where the account category type is

R or E with an account category greater than or equal to 490

Report Line - No Account exists where the account category type is A or L with an account category less than 490

- Validate that Transaction Types are Linked to the Year-end Events.

- FN = Rev and Exp to Balance

- FO = Balance Sheet to Next Year

- FY = Posting Debtor/Creditor inter-ledger

- FQ = Posting budget to next year

- FT = Posting budget to next year (reversal of current budget)

- FP = Posting commitments to next year

- For all these events, the

user must create and link a transaction type to these events. The

system will use these transaction types to generate its automatic

entries. Note that for event "FY" the system will use the debtor and

creditor's GLAs specified on the definition of the Ledgers in option

{FCSC-3}.

Report Line - Transaction code 781 linked to event : fn

Report Line - Transaction code 782 linked to event : fo

Report Line - Transaction code 786 linked to event : fy

Report Line - Credit GLA 000100000001 linked to secondary GL DI (inter ledger)

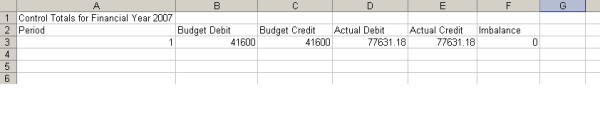

- Test Balance of General Ledger.

- The system will control

that the General Ledger totals are in balance, and thereafter it will

control that the imbalance on the Secondary Ledger is equal to the

imbalance on the Primary Ledger. This can be controlled with the Trial

Balance Report or a Cost Center / Account Cost Report for the whole

ledger. Imbalances will normally be caused by faulty cost center or

account structures, but since balancing should be part of the monthly

procedure, one would expect this to be in order. If not, the system

will respond with: "General Ledger not in balance" and if the second

test fails: "Imbalance on different Ledgers not equal".

Report Line - General ledger is not in balance

Debit: 3571776479742.23

Credit: 3571776564047.23 Balance: -84305.00 Failed

- Validates that all GLAs on the GL table is valid for the year {FCSO-7}

Report Line - All GL transactions valid

- Account Category Validation

Report Line - No Account exists where the account category is null

Report Line - No Account exists where the account category type is not R,E,A or L

Report Line - No Account exists where the account category type is R or E with an account category greater than or equal to 490

Report Line - No Account exists where the account category type is A or L with an account category less than 490

- Accounts in Account Category = 999 should have Non-Zero Balance

- If the user requires the year end process to fail

if any balance exist on an account with the accounts category 999 the

input parameter must be set to (Y)es

Report Line - Accounts in account cat. 999 are zeroed

- Accounts with code less than net surplus/shortfall acc

And category type 'A' or 'L' are zeroed,

- Should the user require asset or liability accounts in

the revenue and expense range the program will validate that

these accounts have zero when the year end close is performed.

Report Line - Accounts with code less than net surplus/shortfall acc and account category type 'A' or 'L' have non-zero value

|