|

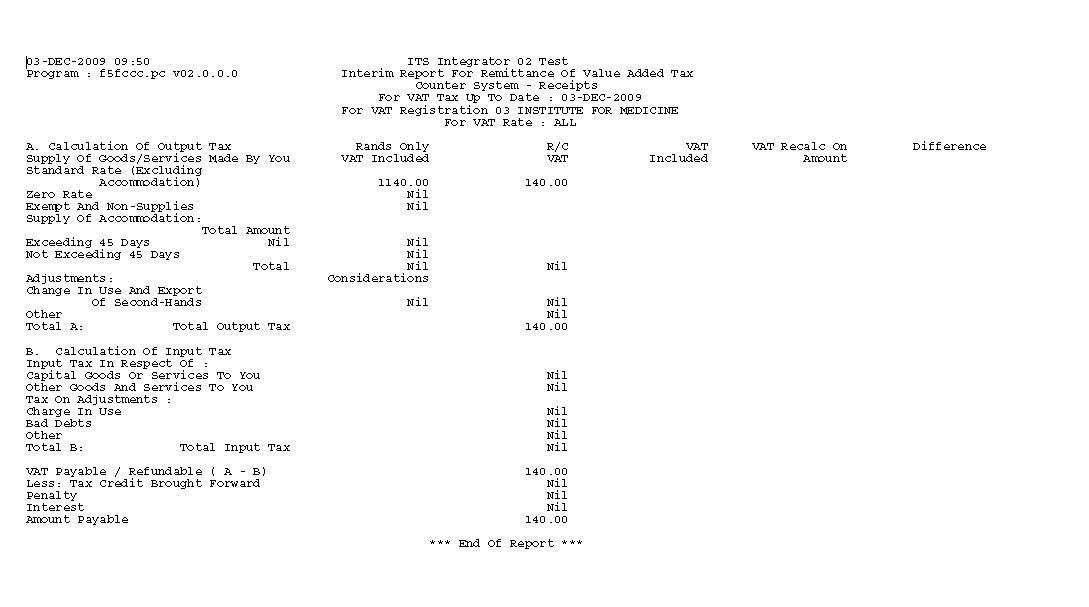

This option is used to print or reprint VAT 201 return as prescribed by the Receiver of Revenue (RSA).

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| Supply the VAT Registration Code (EXIT=XX) | A2 | The VAT registration for which the

VAT201 report is requested. VAT registrations are defined in the option

"Maintain VAT Registrations {FCSC-2}. Enter XX to skip all prompts and exist the program. |

|

| Is this a (R)eprint or (I)nterim or (F)inal Report (R/I/F) | A1 | (I)nterim - generates

the VAT201 report for transactions up to the reporting date but does

not flag the VAT transaction with the VAT reporting cycle. (F)inal - generates the VAT201 report for transactions up to the reporting date and flags the VAT transaction with the VAT reporting cycle. (R)eprint - reprints for a VAT year and cycle. |

|

| If the user selects Interim | |||

| Select a Number from the List : 1. Counter System - Receiveable 2. Counter System - Cheques 3. Accounts Payable 4. Accounts Receivable 5. General Ledger 6. Stores 7. Student Debtors 8. Cash Book 9. ALL of the Above Your Selection |

N1 | When running the VAT 201 report in interim the

user can request the report per subsystem or for all

subsystems. This allows the user to reconcile per subsystem and

eliminate subsystems that reconciles should discrepancies exist. |

|

| Up to which Date Must Transactions be Included | DD-MON-YYYY | The date up to which transactions must be included for the report. | |

| If the user selects Final | |||

| Up to which Date Must Transactions be Included | DD-MON-YYYY | The date up to which transactions must be included for the report. | |

| If the user selects Reprint | |||

| Supply the Reported Tax Period for the Report (YYYYMM) | N6 | The VAT reporting year and cycle for which to re-print the VAT201 report. | |

| Sort Order | Per | Comments |

|---|---|---|

| Counter System - Receiveable Counter System - Cheques Accounts Payable Accounts Receivable General Ledger Stores Student Debtors Cash Book Total Report |

| System Select | |

|---|---|

| No special system selection. |

|

|

|

|

|

|

|

|

|

| Processing Rules |

|

|---|---|

| The program contains specific logic relating to each subsystem and the VAT boxes linked to a transaction type per subsystem. | |

| Boxes 1,2,3,5,7,10,22,23 If subsystem is CT,CB

|

|

| Boxes 4,9,11,12 If subsystem is CT,CB

|

|

| Boxes 14,15,16,17,18 If subsystem is CT,CB

|

|

| Boxe 21 If subsystem is CT,CB

If subsystem is GL

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 03-Dec-2009 | v02.0.0.0 | Marchand Hildebrand | t158613 | Add stock sales transactions to the VAT201 report. |