|

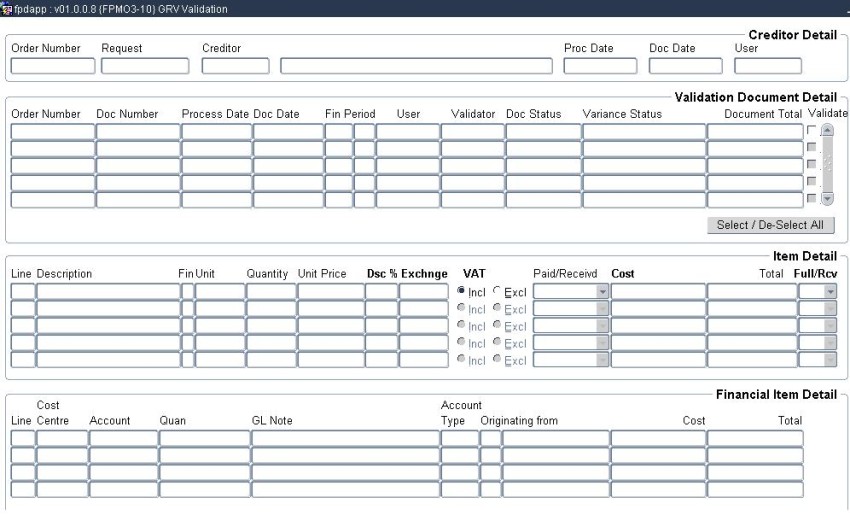

All iEnabler generated GRV's (Web GRV Documents) must pass through a validation phase. This options allows users with validation privileges to perform the validation function and perform validation maintenance if required.

This block displays the Order / Request information of the GRV's displayed in the second and third block. The block can used to enter a query to select specific GRV's for validation using any of the fields or any combination thereof.

| Field | Type & Length |

Description |

|---|---|---|

| Order Number | A15 | The order number is the main selection. Use the LOV to show all available orders with GRVs for validation allocated to the specific validator. |

| Request | A15 | The requisition number that led to the order to be placed, if any. |

| Creditor | N10+A40 | The creditor code that on which the order has been placed and delivered the items. |

| Proc Date | DD-MON-YYYY | Date on which the order has been processed. |

| Doc Date | DD-MON-YYYY | The document date of the order linked to the GRV. |

| User | A8 | The user that processed the order linked to the GRV |

On <NEXT BLOCK> from Block 1 the GRV's from

the Order will be displayed in Block 2

| Field | Type & Length |

Description |

|---|---|---|

| Order Number | A15 | The order document number from which the GRV hes been created and on which the goods were received. |

| Doc Number | A15 | The GRV document number for validation. |

| Process Date | DD-MON-YYYY | The date the GRV document has been processed in the system. |

| Doc Date | DD-MON-YYYY | The document date of the GRV. |

| Fin | N4 | The financial year of the GRV. |

| Period | N2 | The financial cycle of the GRV. |

| User | A8 | The user that generated the GRV. |

| Validator | A8 | The validator allocated to the GRV when the GRV was completed. |

| Doc Status | A20 | The current status of the GRV (should initialy be Validation). If the GRV is selected for validation in block 2 the field will change to indicate the status to which the document will change if the validator has completed the GRV validation and user forwards the GRV for further processing and finally payment.

The document status can change to status 'Normal' or 'Approval'. |

| Variance Status | A30 | The variance status indicates if a line or lines on

the GRV falls outside the allowable Order / GRV variance.

Allowable variance are defined on the SOD codes: The following values can be displayed:

|

| Document Detail | N19 | The GRV amount. |

| Validate | A1 | The 'Validate' tick box is ticked, the document is validated and the document

and variance statuses are updated accordingly. A 'Select / De-Select All' button will mark all documents for validation. If a variance rejection for the document is indicated, the document status will change to 'Approval' else the status will change to normal. |

This block will allow changes to the Unit Price, Disc%, Exchange Rate and Vat Include/Exclude indicator.

| Field | Type & Length |

Description |

|---|---|---|

| Line | N4 | Line number of the item. On right click a pop up menu is

available that allows changes to the financial detail records for

cost distribution purposes. Detail lines may not be added. Financial Item Detail or Set Received/Paid Indicator. The Set Received/Paid option is only available if the line item's Received/Paid option is set to 'Q'uantity. |

| Description | A4000 | Line item description. |

| Fin | A2 | Cost distribution method. Q - Quantity P - Percentage C - Cost |

| Unit | A30 | Describing the grouping of the item eg doz, bundles etc It also cotains the item# for stores and library orders |

| Quantity | N11 | The number of order units that have been received. Unit can have up to 3 decimals. A GRV can receive more units than the quantity ordered. If the paid received indicator is set to "Quantity" the user must enter the total number of order units received. If the paid received indicator is set to "Monetary" the field is a display only field and the system will calculate the quantity value using the cost entered by the user in the cost field. |

| Unit Price | N9 | Unit price is copied from the order when the GRV's is created but may changed by the receiver or during the validation phase. The program will validate if the unit price entered differs from the unit price per order. Variance are defined in {FCSM-1} code BR - "ORD/GRV Variance amount" and BS - "ORD/GRV Variance %". Should the variance be outside the allowable variance the variance will be subject to approvals. |

| Dsc% | N10 | Trade discount perecentage copied from the order when the GRV's was created, may changed by the receiver or during the validation phase. |

| Exchange | N10 | The rate at which the foreign currency value of the receipt will be converted to local currency. The value is copied from the Order Exchange rate is only updateable if the currecny is not local currency and exchange is updateable on PM documents. If the field Exchange Rate Updateable on the Originating document is (Y)es the exchange rate is updateable

Else the field Exchange

Rate Updateable on the Originating document is (N)o the exchange

rate is not updateable and the exchange rate cannot be changed by

the user.

|

| VAT Incl / Excl | BUTTON | Vat = I - Inclusive or E - Exclusive. |

| Paid/Received | A8 |

Paid / Received indicator, indicates the method by which goods will be received. Good can be received in quantity or in monetary value. The paid / received indicator on a GRV is updateable until the first unit of the item has been received (first GRV) thereafter the indicators is set for the item. On the first GRV the value is copied from the order thereafter the indicator is set to the value of the GRV's already received. If the line item is indicated here as 'Q'uantity, the indicator may be changed to 'M'onetary in the line item pop-up menu. 'M'onetary will allow the line to be be received as cost instead of 'Q'uantity.Only changes from 'Q'uantity to 'M'onetary is allowed. |

| Cost | N17.2 | If goods are received based on quantity,

Paid / Received = 'Q' then cost = Quantity * VAT Inclusive Unit

Price . If goods are received based on monetary value , Paid / Received = 'M' then the user enters the cost value and quantity is calculated quantity = unit price / cost. If the cost entered is VAT Exclusive, VAT is added to the unit price Cost is only updateable if the Paid/Received indicator = 'M'onetary. |

| Total | N17.2 | The local currency value of the item which includes the trade discount and exchange conversion. |

| Full/Rcv | A2 | Fully Received can be set up when the iEnabler GRV is

created, or it can be changed at validation, which will close the item

detail as Fully Received. The result of marking a line as fully received is similar to the complete function for a GRV document. |

| Field | Type & Length |

Description |

|---|---|---|

| Line | N4 | Line number of the item. |

| Cost Centre | A6 | The expense cost centre code of the GLA. |

| Account | A8 | The expense account code of the GLA |

| Quantity | N11 | The number of units for this line item. |

| General Ledger Notes | A30 | The note to follow the tansaction to the general ledger. |

| Account Type | A4 | Creditor account Type. |

| Originating From | A2+A15 | The order from which the GRV was created. The Document Type of the copied document The Document Number of the copied document |

| Cost | N17.2 | Cost price of item. |

| Total | N17.2 | The local value of the line. |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 01-Jun-2007 | v01.0.0.0 | x | t12345 | New manual format. |

| 01-Mar-2011 | v01.0.0.0 | Kobus Kleinhans | t163381 | Completed field descriptions |

| 14-Nov-2011 | v02.0.0.0 | Marchand Hildebrand | t178236 | Apply manual to Int 2 |