|

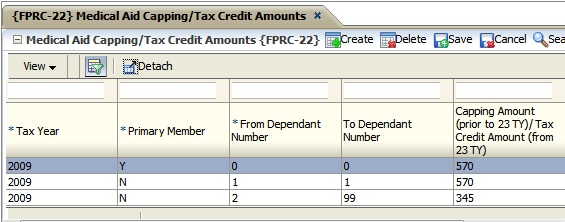

The values in this option are supplied by the South African Revenue Service (SARS) and are populated by ITS. These values are for viewing purposes only and cannot be deleted or changed.

This is a display option only: no changes are allowed.

| Field | Type & Length |

Description |

|---|---|---|

| Tax Year | N4 | The specific tax year for which the record is applicable. |

| Primary Member | Yes/No | Indicates whether the record represents the medical aid primary member. |

| From Dependant Number | N2 | This field indicates the number of dependants as from which the record is applicable for. |

| To Dependant Number | N2 | This field indicates the number of dependants as from which the record is applicable for. |

| Tax Credit Amount | N17.2 | This field represents the tax credit for the specific number of dependants. |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 19-Oct-2006 | v01.0.0.0 | Amanda Nell | T134031 | New manual format. |

| 18-may-2007 | v01.0.0.0 | Allie de Nysschen | T134031 | Enhancements. |

| 17-Aug-2009 | v01.0.0.1 | Charlene van der Schyff | T161012 | Edit language obtained from proof read language Juliet Gillies. |

| 01-Mar-2013 | v02.0.0.0 | Sister Legwabe | T189018 | Medical Aid Tax Credits |

| 16-Oct-2015 |

v04.0.0.0 |

Frans Pelser |

T198075 |

Correct image dimensions |