|

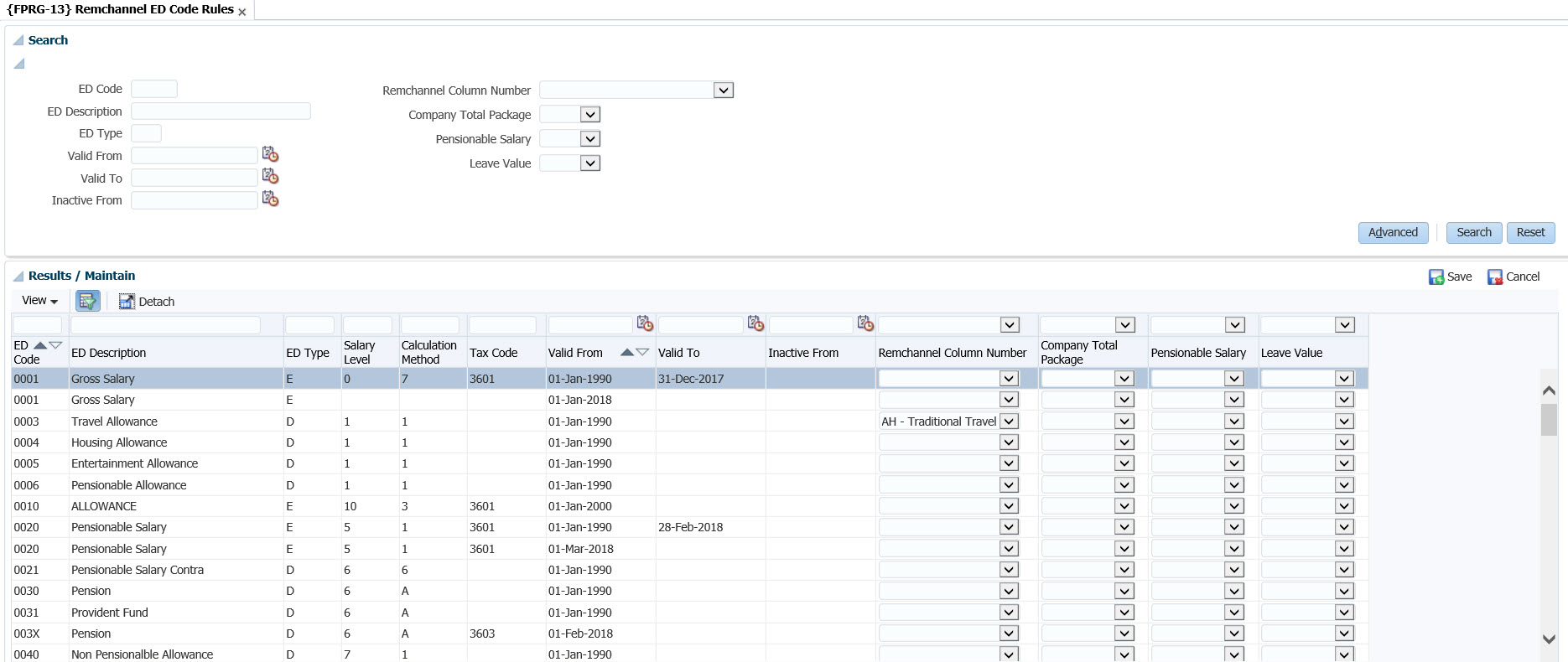

Remchannel Spreadsheet Column Number

|

DESCRIPTION

|

REPORTING DETAILS

|

|

T

|

Basic Cash

|

Monthly rand value of the employee paid through the payroll - companies

on total / flexible package structure this is the cash "left over"

after allocation to permitted remuneration items, and is typically the amount

paid monthly as cash through the payroll.

This is a compulsory field and may not contain any blank cells.

|

|

U

|

Annual Guaranteed Bonus

|

Monthly rand value of the current guaranteed annual bonus/ 13th cheque/

holiday leave allowance or structured guaranteed annual bonus.

|

|

V

|

Performance Bonus

|

Monthly rand value of the most recently paid incentive / performance /

production and/or any other non-guaranteed bonuses over the past 12

months.

The bonus value should account for the full declared bonus and not only

reflect the portion paid in cash, before any deferrals are allocated to

either a short-term or longer-term savings/retention scheme.

|

|

X

|

Combined Retirement Fund

|

The monthly rand value of the company's contribution to the registered

combined retirement scheme if applicable i.e. to a combined provident /

pension fund scheme arrangement.

|

|

Y

|

Pension Fund

|

Provide the monthly rand value of the company’s or structured contribution

to the pension fund, if applicable.

|

|

Z

|

Provident Fund

|

Provide the monthly value of the Company’s or

structured contribution to the provident fund, if applicable.

|

|

AA

|

Medical Scheme

|

Provide the monthly amount that the Company pays towards an individual’s

medical aid scheme or the effective value of an in-company medical assistance

scheme/program. If the full Medical Scheme contribution is paid from the

total package/flexi package, please insert the full amount as being

indicative of the company contribution.

|

|

AD

|

Housing Allowance

|

Provide the actual monthly housing subsidy or housing allowance amount

that an employee receives. This is a compulsory field and may not contain any

blank cells. If you do not have this benefit at your company please insert a

zero in each of the cells in this column.

|

|

AE

|

Free/Subsidised Housing

|

Provide the monthly fringe benefit rand value of the free/subsidised

housing that an employee receives. If the accommodation is a residential

property owned by employer please reflect the Receiver of Revenue value for

the property as a monthly amount. If

the accommodation is a Hostel, please reflect the value as agreed at the User

Group Meeting for each individual employee who makes use of the hostel

accommodation.

|

|

AF

|

Traditional Company Car

|

Provide the actual purchase value of the vehicle including VAT i.e. tool

of trade. (The value of the benefit of

the traditional company car will be calculated for survey purposes from this

data together with information provided on the survey Remuneration Policies).

The value should be entered into the Reference field of the ED Code,

this will be used for reporting

|

|

AG

|

Structured Company Car

|

Provide the monthly rand value structured by the employee towards a

company car.

|

|

AH

|

Traditional Travel Allowance

|

Provide the monthly rand value of the travel allowance that the employee

receives in terms of the company's car allowance scheme policy. Do not

include any amounts that the employee may have received for business travel

reimbursement.

|

|

AI

|

Structured Travel Allowance

|

Reflect the actual monthly rand value that the employee structures

towards the travel allowance.

|

|

AK

|

Entertainment Allowance

|

Provide the monthly rand value of this allowance, where your company

provides this as an add-on benefit or as a package allocation / salary

sacrifice item.

|

|

AL

|

Telecoms

|

Provide the monthly rand amount that the Company pays for an employee’s

home telephone, mobile or data. Do not include any amounts that the employee

may have received for business reimbursement.

|

|

AM

|

Club Subscriptions

|

Provide the monthly rand amount that the Company pays towards an

individual’s Club subscriptions.

|

|

AN

|

Holiday Accommodation

|

Provide the monthly rand value equivalent of any Company-provided

holiday accommodation. The value is calculated by determining the rental

value/cost of the accommodation for the period provided to the employee

reduced to a monthly amount. (Please discuss with your Key Account Manager if

you have any difficulty with this calculation).

|

|

AO

|

Deferred Compensation

|

Provide any monthly rand amount paid by the Company into a Deferred

Compensation scheme.

|

|

AP

|

Financial Counsel

|

Provide the monthly rand value of this benefit provided by the company

or the amount allocated to financial counseling by the employee from a

flexible / total package remuneration structure.

|

|

AQ

|

Group Risk Benefits

|

Provide the monthly rand amount of the Company’s contribution towards

group risk benefits.

|

|

AR

|

Overseas Travel

|

Provide only the cost of the Company-paid overseas airtickets for

spouses, reduced to a monthly rand amount.

|

|

AS

|

Cheap Assets

|

The difference between the market value of a company asset/product and

the amount that an individual pays, reduced to a monthly figure, should be

reflected.

|

|

AT

|

Academic HOD Allowance

|

Provide the monthly amount of the allowance (Higher Education

participants only).

|

|

AU

|

Market Premium Allowance

|

Provide the monthly rand amount of any market premium/scarcity allowance

paid to the employee.

|

|

AV

|

Proto Team Allowance

|

Reflect

the monthly rand value for employees who are

part

of disaster management team i.e.: Fire Brigade Team/

Emergency Services Team

|

|

AW

|

Shift Allowance

|

Reflect the monthly rand value for employees who are part of disaster

management team i.e.: Fire Brigade Team/ Emergency Services Team.

|

|

AX

|

Standby Allowance

|

This allowance is reflected as a monthly rand amount. The monthly average will be calculated by

summing the amount calculated for this ED Code over the prior 12 months and

divided by 12 to calculated the average monthly amount.

|

|

AY

|

Other Cash Benefits

|

Please reflect the monthly rand value of any Other Cash benefit or cash

allowance, paid through the payroll, which is not already catered for in

other columns on the data spreadsheet e.g. education allowance for children

of employees; servant allowance; transport allowance etc.

|

|

AZ

|

Other Non-Cash Benefits

|

Please reflect the monthly rand value of any other non-cash benefit

which can be converted to a cash value and which is not already catered for

in other columns on the data spreadsheet and is paid to a third party. Do not include the value of gains from share

incentive schemes. A detailed schedule for the treatment of Non-Cash Benefits

is included as Table 4 of Remchannel document.

|

|

BA

|

Commission

|

Reflect this allowance as a monthly rand amount, if applicable. The

monthly average will be calculated by summing the amount calculated for this

ED Code over the prior 12 months and divided by 12 to calculated the average

monthly amount.

|

|

BB

|

On-Target STI

|

Reflect

the average monthly value of the most recent On-Target Short-Term Incentive

value, which the employee would have received based on the company scheme

rules, should all performance measurements be achieved.

The monthly average will

be calculated by summing the amount calculated for this ED Code over the

prior 12 months and divided by 12 to calculated the average monthly amount.

|