|

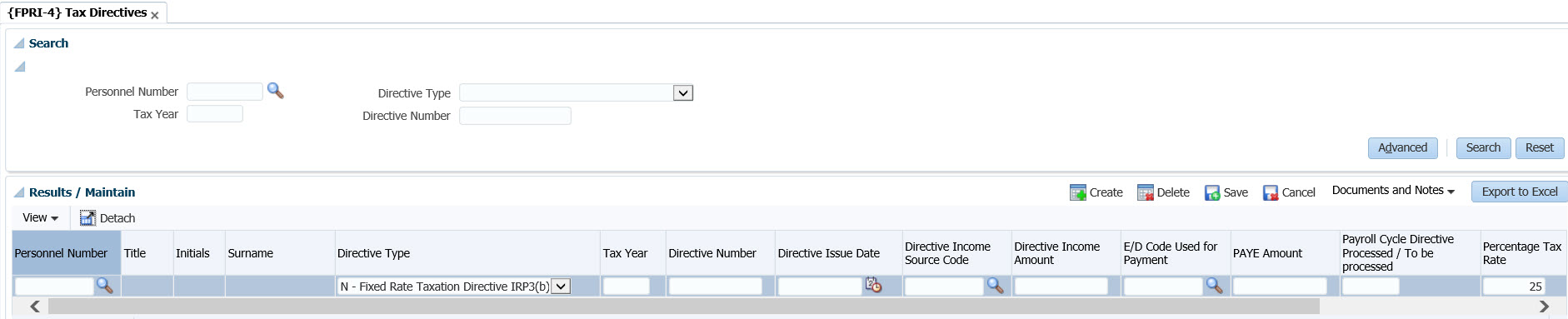

This option provides the facility to capture directives issued to personnel by the Receiver of Revenue.

This menu option also provides Document Storage and Retrieval where documents may be uploaded.

The directive issued will be in respect of either of the following two selections: Percentage Tax Rate or For Lump Sum. The user must complete the applicable one.

| Field | Type & Length |

Description | |

|---|---|---|---|

| Personnel Number | N9 | Supply the personnel number to which the directive applies. The title, initials and surname of the personnel member will default into the name field. | |

| Directive Type | A1 | Select one of the following: Y- Lumpsum Directive N- Fixed rate Taxation Directive IRP3(b) |

|

| Tax Year | YYYY | Supply the tax year to which the directive applies. The tax period will default into the next fields and may be updated.

|

|

| Directive Number | A15 | This is the Directive number issued by SARS | |

| Directive Issue Date | D11 |

SARS) |

|

| Directive Income Source Code | N4 |

Select Source Code from LOV provided. Mandatory, where Directive Type = Y – Lumpsum Directive AND Tax Year >= 2022 The Directive Income Source Code as displayed on the Tax

Directive issued by SARS |

|

| Directive Income Amount | N15.2 |

Enter the Lump Sum Payment amount for which the Tax Directive

was issued. |

|

| E/D Code Used for Payment | A4 |

The ED Code used to process the Directive Income Amount in Payroll. Mandatory, where Directive Type = Y – Lumpsum Directive and Tax Year >= 2022 |

|

| PAYE Amount | N15.2 |

The PAYE Amount reflected on the Tax Directive. (0.00 allowed). Mandatory, where Directive Type = Y – Lumpsum Directive and Tax Year >= 2022 |

|

| Payroll Cycle Directive Processed/to be Processed | N6 |

The Payroll Cycle in which the Tax Directive will be processed This validates to the Tax Year and ensures that the Payroll Cycle falls within Tax Year entered. Mandatory, where Directive Type = Y – Lumpsum Directive and Tax Year >= 2022 |

|

| Percentage Tax Rate | N7.3 | Enter the Percentage Tax Rate. This field may not have a value if Tax Cycle >= 2022 and Directive Type = Y Lumpsum Directive. This field may only have a value where Directive Type = N - Fixed

Rate Taxation Directive IRP3(b) |

|

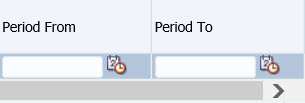

| Period From | D11 | Enter the from date. This field may not have a value if Tax Cycle >= 2022 and Directive Type = Y Lumpsum Directive. This field may only have a value where Directive Type = N - Fixed Rate Taxation Directive IRP3(b) |

|

| Period To | D11 | Enter the to date. This field may not have a value if Tax Cycle >= 2022 and Directive Type = Y Lumpsum Directive. This field may only have a value where Directive Type = N - Fixed Rate Taxation Directive IRP3(b) |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 23-Jan-2007 | v01.0.0.0 | Anelia Terblanche | t134079 | New manual format. |

| 30-May-2007 | v01.0.0.0 | Allie | t138771 | Changes to one directive per tax certificate. |

| 22-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing - Juliet Gillies. |

| 08-Feb-2011 | v01.0.0.1 | Goodman Kabini | t172269 | Add more description on the Processing Rules table. |

| 09-Oct-2017 |

v05.0.0.0 |

Sthembile Mdluli |

t220430 |

Convert the image to the intergrator 5 system version. |

| 13-Aug-2021 | v04.1.0.0 | Kerrylee Naidoo | t249965 | Enhancement to Tax directives |