|

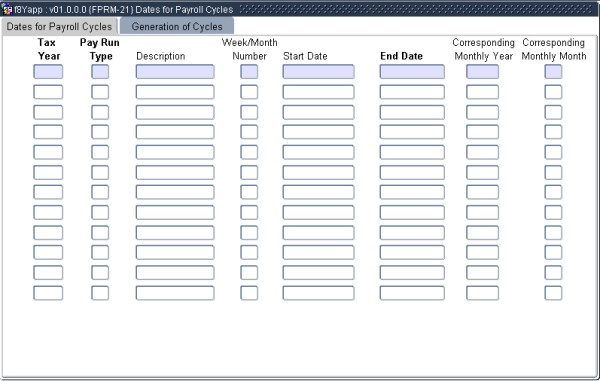

This option is used to define the

period

applicable to Payroll cycles. The initial dates are set when the system is

installed, but the user may create new records.

This option consists of two blocks. On the first block, the records

created may be viewed. The second block offers the facility to create

new records.

| Field | Type & Length |

Description |

|---|---|---|

| Tax Year | YYYY | This is a query only field and the Tax Year is displayed. |

| Pay Run Type | A1 | This is a query field only and the valid values are (M)onthly or (W)eekly. The description defaults and cannot be queried. |

| Week/Month Number | N2 | Depending on the selection made in the field Pay Run Type above, the (M)onth or (W)eek number will be displayed. |

| Start Date | DD-MON-YYYY | The start date will be displayed. |

| End Date | DD-MON-YYYY | Enter the week ending / month ending date. |

| Corresponding Monthly Year | YYYY | This field only applies where the field Pay Run Type above is (W)eekly. Enter the year of the corresponding monthly Payroll cycle. |

| Corresponding Monthly Month | N2 | This field only applies where the field Pay Run Type above is (W)eekly: the user can indicate the applicable month number in which the week start/end dates fall. |

|

This block affords the

facility to create new cycles that do not currently exist.

Execute <INSERT

RECORD> for the program to generate the desired records. These

records can be viewed on Block 1.

| Field | Type & Length |

Description |

|---|---|---|

| For Year | YYYY | Supply the Tax Year for which to generate records. |

| Pay Run Type | A1 | Indicate whether (M)onthly or (W)eekly records must be generated. The description will be displayed. |

| First Cycle’s End Date | DD-MON-YYYY | Supply the end date for the first month or week. The program will use this date to generate the remaining periods of months or weeks. The program will validate that the date provided does fall within the tax year specified in the field Year above. |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 24-Jan-2007 | v01.0.0.0 | Anelia Terblanche | t134090 | New manual format. |

| 12-Aug-2009 | v01.0.0.1 | Charlene van der Schyff | t161012 | Edit language obtained from proof read language Juliet Gillies. |