|

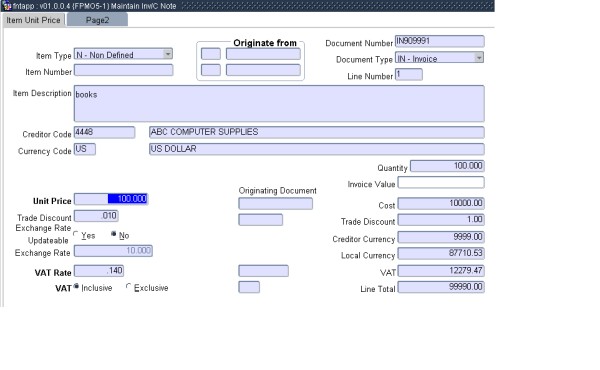

This applications is common to the applications in the Accounts Payable PM module. This applications are normally not directly accessible from a menu but from related Pop Up Menus on fields in Accounts Payable options.

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displayed item type can either be (N)on-Defined or

Defined. (G)eneral

items, (S)tock

items and (L)ibrary

items

are defined items. Defined Items.

Valid values are G, S, L or N G - General Item is maintained in FPMM-3 S - Stock Item maintained in FPMM23 L - Library Item is maintained in LCAO-1 Non Defined Items

|

| Item Number | N8 | Display a valid stock, general or library item number depending on the item type selected. |

| Originate from | ||

| Document Number | A15 | The document number for the type of document specified in the previous field from which information was copied. |

| Document Type | A2 | Valid values are (O)rder/(G)RV if the Type of Document is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. |

| Line Number | N5 | The item Line Number, running sequentially from 1 onwards and is controlled by the system. The field is not accessible to the user |

| Item Description | A4000 | The

item description.

|

| Creditor Code and Name | N9 | The creditor must be defined on option {FPMM-2}, TAB - Crediotor Detail. |

| Currency Code and Description | A3 |

|

| Invoice Value | N15.2 | The field is used to adjust an items amount where due to rounding an items values calculated through the program differs form the invoice received from the creditor. If a value is entered in to the field and the variance between what the program calculated and the amount entered is less than 0.5% the system will adjusted to the invoice amount to the amount entered. |

| Quantity | N10.3 | The number of units that must be paid or taken credit for. Unit can be up to 3 decimals. |

| Unit Price | N15.4 | The currency value of one unit

The

value defaults from the original document and can be changed by the

user.

The value defaults

from the original document.

The currency value

of one unit. The value supplied here must correspond to a value of the

currency code.

|

| Trade Discount | N5.2 | The percentage trade discount that

will be deducted from the unit price irrespective of when the item will

be paid.

The value defaults

from the original document and can be changed by the user.

The value defaults

from the original document and cannot be changed by the user.

|

| Exchange Rate | N7.3 | The system will default the exchange rate depending on

the following criteria:

|

| Exchange Rate Updateable | A1 | Exchange Rate Updateable (Y)es

ot (N)o

|

| VAT Rate | N8.3 | The VAT rate for the unit price and the valid

range is 0 up to 1.000.

The value defaults

from the original document and can be changed by the user.

The value defaults

from the original document and cannot be changed by the user.

|

| VAT | A1 | Is VAT included/excluded in

the unit price of this item? (I)ncluded or

(E)xcluded.

The unit

price entered will remain unchanged if this value is changed.

The value defaults

from the original document and can be changed by the user.

The value defaults

from the original document and cannot be changed by the user.

|

| Originating Documents | ||

| Unit Price | N15.4 | The currency value of one unit as it appears on the Originating Document. |

| Trade Discount | N5.2 | The percentage trade discount that will be deducted from the unit price irrespective of when the item will be paid as it appears on the Originating Document. |

| Vate Rate | N8.3 | The VAT rate for the unit price and the valid range is 0 up to 1.000 as it appears on the Originating Document. |

| VAT | A1 | The VAT included/excluded in the unit price of this item as it appears on the Originating Document. |

| Cost | N15.2 | If VAT is inclusive * Unit price multiplied by the quantity for the item. Otherwise if VAT is exclusive * Unit price multiplied by the quantity for the item multiplied by (1 plus VAT rate) |

| Displays the total Trade Discount value of the Item The calculation for Trade Discount is Cost multiplied by the Trade Discount Percentage divided by 100. | ||

| Creditor Currency | Displays the total Given Currency Value for the Item. The calculation for Creditors currency is Cost minus Trade Discount . | |

| Local Currency | Displays the total value before VAT for the Item Detail (The value is in local currency). The calculation for local currency is Line Total minus VAT. | |

| VAT | Displays the total VAT value for the Item. The calculation for VAT of this record is Line Total multiplied by the VAT rate divided by (1 plus VAT rate). | |

| Line Total | Displays the VAT inclusive Total for the Item (The value is in local currency). The calculation for the Line Total is Creditor Currency amount multiplied withe the exchange rate for the creditors currency on the transaction date. | |

|

| Field | Type & Length |

Description |

|---|---|---|

| Document Number | A15 | Document number defaults and dios[plays form the previous page. |

| Document Type | A2 | Valid values are (O)rder/(G)RV if the Type of Document is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. |

| Line Number | N5 | The item Line Number, running sequentially from 1 onwards and is controlled by the system. The field is not accessible to the user |

| Item Type | A1 | Displayed item type can either be (N)on-Defined or

Defined. (G)eneral

items, (S)tock

items and (L)ibrary

items

are defined items. Defined Items.

Valid values are G, S, L or N G - General Item is maintained in FPMM-3 S - Stock Item maintained in FPMM23 L - Library Item is maintained in LCAO-1 Non Defined Items

|

| Item Number | N8 | Display a valid stock, general or library item number depending on the item type selected. |

| Item Description | A4000 | The

item description.

|

| Creditor Code | N9 | The creditor must be defined on option {FPMM-2}, TAB - Crediotor Detail. |

| Quote/Contract | A15 | The ID Code or name by which this contract or quotation is known. In other words this number is an external supporting document for the unit price information. |

| Version | A10 | Version number of the Quote/Contract. |

| Payment Terms | The Payment Term code as defined in option

{FPMC-4}, the description

of the payment term will be displayed. The

payment term will ensure that the item is displayed and calculated with

the correct payment percentage and effective payment date. If

the item

is paid before or on the effective payment date, the correct settlement

discount (Using payment percentage) is deducted from the

item. A list of values is available of payment term codes and the description will be

displayed.

The value defaults

from the original document and can be changed by the user.

The value defaults

from the original document and cannot be changed by the user.

|

|

| Payment Percentage | N5.2 | This payment percentage will be used if the

item is paid before or on the effective payment date and the settlement

discount (Using payment percentage) is then deducted from the item cost

price. The system will default the payment percentage of the payment

term as defined in option {FPMC-4}

and the value is updateable as

follows:

The value defaults

from the original document and can be changed by the user.

The value defaults

from the original document and cannot be changed by the user.

|

| Effective Payment Date | DD-MON-YYYY | The date when this item is due

for payment to the supplier. The program calculates this date

using the Document Date, the numbers of Days and From

Document (Statement or Invoice) of the above payment term as

defined in option {FPMC-4}. If the payment term is "30 days after invoice", the system will add 30 days to the document date. If the payment term is "30 days after statement", the system will add 30 days to the first statement after the document date. The system will default the effective payment date calculated by using the payment terms and the value is updateable as follows:

The value defaults

from the original document and can be changed by the user.

The value defaults

from the original document and cannot be changed by the user.

NB. DIFFERENT ITEMS ON A DOCUMENT MAY HAVE DIFFERENT PAYMENT INFORMATION. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 03-Dec-2007 | v01.0.0.0 | Kobus Kleinhans | t144148 | New manual format. |

| 13-Mar-2009 | v01.0.0.1 | Marchand Hildebrand | t152121 | Proof Read System Owner. |

| 06-Oct-2009 | v01.0.0.2 | Marchand Hildebrand | t160208 | Currency Updateable corrected |