|

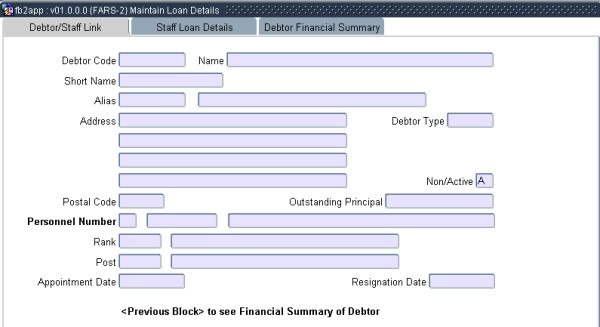

This three-Block option allows the creation and maintenance of staff loan details per person, as well as the take-on of existing loans.

| Field | Type & Length |

Description |

|---|---|---|

| Debtor Code | N9 | Unique code to identify the debtor. |

| Name | A40 | Name of debtor. |

| Short Name | A10 | Short name for quick reference and display purposes. |

| Alias | N9 | Alias code to be used with this debtor. |

| Address | A30x4 | Address Lines 1 to 4. |

| Postal Code | A4 | Postal Code. |

| Debtor Type | A4 | Debtor type. |

| Non/Active | A1 | Is this debtor (A)ctive or (N)on-active. |

| Outstanding Principle | N15.2 | Outstanding principle. |

| Personnel Number | A7 N9 A43 |

Person type. Personnel number to be linked to this debtor. Persons title, initials and surname. |

| Rank | N5 | Person's rank. |

| Post | A4 | Person's post. |

| Appointment Date | DD-MON-YYYY | Appointment date. |

| Resignation Date | DD-MON-YYYY | Resignation date. |

|

The system displays the

debtors code

and name after a <NEXT BLOCK> command in Block

1. The user

now updates the details of the specific loan for this debtor as

follows, more than one record being allowed:

When a valid loan code is entered, the system displays the

loan

description and the following default details from the “Loan

Types”, all of which can be updated:

| Field | Type & Length |

Description |

|---|---|---|

| Official Interest Rate | Default from the loan type definitions. "Official Rate" interest" means

|

|

| Interest Rate for this Loan | The ineterest rate as per the loan agreement with the perosnal member for the loan type. | |

| Repayment Period | The standard repayment period in months for this loan type. | |

| Repayment Deduction Code | The code defaults from the loan type definition

and must be an active Deduction Code with a

valid Tax

Code as per Earning/Deduction Detail {FPRG-6} in the ITS Payroll

System. The field is used when Payroll Deductions are to be generated for Staff Loans. The Deduction should be set up so that it does not influence tax. |

|

| Fringe Benefit Earning Code | The code defaults from the loan type definition

and must be an active Earning Code with a valid Tax

Code as per Earning/Deduction Detail {FPRG-6}

in the ITS Payroll System. The code is used to process the "Fringe Benefit" on the Staff Loans, that is, where the Official Interest Rate is higher than the Interest Rate for this Loan (Type). The Earning should be set up so that it increase the taxable income. |

|

| Fringe Benefit Deduction Code | The code defaults from the loan type definition and is

used to

"Contra" the Fringe Benefit transaction created for tax calculation

purposes. It should be a valid Deduction Code with a

valid Tax Code as per Earning/Deduction Detail {FPRG-6}

in the ITS Payroll

System. The Deduction should be set up so that it does not influence the taxable income. |

|

| The following fields must also be updated as indicated: | ||

| Loan Principal | N17.2 | This value can be supplied when a record is created, but cannot be updated thereafter. |

| Advised Repayment | N17.2 | This value is optional; if the system should calculate the instalment, this field must be left blank. |

| From | YYYYMM | The field indicates the start pay cycles between which the advised repayment amount will be valid. The field is mandatory when the advised repayment amount contains a value. |

| To | YYYYMM | The field indicates the end pay cycles between which the advised repayment amount will be valid. The field is mandatory when the advised repayment amount contains a value. |

| Effective Cycle | N4 + N2 | In which repayment will commence. |

| Generation of E/D’s Required? | Yes/No | The system defaults to (Y)es, in which case Payroll transactions can be generated via option {FARS-5}. |

| From | YYYYMM | The field indicate the start pay cycles between which E/Ds will NOT be generated by option {FARS}. The field is mandatory if the field "Generation of E/Ds" contains a (N)o. This facility is useful when an employee is on unpaid leave, for example, since interest on the loan can still accrue but no deductions are made via the Payroll System. |

| To | YYYYMM | The field indicate the end pay cycles between which E/Ds will NOT be generated by option {FARS-5}. |

| Number/Reference of Approval | A12 | An optional reference number can be entered. |

| Date of Approval | DD-MON-YYYY | This field is mandatory. |

| Two

further fields are displayed, which can be updated by the user only

when a record is created, thereafter only via option {FARS-5}, namely: |

||

| Cumulative Repayment | N17.2 | This value defaults to 0. |

| Cumulative Interest | N17.2 | This value defaults to 0. |

| Also

displayed is the Reducing Principal for this loan. Note that

this

amount will NOT correspond with the amount owed by an INACTIVE debtor

for whom monthly interest is calculated but no repayments are deducted. Please note that records may be deleted from this Block only if no computer-generated interest or repayment transactions exist, or if the loan has been fully redeemed. This allows the correction of errors during take-on, but once computer processing of a loan has commenced, the process must be completed before the record can be deleted. |

||

|

| Field | Type & Length |

Description |

|---|---|---|

| This

screen cannot be updated by the user, and is accessed as follows: query

a debtor by Debtor Code in Block 1, press <PREVIOUS

BLOCK> and

<RETURN>. The following information is now

displayed: Debtor Code and Name

|

||

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 03-Mar-2007 | v01.0.0.0 | Charlene van der Schyff | t133685 | New manual format. |

| 07-Jul-2009 | v01.0.0.1 | Charlene van der Schyff | t158351 | Edit language obtained from proof read language Juliet Gillies. |