|

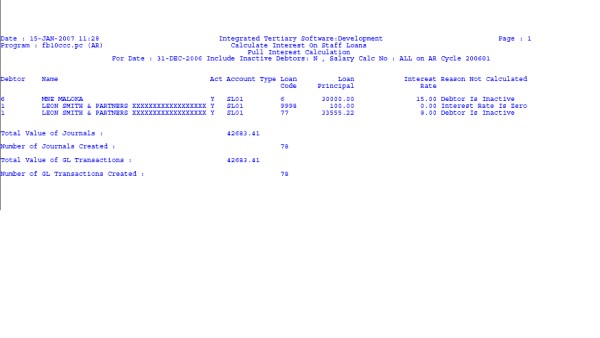

After interest on staff loans has been generated, the option is used to create Individual Earnings / Deductions {FPRI-2} for the Payroll System that allows the fringe benefit value of low interest loans to be taxed and the loan repayment to be deducted from the person's salary.

This option is also available in Generate Staff Loan Payroll Transactions {FPRI-23} in the payroll system. Users should ensure that access is allowed to only one of these two options.

Staff loan transactions may be rolled back and

regenerated as long as cheques have not been generated for the specific

payroll cycle, calc and sequence number. Once cheqeus have been generated,

staff loan deductions are finalized for that specific payroll cycle calc and sequence number. The

"C" record as set up in menu option {FPRM-2} determines

the payroll cycle for which staff loan deductions

should be generated.

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| Institution Code | N3 | Do not change this field. | |

| Transactions will be generated for Cycle YYYYMM, is this correct? | A1 | Only (Y)es or (N)o; the date displayed is determined by the "C" record as set up on menu option {FPRN-2}. | |

| Enter the salary calculation or ALL | N1 | Enter the correct calc number or "ALL" | |

| Enter the personnel number or ALL | N9 |

| Sort Order | Per | Comments |

|---|---|---|

| Personnel number, loan code. |

| System Select | |

|---|---|

| The system selects staff loan data for

staff debtors, who has loans that have not yet been redeemed. Only debtors linked to a personnel number with Salary Calculation Number as in the User Selection Parameters and a service record for the payroll cycle indicated by event "C" in the Run cycle Control File {FPRM-2} will be included. |

|

| Processing Rules |

|||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 |

The program will create transactions for the cycle of the “C” - Salary Calculations record in the Run Cycle Control File {FPRM-2}. |

||||||||||||||||||||||||||||||||||||||||||

| 2 |

The program will stop processing if Calculate Interest {FARS-3} was not executed for the cycle. |

||||||||||||||||||||||||||||||||||||||||||

| 3 | If transactions have already been generated for this pay cycle the run will terminate. | ||||||||||||||||||||||||||||||||||||||||||

| 4 |

For those loans with “Generation of E/Ds Required”

indicator = (Y)es, the value of the interest is obtained from the

debtor's transaction file. The calculations are as follows:

I = interest rate P = principal CP = cumulative principal repayment N = balance of repayment period RP = reducing principal OR

= official interest rate

The installment is as follows

Then

|

||||||||||||||||||||||||||||||||||||||||||

| 5 |

The following three Individual Earnings / Deductions {FPRI-2} are generated for each loan:

The latter two

transactions are obviously generated only if a fringe benefit exists. The detail of all the individual earnings or deductions are

|

||||||||||||||||||||||||||||||||||||||||||

| The Start Date of each transaction will be the first day of the payroll cycle indicated by event "C" - Salary Calculations in the Run Cycle Control File {FPRM-2}; the end date will be the last day of the cycle. | |||||||||||||||||||||||||||||||||||||||||||

| Existing Individual Earnings or Deductions for the employee, with the same E/D Code, Salary Level and Start date will be removed before the new earnings or deductions are are created. | |||||||||||||||||||||||||||||||||||||||||||

| The program will generate a warning message per loan if an

Earning or Deduction Code without a valid tax Box in the

Earning / Deduction Types {FPRG-6} exists on the Loan; staff loan deductions will not be created for such loans To correct this, the staff loans should be rolled back, corrected and generated again, before the payroll calculation is run. |

|||||||||||||||||||||||||||||||||||||||||||

| If any inactive Earnings or deductions are encountered, the run

aborts. These E/D codes should be corrected before another attempt is made. |

|||||||||||||||||||||||||||||||||||||||||||

|

The program will generate a list of

|

|||||||||||||||||||||||||||||||||||||||||||

|

The field “Cumulative Principal Repayment” in Maintain Loan Details {FARS-2}

will only be updated with the latest value of CP if the Copy

Staff loan Deductions to AR {FARS-7} was run. Each interest transaction is flagged with the date of calculation in order to avoid repetitive calculation of interest for the same period. |

|||||||||||||||||||||||||||||||||||||||||||

| At this stage, the Salary Loan Suspense account will reflect the total

deduction for loan repayments. On “Post-to-GL”, the following transactions will be posted:

NOTE: This credit will be cleared by “Copy Staff Loan Transactions to AR” in option {FARS-7}, as explained below. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 10-Jan-2007 | v01.0.0.0 | Frans | t129600 | Tax boxes on EDs. |

| 10-Jan-2007 | v01.0.0.0 | Allie | t126911 | New manual format + date effective notches. |

| 10-Jan-2009 | v01.0.0.1 | Magda van der Westhuizen | t158351 | Update manual; Language Editing; Juliet Gilies. |