|

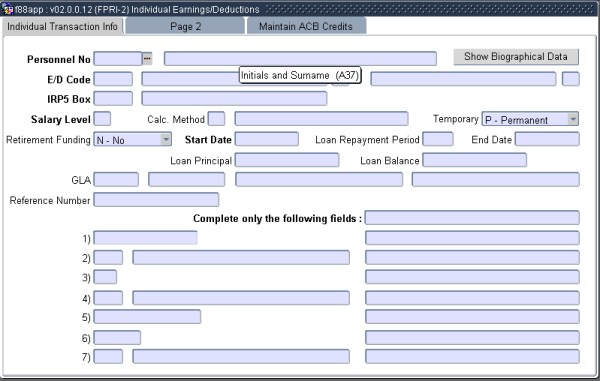

Every employee can be linked to a global

compensation package as created via option {FPRG-7}, through his / her

appointment type. Specific earnings or deductions relevant to an

employee are maintained here alternatively, the employee's entire package can be

maintained.

The total compensation package for

an employee at any particular time consists, therefore, of both the

individual and the global earnings and deductions that apply at that

time. When a salary calculation is done, the system combines the

entire individual and global earnings and deductions applicable to an employee.

It

is important to realize that an individual Earning / Deduction will override the

global, if it is specified at the same salary level as the

global. Hence, if (for example), arrears PAYE has to be deducted

for an employee as an Advised Amount, this deduction should be

specified at a higher salary level than the global PAYE

calculation. If it is specified at the same level, the system

will respond only to the individual deduction.

| Field | Type & Length |

Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Personnel Number | N9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| E / D Code | A4 | When a valid code, as specified in Earning / Deduction Detail {FPRG-6} is entered, the name and an “E / D” indicator is displayed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| IRP5 Box | N4 | The value for the Earning / Deduction Code from Earning / Deduction Detail {FPRG-6} will default. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salary Level | N2 | The value for the Earning / Deduction Code from Earning / Deduction Detail {FPRG-6} will default. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Calc Method | A1 | The value for the Earning / Deduction Code from Earning / Deduction Detail {FPRG-6} will default. Refer to the documentation on Calculation Methods {FPRG-25} to view the rules that the system will apply for each method. The following calculation methods may not be used for weekly paid personnel:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Temporary | A1 | (P)ermanent or (T)emporary. If this field has the value (T)emporary, an End Date must be inserted; any other value will allow a null end date to be accepted. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retirement Funding | A1 | (Y)es or (N)o. Is this income to be considered when calculating pensionable income? The value for the Earning / Deduction Code from Earning / Deduction Detail {FPRG-6} will default. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Start Date | DD-MON-YYYY | The date on which this transaction should become effective. The salary calculation will ignore transactions with a start date after the end date of the cycle. The start date should be less than the end date, and should be greater than or equal to the person's appointment date. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Repayment Period | N2 | This field may be used to keep track of a fixed amount to

be recovered from the salary of a person over a period of time

where the deduction is handled with Calculation Method "3 - Advised

Amount". It represents the number of payroll cycles that the deduction

will be active to recover the full amount as entered in the Loan

Principal - field.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Date | DD-MON-YYYY | The date on which this transactions stops to being effective. The salary calculation will ignore transactions with an end date before the start of the cycle. The end date should be before or on the person's resignation date, if a resignation date exists. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Principal | N15.2 | This field may be used keep track of a fixed amount to be

recovered from the salary of a person over a period of time

and represents the total amount to be recovered from the

salary of the person over the number of payroll cycles indicated

in the Loan Repayment Period - field. It cannot be updated once the deduction was included in a payroll calculation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan Balance | N15.2 | This field may be used keep track of a fixed amount to be

recovered from the salary of a person over a period of time and

represents the balance still to be recovered. It cannot be entered and

is automatically calculated using the Loan Principal - field and the

sum of the transactions already included in the Payroll

Transactions field through this Deduction. Note that the fields Loan Principal, Loan Repayment Period and Loan Balance does not automatically handle interest calculations. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLA | A4 + A8 | The value for the Earning / Deduction Code from Earning / Deduction Detail {FPRG-6} will default. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reference Number | A15 | A reference number that will be written away with the calculated salary transaction. Reference numbers, other than a person's Tax, Pension, Medical Aid or Group Insurance Numbers, are usually specified here. Note that this Reference Number is normally not used at a global level, but becomes important at a personal level, e.g. when a deduction is made on behalf of a specific organization. In such a case, the membership or other number of the employee is entered; it will appear on the relevant Report as per Earning / Deduction Type {FPRNR1-6}. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Information Required for the Calculation, to be entered into the fields numbered from 1 to 7 | The fields to be completed are dependent on the calculation method. Possible values for this field are:

Required values for each calculation method are:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Formula | A1024 | If the Calculation Method is "I - Custom Formula", the formula should be entered in this field. For more information refer to the relevant section in the on-line help of Calculation Methods {FPRG-25}. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Amounts Low Limit | N15.2 | If the earning or deduction should be valid only within an income range, the low limit is specified here. Note that this amount refers to annualized earnings. This field may be left blank if no test is to be done on a low limit. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| High Limit | N15.2 | Note that the salary calculation program will test against low and high limits only for calculation methods:

For WCA, regular and one-time earnings are accumulated separately to arrive at a correct annualized income. For calculation methods 1 (Pct of Salary Level Total), 6 (Pct of Transaction) and F (General Lookup Table), the program assumes that only regular monthly earnings are involved; it applies the test against the salary level total at the “Reference Salary Level” specified in paragraph . below. For calculation methods 3 (Advised Amount) and 7 (Salary Notch), the test is done against the person's annual notch. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debtor / Student | A1 | (S)tudent or (D)ebtor. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debtor Number | N9 | Student Number or Debtor Number. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Account Type | A4 | The Account Type is used for / by: |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Post to Subsystem | A1 | Must the deduction be copied to the student's fee account: (Y)es or (N)o. If this field is set to (Y)es, the deduction will be posted to the student's account, if the “Reference Number” field contains a valid student number in the format ST**9999999. Refer to Copy Deductions to Student Accounts {FPRI-24}. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Agreement | A4 | Valid payment agreement for the student, if the E / D is to be used by Copy Deductions to Student Accounts {FPRI-24}. |

|

|

This option allows the maintenance of

bank information, which will be used by the ACB tape program {FPRM-7}

to credit the bond accounts of employees with the amounts that are

deducted during the monthly salary calculation.

| Field | Type & Length |

Description |

|---|---|---|

| Personnel Number | N9 | |

| Deduction Code | A4 | Enter the deduction code used for this person's bond repayment deduction; and the description is displayed. Only deduction codes are allowed. The <LIST> command will show valid deduction codes. |

| Account Type | A1 | C)urrent, (S)avings, (T)ransmission or (B)ond. |

| Bank Account Number | N24 | The same rules as those to Bank Accounts apply here, as specified in the Fixed Salary Detail {FPRI-1}. Note that account numbers, which are to be used for ACB tape transfers for PERM accounts other than current accounts, are 13 digits long; all other account numbers may not exceed 11 digits. Leading zeros are not essential. Only numeric characters must be used, to ensure that hash control totals for the transfer tape are correctly calculated. |

| Branch Code | N6 | When an existing Branch Code is entered (as maintained in option {FPRC-2b2}), the names of the branch, the bank code and the bank name are displayed. The <LIST> command will show valid codes. |

| Tape Pay Date | N1 | Allowed values are “1” and “2”. “1” means that the payment will be credited on the First Action Date of the ACB tape whereas “2” will result in a transfer on the Last Action Date. |

| Maximum Amount | N15.2 | This field is optional. Users may indicate the maximum amount that may be deposited into the specified account for bond payments. |

| Sequence Number | N2 | The sequence the program must use for allocation of unallocated monies. |

|

If the "Validate Account Detail" option is executed, the following report will be produced:

Example:

|

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 | Report on (W)eekly or (M)onthly Paid Personnel [M]. | A1 | |

| 2 | Monthly Payroll Cycle. | YYYYMM or YYYYWW | |

| 3 | Supply 1st Of 10 E / D Codes. | A4 |

| Sort Order | Per | Comments |

|---|---|---|

| 1 | ED Code. | |

| 2 | Personnel Number. |

| System Select | |

|---|---|

| All employees who will be in-service during the

given pay cycle and who have one or more of the supplied

E / D codes in either Block 1 or Block 2. Only those employees who do not have the E / D code on both tables will be printed. The report consists of two sections:

|

|

01-AUG-2002

15:05 INTEGRATED TERTIARY SOFTWARE

PAGE 1 |

|

PROGRAM

: F9Fccc.pc V12.0.0.0 E / D CODES NOT

ON ACB TAPE CREDITS |

|

For E / D CODES

6500 6510

|

|

For Cycle :

199503 |

|

|

|

PERSONNEL

PERSONNEL

E / D E / D

|

|

NUMBER NAME

CODE

DESCRIPTION

|

|

---------

---------

---- -----------

|

|

72 DU PLESSIS, MRS U

6510 SECOND BOND

PAYMENT

|

|

|

|

|

|

|

|

|

|

01-AUG-2002

15:05 INTEGRATED TERTIARY

SOFTWARE

PAGE 2 |

|

PROGRAM

: f9Fccc.pc V12.0.0.0 E / D CODES NOT

ON INDIVIDUAL EARNINGS TRANSACTIONS |

|

For E / D CODES

6500 6510

|

|

For Cycle :

199503 |

|

|

|

PERSONNEL

PERSONNEL

E / D

E / D

|

|

NUMBER NAME

CODE

DESCRIPTION

|

|

---------

---------

---- -----------

|

|

180 SMITH, MRS V 6500 BOND

PAYMENT

|

|

|

|

END OF

REPORT |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 04-Jan-2007 |

v01.0.0.0 | Frans | T138771 | Proofread and correction of manuals |

| 16-Apr-2007 | v01.0.0.0 | Charlene van der Schyff | T134077 | Convert to new format. |

| 22-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | T152258 | Update manual: Language Editing - Juliet Gillies. |

| 18-Jun-2012 | v02.0.0.0 | Sister Legwabe | T177281 | Insert new screen and new fields on Block 1 |

| 19-Jun-2012 | v02.0.0.0 | Sister Legwabe | T181348 | Insert new screen and field formula on Block 1 |