|

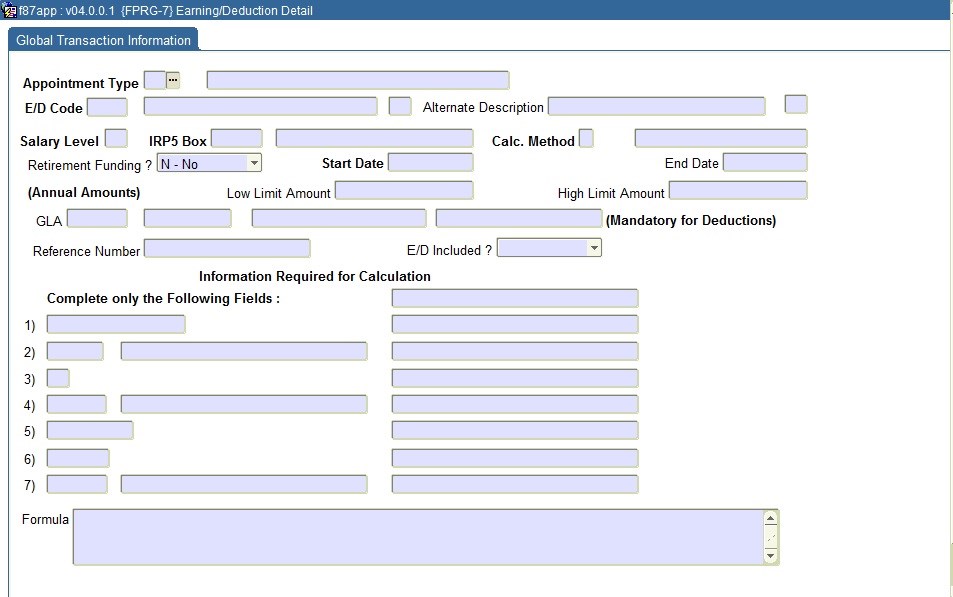

This option allows the creation of a “global compensation package” per Appointment Type {FPRG-10}, thereby obviating the effort required to create full detail at employee level. Only exceptions for specific employees need be maintained at employee level. All salary calculations are based on the information on this screen, which implies thorough and careful planning by the user before creating these transactions. A design form can be produced with Print Design Form {FPRGR1-8}.

Information from the following screens is required by this screen :

| Field | Type & Length |

Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Appointment Type | N2 | When a valid Appointment Type {FPRG-10}, is entered, the description is displayed. The <LIST> command is linked to this field. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| E / D Code | A4 | When a valid code as specified in Earning / Deduction Types {FPRG-6} is entered, the name and an “E / D” indicator are displayed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salary Level | N2 | The value as specified in Earning / Deduction Types {FPRG-6} will default here, but may be changed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IRP5 Box | N4 | The value as specified in Earning / Deduction Types {FPRG-6} will default here, but may be changed. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Calc. Method | A1 | Calculation Method For an overview of the calculation methods, refer to the on-line documentation of Query Calculation Methods {FPRG-25} The value as specified in Earning / Deduction Types {FPRG-6} will default here, but may be changed. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retirement Funding? | A1 | Is this income to be considered when calculating pensionable income? (Y)es or (N)o. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Start Date | DD-MON-YYYY | The date on which this transaction should become effective. The salary calculation will ignore transactions with a start date after the end date of the cycle. The start date should be smaller than the end date; it should als be greater than or equal to the person's appointment date. The system will prevent an ED Code from appearing more than once in the same cycle on the same salary level for an appointment type. The program will generate an error message if the Start Date is after the Inactive Date of the Appointment Type {PACS-2} and will not save such records. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| End date | DD-MON-YYYY | The date on which this transaction stops being effective. The salary calculation will ignore transactions with an end date before the start of the cycle. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Low Limit Amount | N15.2 | If the earning or deduction should be valid only within an income

range, the low limit is specified here. Note that this amount refers to annualised earnings. This field may be left blank, if no test is to be done on a low limit. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High Limit Amount | N15.2 | The same remarks, as above, apply. Note that the salary calculation program will test against low and high limits only for calculation methods:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLA | A4 + A8 or A6 + A8 (UK) |

General Ledger Allocation, consisting of a Cost Centre and an Account. The value as specified in Earning / Deduction Types {FPRG-6} will default here, but may be changed. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reference No | A15 | Reference numbers other than a person's Tax, Pension, Medical Aid or Group Insurance Numbers are usually specified here. Note: The Reference Number is normally not used at a global level, but becomes important at a personal level, e.g. when a deduction is made on behalf of a specific organisation. In such a case, the membership or other number of the employee is entered and will appear on the relevant Report per Earning / Deduction Type {FPRNR1-6}. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| E / D Included | A1 | This field is for the purposes of the Evaluation System {PMAIN-5}. This field’s link with the Evaluation System is not yet in place and will be available in a later release. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Information Required for the Calculation, to be entered into the fields numbered from 1 to 7 | The fields to be filled in are dependent on the calculation method, possible

values for this field are:

Required values for each calculation method are:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Formula | A1024 | If the Calculation Method is "I - Custom Formula", the formula should be entered

in this field. For more information refer to the relevant section in the on-line help of Calculation Methods {FPRG-25}. |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 03-Mar-2007 | v01.0.0.0 | Charlene van der Schyff | T134069 | New manual format. |

| 07-Jun-2007 | v01.0.0.0 | Frans Pelser | T137726 | Inactive Date on Appointment Type |

| 22-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | T152258 | Update manual: Language Editing - Juliet Gillies. |

| 20-Apr-2011 | v01.0.0.1 | Goodman Kabini | T173312 | Add new screen which combines two tab pages. |

| 19-Jun-2012 | v02.0.0.0 | Sister Legwabe | T181348 | Add field formula and new screen |

| 27-Jun-2012 | v03.0.0.0 | Frans Pelser | T178590 | Reference to FPRG-10 |

| 21-Jan-2016 | v03.0.0.1 | Sakhile Ntimane | T209237 | Add new field on dependent on the calculation method |

| 31-Jan-2017 | v04.0.0.0 | Sakhile Ntimane | T219225 | Change image to Integrator4. |