|

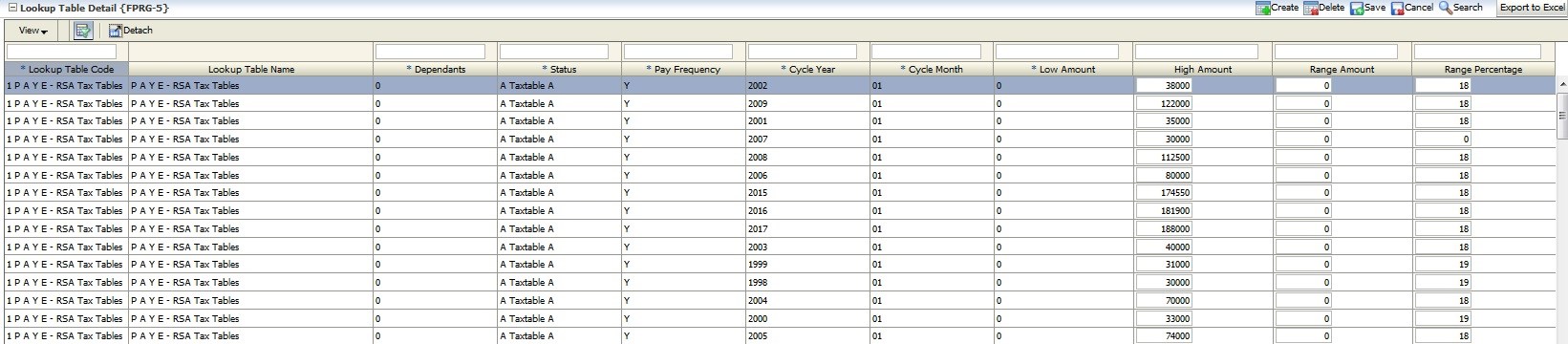

This option is used to maintain the detail of a lookup table.

When detail is loaded for Medical Aid, Group

Insurance and Pension Tables, consideration should be given as to

whether the total contribution applicable to an employee should be

loaded, or whether only that portion for which he / she would be responsible (the

institution contributing the rest) should be loaded. This could influence the

reports to the Fund Administrator.

The system is supplied with the following Table details, which are valid

at the date of installation and are applicable to the country of the client. These tables cannot be updated by users.

If the user attempts to delete a table, the system will investigate all ED codes in Individuals {FPRI-2} as well as Globals {FPRG-7}; if an ED code exists which is still active, or where the end date is < 1 year from the current system date on which the table should be deleted, the system will not allow the table to be deleted. All ED codes on Globals and Individuals are date effective.

| Field | Type & Length |

Description |

|---|---|---|

| Table | N4 | When the code of an existing table is entered, the name of the table is displayed. Code 0001 is reserved for the PAYE Tax Table, which is supplied with the system, and which cannot be updated by the user. |

| Dependants | N1 | The only tables for which a person's dependants must be specified, are those that refer to Medical Fund Contributions. For all other tables, the default value of zero is used. If a medical aid fund contribution stays constant - from (say) five dependants - records must still be created for 6, 7, 8, and 9 dependants. |

| Status | A1 | This indicator has different meanings, depending on the type

of table being defined: it could refer to Tax Status, Marital Status or

Gender. If a table does not refer to a status at all, the default

value of zero must be used. RSA PAYE Table: Tax Status : “A” = Married Person. “B” = Single Person. “C” = Married Woman. (For other countries, this status could have different meanings). Group Insurance: “M” = Male, “F” = Female, “0” = non-applicable. Pension Table: “M” = Male, “F” = Female, “0” = non-applicable. Medical Tables: Marital Status : “0” = non-applicable (usual case). “M” = Married. “S” = Single. (The calculation program will treat marital status “W”idow(er) as “M”arried; “D”ivorced is treated as “S”ingle, if number of dependants is zero, or otherwise as “M”arried). |

| Pay Frequency | A1 | Indicate whether the table is (W)eekly, (M)onthly or (Y)early. |

| Cycle | YYYYMM or YYYYWW | Supply the year and week / month from when this table is applicable. |

| Low Amount | N15.2 | Specify the low value of a range. An amount must be entered, e.g. 0.00. |

| High Amount | N15.2 | Specify the high value of a range; it must be larger than the low amount. An amount must be entered, e.g. 999999.99. Note: for PAYE tables, the above amounts represent taxable annual earnings; for other tables, which refer to earnings they represent monthly earnings. |

| Range Amount | N15.2 | The calculation of an earning or deduction is always based on a fixed amount or a percentage or both. The fixed amount applicable to the above range is specified here. If only a percentage is applicable, this field must be left blank. |

| Range Percentage | N4.3 | If only a percentage is specified, the deduction will be

calculated as a percentage of the taxable amount (in the case of PAYE)

and of the relevant salary level total in other cases. If only a

range amount is applicable, this field must be left blank. If both a range amount and a percentage are specified, the deduction is calculated, in the case of PAYE, as the sum of: the range amount and the specified percentage of the excess of taxable annual income above the low level of the range. In all other cases, the deduction is calculated as the sum of: the range amount and the specified percentage of the relevant salary level total. |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 23-Jan-2007 | v01.0.0.0 | Anelia Terblanche | t134066 | New manual format. |

| 20-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing - Juliet Gillies. |

| 09-Dec-2015 | v03.0.0.0 | Sakhile Ntimane | t209237 | Adding Table Codes |

| 18-Oct-2016 | v03.0.0.1 | Sakhile Ntimane | t216733 | Adding Retirement Funding pre-tax limits |

| 31-Jan-2017 | v04.0.0.0 | Sakhile Ntimane | t219225 | Change image to Integrator4. |