|

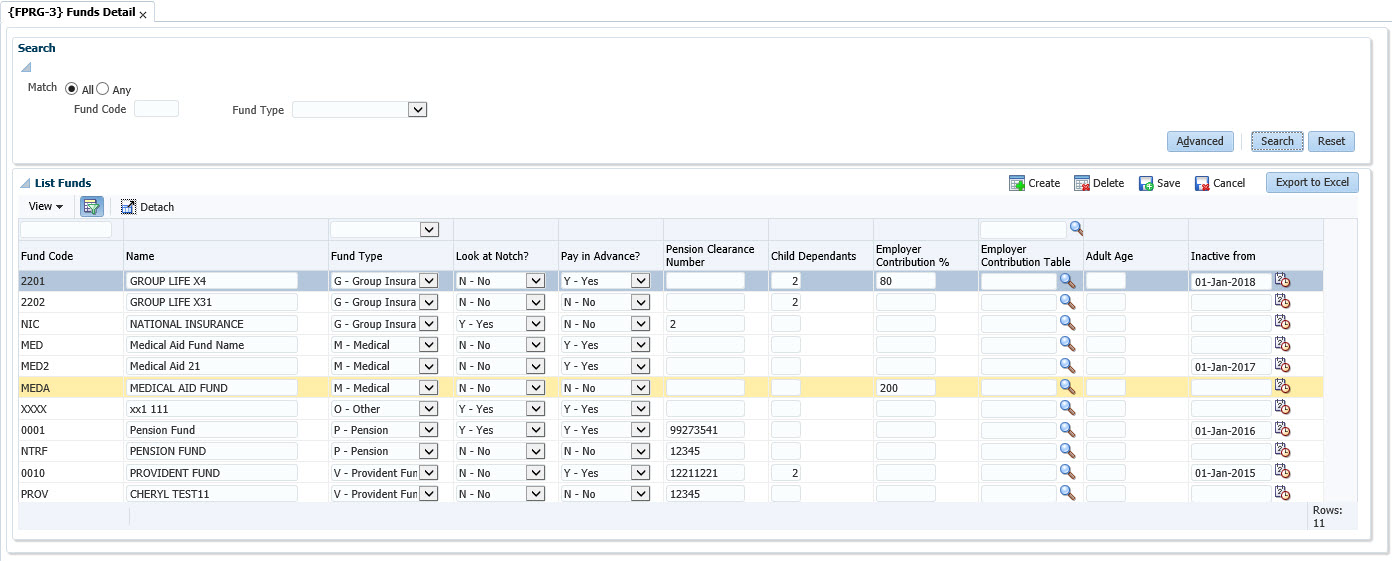

This option allows the definition of the funds to which employees of the institution may or must belong, i.e.: Pension Funds, Provident Funds, Retirement Annuity Funds, Group Medical Schemes, Group Life Insurance Funds and Other Funds.

| Field | Type & Length |

Description |

|---|---|---|

| Fund Code |

A4 | A unique code by which to identify the fund. |

| Name | A30 | Supply an appropriate description for the fund. |

| Fund Type | A1 | Allowed values are: (G)roup Insurance, (M)edical Aid, (P)ension, (R)etirement Annuity, Pro(V)ident Fund and (O)ther. The type of fund is displayed when a valid code is entered. |

| Look at Notch? | A1 | Indicate by “Y”es if a fund looks at actual monthly income, or income based on full notch. For Medical Aid, this value would typically be “Y”es. If the answer is “N”o, the field may be left blank. Calculation methods “5”, “A”, “C” and “G” for the various funds are sensitive to this indicator. |

| Pay in Advance? | A1 | Indicate by “Y”es if the monthly premiums must be paid in advance. If the answer is “N”o, the field may be left blank. If the answer is “Y”es, the salary calculation program will automatically deduct double contributions during the first month of membership of this fund, and will automatically deduct no premiums in an employee's resignation month. Most Medical Schemes and Group Funds operate in this way. |

| Pension Clearance Number | N11 | Supply the Pension Clearance Number for tax purposes. |

| Child Dependants | N1 | Supply the maximum number of child dependants for medical aid purposes. |

| Employers Contribution % | N3.3 |

Supply the employer's contribution, in percentage format, for medical aid purposes. Should an employee resign from a fund whilst still in service with the institution, the deduction of premiums in the resignation month must be stopped manually by entering the actual fund resignation date in option {PAOP-4 and 5} of the Personnel System. Should a new employee maintain unbroken existing membership of a fund, and therefore not be subject to an advance payment, the first month's premium should be advised at individual level as one-half that of the normal premium. |

| Employer Contribution Table | N4 | Local Software include programs may use this field to determine which table must be used for the calculation of the maximum employer medical aid contribution. |

| Adult Age |

N1 |

Supply the age which an employee will go on pension. |

| Inactive from | DD-MON-YYYY | The date from which this Fund is inactive. The following programs will not allow the user to create records with Funds where the Start Date or Fund Join Date is greater than this date: |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 22-Jan-2007 | v01.0.0.0 | Anelia Terblanche | t134064 | New manual format. |

| 20-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing - Juliet Gillies. |

| 06-Aug-2008 | v01.0.0.1 | Precious Diale | t153303 | Update manual: Add a new field |

| 01-Mar-2011 | v01.0.0.2 | Precious Diale | t174563 | Update manual: Add a new field 'Inactive from' and change image |

| 13-NOV-2017 |

v05.0.0.0 |

Sthembile Mdluli |

t221215 |

update manual : new int 5 image |

| 27-Nov-2018 |

v04.1.0.0 |

Sthembile Mdluli |

t231976 |

ADF update |