|

Student Tuition Fees deductions and study subsidies deducted from employees' salaries are typically posted to a Fees Control General Ledger Allocation (GLA).

Journal entries are then subsequently made to the

students' accounts. This program allows the direct copying of such payroll deductions to student accounts.

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 | Pay Cycle From Which Transactions Must Be Copied: |

YYYYMM | This refers to the actual cycle in which the student deductions were deducted from the payroll. |

| 2 | Calculation Number | N1 | This is the payroll calculation number in which the student deductions were deducted from the payroll system. Only calculation numbers 1 to 9 exist. |

| 3 | Calculation Sequence Number (1 - 99) | N2 | Only 99 sequences allowed. |

| 4 | Must a Note for statement be generated? (Y)es / (N)o. | A1 | (Y)es or (N)o? (The Note will contain: Sal. Deduct - Staff 99.) |

| Sort Order | Per | Comments |

|---|---|---|

| Personnel Number / Sequence. |

| System Select | |

|---|---|

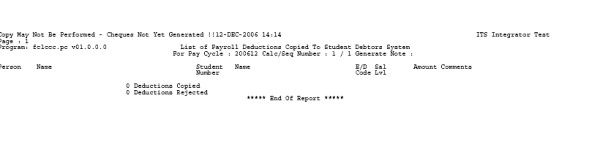

| All deductions for the specified payroll cycle, calculation

number and sequence number, where the deduction was entered as described in the Procedure below. If incorrect data exists, the deductions will not be selected for copying back to the student debtor account. |

|

| Processing Rules |

|

|---|---|

The program will validate that:

Salary transactions that are copied will be date-stamped with the system date, so as to prevent these from being copied again. Student It will create a transaction in {FSAO-1} “Student Account Transaction”. This program produces a control report. There is no danger that a transaction can be copied twice, in view of the date stamping mentioned above. When “Post to GL” is done for Payroll, the summary crediting of the Fees Control GLA will occur as usual. When “Post to GL” is done for Student Debtors: Fees Control GLA will be debited and Student Debtors Control GLA credited. At the end of this process, the balance of Fees Control GLA should be zero. NOTE: Transactions may be rejected for the following reasons:

In cases1.2, 1.3 and 1.4, users must pass manual journals to correct the situation. In Case 1.5, a manual journal can be passed or the calculation method can be corrected on menu option {FPRI-2}; a rollback and re-calculation must then be done before the transactions are copied over. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 11-Dec-2006 | v01.0.0.0 | Allie | t130627 | Documenting all existing features on menu option {FPRI-24}. |

| 16-Apr-2007 | v01.0.0.0 | Charlene van der schyff | To be inserted | New project |

| 21-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing - Juliet Gillies. |