|

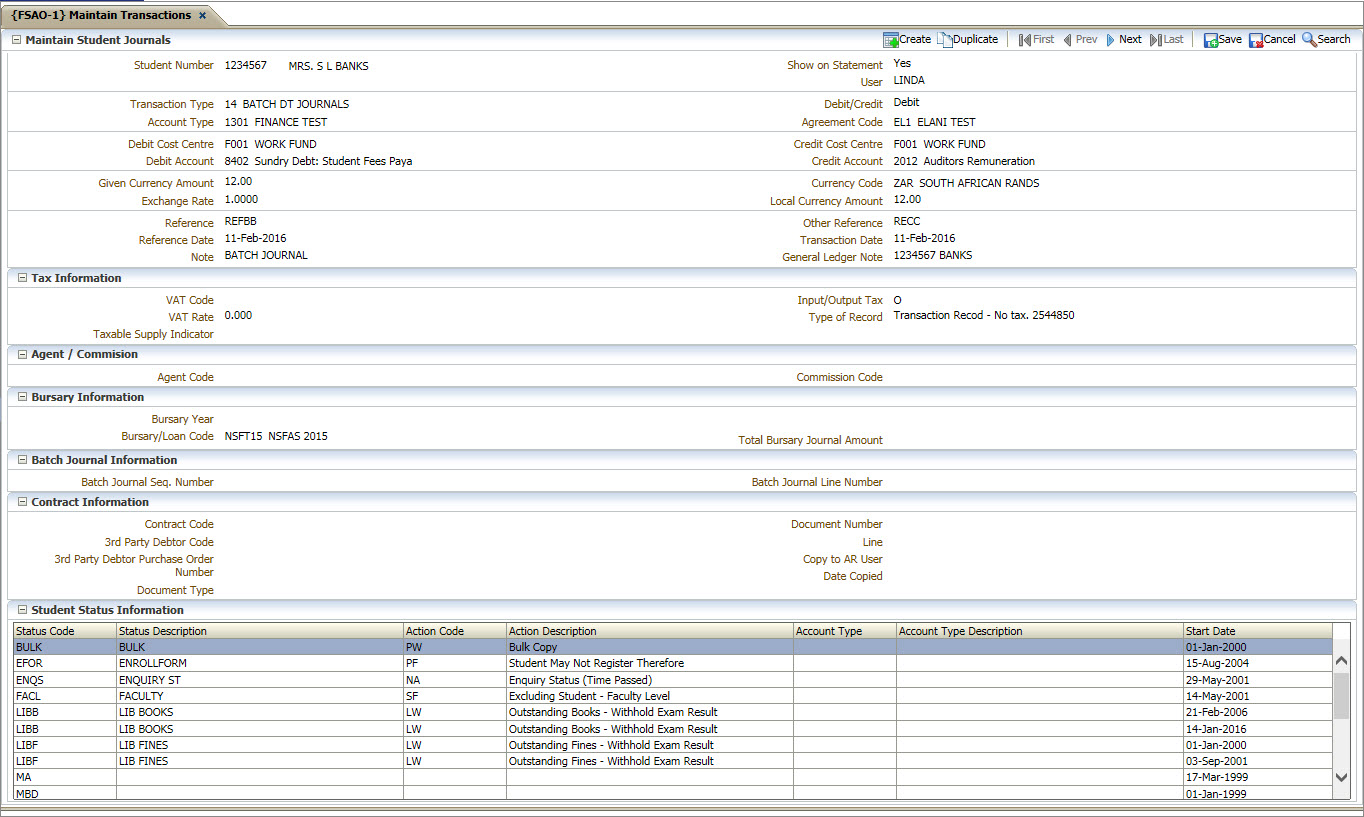

Upon the registration of a

student, certain debits e.g. class fees, registration fees, residence

fees and/or deposits can be raised automatically {FSAM-1}.

| Field | Type & Length |

Description |

|---|---|---|

| Left Column | ||

| Student Number | N9 | Student number as defined in option {SREGB-1} of the student account on which the journals will be processed, the students title, initial and surname will be displayed next to the account number. |

| Transaction Type | N4 | The transaction type as defined in option {FCSO-7} for the subsystem SD, the description of the code will be displayed next to the field. |

| Account Type | A4 | The account type on which the journal will the processed. The list of values will list all the valid account type / payment agreement combinations as well as the balance for every combination for the student. The account type must be linked to the student on option {FSAO-13} before it can be used in this option. The account type description will be displayed next to the field. |

| Debit GLA | A4+A8 | When processing a debit journal, the GLA of the account type {FCSC-21} will default into debit GLA, the credit GLA will default from the transaction type and will only be updateable if so indicated on the transaction type definition {FCSO-7}. GLA's are defined in option {FCSO-6} for a financial year. |

| Given Currency Amount | N15.2 | This is the amount which must be posted against the

student’s account. This amount must be

in the currency of the student, the system will

automatically convert it to the local currency. If the VAT rate is not zero and a VAT-linked transaction is used, the system will alter the amount to the “VAT exclusive” amount. This done during the <Save> process. |

| Exchange Rate | N5.3 | This field will be displayed the moment the currency code is entered. The user can overwrite this field, if the update status in option {FCSO-21} is set to (Y)es, otherwise not. |

| Reference Number | A10 | A reference that relates to the source documentation which initiated the transaction. |

| Reference Date | DD-MON-YYYY | The default value of the field is system date but the date can be updated to the date on which the transaction was initiated. |

| Note | A40 | The transaction type/code note or alternative note as maintained under {FCSO-7} will default in this field in the preferred language of the student. The user can however update this note. This note will be printed on the student’s statement. |

| Right Column | ||

| Show On Statement | A1 | This is a display only field. This indicator is set in option {FSAO-5}. A (Y)es or a null indicator means that this transaction will show on the student’s statement, while a (N)o indicator means that the transaction is done but will not appear on the student’s statement. |

| User | A8 | Displays the user who create the

transaction if it was manually enter, else if it is system generated

the it is the user who started the process. E.g The user that registered the student will be use as the user when the fees are raised by the background process.

|

| Debit/Credit | A1 | Indicates the entry on the student’s account either being a Debit or Credit. The value defaults from the transaction type definition as defined in {FCSO-7} for subsystem SD. |

| Agreement Code | A4 | The Payment Agreement code of the account type / payment

agreement combination on which the journal will be processed. The list

of values will list valid agreement codes for the student and selected

account type. Only the valid payment agreements for the student / account

type combination will be listed. The agreement code is mandatory unless the

journal is processed against a default account type in which case this

field will be null. The account type and payment agreement must be

linked to the student on option {FSAO-13} before it can be used in this option. The agreement code description will be displayed next to the field. |

| Credit GLA | A4 + A8 | When processing a credit journal, the GLA of the account type {FCSC-21} will default into this field, the debit GLA will default from the transaction type and will only be updateable if so indicated on the transaction type definition {FCSO-7}. GLA's are defined in option {FCSO-6} for a financial year. |

| Currency Code | A3 | Displays the currency code of the currency in which the student was defined on the student biographical record {SREGB-1} and determines the currency of the given currency amount. The description of the code will be displayed next to the field. |

| Local Currency Amount | N15.2 | Displays the journal amount converted to local currency. The

amount is the product of Given Currency Amount and Currency Rate. The

local Currency Amount is the amount posted to the general ledger when

posting student journals to the general ledger. |

| Other Reference | A10 |

An alternate journal reference. “Other Reference” is not a mandatory

field. |

| Date | DD-MON-YYYY | This field defaults automatically to the system date for new records. The system date and time of the transaction. |

| General Ledger (G/L) Note | A40 | The GL note to be displayed in the GL if the transaction is

not posted in summary. The GL note will default from the transaction

type definition, if not entered on the transaction the student number,

name and initials will default on a journal as the GL note. |

| Field | Type & Length |

Description |

|---|---|---|

| Left Column | ||

| VAT Code | A2 | VAT code as defined in {FCSC-1}, the list of values will list the code, description, rate and taxability indicator. Sales based type of tax i.e. VAT, GST, can be set to be applied in the system at a number of levels. On the highest level the system can be set to apply the tax rule or not to apply the tax rule through the SOD code “02”. If set to (N)ot Taxable, tax rules will not apply and the VAT/ GST code will default to N- Not Taxable and is not updateable. On the second level, tax rules can be applied on the ledger. Should the ledger used on the transaction be linked to a tax registration, tax rules will be applied, the default taxability indicator and rate will default for the ledger definition. The ledger is derived from the cost centre linked to the student account type, used on the transaction. On the third level, tax rules can be applied on subsystem level. Should tax rules apply to the SD subsystem, the default taxability indicator can be set, which will default for transactions in the subsystem. Should the transaction be subject to tax the user may override the default taxability indicator and rate. The fourth level at which the system can be set to apply tax, may be on transaction type. Some transaction types may not be taxable. Should tax rules apply, the default taxability indicator can be set on the transaction type which will default on transactions using the transaction type. |

| VAT Rate | N1.3 | The VAT rate defaults from the VAT codes and rates, as defined in option {FCSC-1}. This field is not updateable. |

| Taxable Supply Indicator | N1.3 |

The taxable supply defaults from the VAT code and determines

the tax treatment of the journal if tax is applicable. A transaction is either

standard rated, zero rated, exempt or not taxable supply. |

| Right Column | ||

| Input / Output Tax | Indicates if a transaction relates to input or output tax

if sales tax is applicable. All student journals in

the student debtors system are output, if the supply is a

taxable supply. Valid values are

|

|

| Type of Tax Transaction | Displays the type of record for tax purposes. Valid values are :

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Left Column | ||

| Agent Code | N9 | The agent code to be used in the calculation of agent’s commission. The description of the code will be displayed next to the field. |

| Right Column | ||

| Commission Code | A2 | The commission code to be use if this

transaction is included in the calculation of agent’s

commission. The description of the code will be

displayed next to the field. |

| Field | Type & Length |

Description |

|---|---|---|

| Left Column | ||

| Bursary Year | YYYY | Displays the year of the bursary/loan

code. |

| Bursary / Loan Code | A7 | The logical sequence for bursary/loan transactions is to create a Bursary/Loan Fund, allocate a specific amount of the fund to the student and only then credit that amount or portion thereof against the student's account. If the user tries to enter a transaction without first allocating an amount to the specific student, the system will display “Bursary/Loan does not exist for this Student”. If it is not a Bursary/Loan transaction, this field need not be completed. |

| Right Column | ||

| Total Bursary / Loan | The total amount of transactions on the student account that are linked to this bursary. | |

| Field | Type & Length |

Description |

|---|---|---|

| Left Column | ||

| Batch Journal Sequence Number | This field is populated by Batch Journal program {FSAO-10} and displays the sequence allocated when the record was created the record. |

|

| Right Column | ||

| Batch Journal Line Number | This field is populated by Batch Journal program {FSAO-10} and displays the line number with which the record was created the record. | |

| Field | Type & Length |

Description |

|---|---|---|

| Left Column | ||

| Contract Code | Displays the contract code under which the student was registered to which the student debtor transactions was transferred. | |

| 3rd Party Debtor Code | N9 |

Displays the Employer / 3rd Party’s, accounts

receivable debtors account, responsible for the students account or

portion there off to which the student debtor transactions was transferred. |

| 3rd Party Debtor Purchase Order Number | A9 | Displays the 3rd Party's purchase order number, responsible for the student's account or portion there off. |

| Document Type | A2 | Displays the the document type, i.e. Invoice or Credit Note, created in the Accounts Receivable subsystem on transfer of the transactions from the debtors account to the employer or third party. |

| Right Column | ||

| Document Number | A10 | The

document number that was created in the Accounts Receivable subsystem

on transfer of the transactions from the debtors account to the

employer or third party. This is a query only field and cannot be

updated by the user. |

| Line Number | N3 | The document line number into which the transaction from the debtors account was transferred into on the document type and number of the employer or third party debtor account. This is a query only field and cannot be updated by the user. |

| Copy to AR User | A8 | The

user that transferred the student debtor transactions to the Accounts

Receivable subsystem. This is a query only field and cannot be updated

by the user. |

| Date Copied | DD-MON-YYYY HHMM | The date and time the transactions were transferred to the Accounts Receivable subsystem. This is a query only field and cannot be updated by the user. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 17-Mar-2007 | v01.0.0.0 | Amanda Nell | t130149 | New manual format. |

| 19-May-2009 | v01.0.0.1 | Ernie van den Berg | t157364 | Review the manual. |

| 09-Nov-2015 | v04.0.0.0 | Marchand Hildebrand | t196629 | Convert to ADF |