|

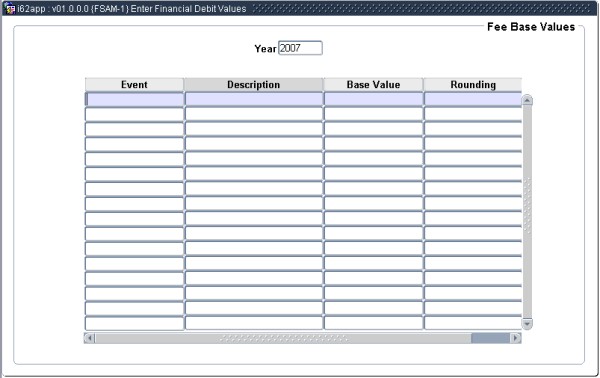

In this two-Tabs option the debit values for generating transactions against the student accounts are defined and maintained. The user will only be able to see the fields that were flagged as key fields on {FSAM-29} in Panel Box 1 Tap 2.

This is the last step in the creation and maintains of the SD fee structure.

The first screen contains the academic year, all the events and there base values and rounding. The second screen is per event and has the key fields, as define in {FSAM-29}, that represent the ‘key’ of the the SD Fee Structure per event, that is also according to which academic field values must the student be charged.

These key fields, per event, can only be changed at the beginning of a new academic year and structure – that is when a fee structure is created for a new academic year BEFORE A APPLICATION AND/OR REGISTRATION, WAS PROCESSED, FOR THE NEW ACADEMIC YEAR. If any application and/or registration was done for a academic year then no maintenance is allowed on the key fields. Maintenance is allowed on the second block of this option during the academic year.

KEY FIELD MAINTENANCE CANNOT BE DONE IN THIS OPTION, it is done as followed:

To change some of the key fields, only one field at a time can be changed, using the batch programs.Fields in the option:

| Field | Type & Length |

Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Academic Year | YYYY | Enter the academic year for which the information is applicable. On

<NEXT TAB>, the following information will be displayed. |

||||||||||||

| Event | N2 | The events as per option {FSAC-1} where the event and reference event is equal will be displayed on the screen and the base value and rounding factor can be maintained. | ||||||||||||

| Event Description | This is a display field only and shows the description of the event. |

|||||||||||||

| Base Value | N15.2 | The financial value is maintained as a ”Standard Cost” for practical reasons, the cost of individual, E.g. subjects, being expressed as a fraction (Fee Weight) of this value. One obvious advantage lies in the fact that an across-the-board percentage increase in event fees may now be handled by merely adjusting this single value. | ||||||||||||

| Rounding | The user has the option of rounding fees off to the next (0) One cent, (1) One Rand, (2) Ten Rand, (3) Hundred Rand. Example: Fee Value = Base Value times Fee Weight = 2212 times 0.97521 = 2157.1645 Fee Value Rounded:

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Year | N4 | Display field only and will default from tab 1. |

| Event | A2 | Display field only and will default from tab 1. |

| Base Value | N17.2 | Display field only and will default from tab 1. |

| Field | Type & Length |

Description |

|---|---|---|

| Currency | A3 | The valid currencies, as defined in {FCSO-21}, will be displayed. The field has a <List of Values> function and can be used for query mode and new records. The field has a Pop Up Menu that has the following: Description of the Currency Code

List Of Currencies |

| Post / Under Graduate | A1 | State if the subject (event 07) or qualification (event 05) is a (P)ost or (U)ndergraduate subject/qualification. |

| Cash / Terms | A1 | Select (C)ash, (T)erms. Different fee weights can be linked to a record for students paying cash and students paying on terms. (C)ash might be used to reduced fee value for the qualification/subject/residence if a student pays cash. |

| Offering Type | A2 | The valid Offering Types, as defined in

{GCS-5} and used in

{SACAD-13}

or {SACAD-14},

will be displayed. The field has a <List of Values> function and can be used for query mode and new records. The field has a Pop Up Menu that has the following: Description of the Offering Type

List Of Offering Types |

| Study Period | A1 | The valid Study

Period, as defined in option {SCODE-30} and used in {SACAD-13},

TAB - Qualification

Study Periods / Quotas will be displayed.

This field

is only used when the event for a Qualification. The field has a <List of Values> function and can be used for query mode and new records. The field has a Pop Up Menu that has the following: Description of the Study Period

List Of Study Periods |

| Student Type | A2 | The valid

Student Types, as defined in {SCODE3-5} will be displayed. The field has a <List of Values> function and can be used for query mode and new records. The field has a Pop Up Menu that has the following: Description of the Study Period

List Of Study Periods |

| Block Code | A2 | The valid Block Code, as defined in {SCODE2-1} and {SCODE2-2} will be displayed. The field has a <List of Values> function and can be used for query mode and new records. The field has a Pop Up Menu that has the following: Description of the Block Code

List Of Block Codes |

| Exam Type | A1 | The valid Exam Type, as defined in {SCODE2-1} and {SCODE2-2} will be displayed. The field has a <List of Values> function and can be used for query mode and new records. The field has a Pop Up Menu that has the following: Description of the Exam Type

List Of Exam Types |

| Field | Type & Length |

Description |

|---|---|---|

| Qualification / Subject / Residence Code | A7 |

This field is not used by all events, it is only used by events 05, 07, 13, 17, and 32. Query a valid qualification / subject / residence code. The field has a Pop Up Menu that has the following: Description of the Qualification/Subject/Residence and its active status

List Of Qualification/Subject/Residence Codes. |

| Fee Weight | N2.3 | Set this field to 0 (zero) if the transaction type has a default amount as defined in

option {FCSO-7}.This

transaction type default amount override all values of this field Fee

Weight. The transaction type default amount will not display in

the next field Fee Value, to see the transaction type default amount

use the <List of Values> function on the transaction type field

below. To discontinue the transaction type default amount set it

to null in option {FCSO-7} and then change Fee Weight to the required value. Fee Weight is expressed as a fraction of the base value of the event as per Tab 1. The system defaults to a value 0, but the user may adjust this value as required. The calculated monetary value is displayed in the next field when <RETURN> is pressed. |

| Fee Value | N15.2 | This is a display field only, and will display the

fee amount that will be

generated for this record. The amount is determined by multiplying the event base value with the above fee weight. The system will round off according to the rounding rule of the event as per Tab 1. |

| Fee Adjusted |

Valid values is Y/N (Yes/No/null). When the system

create the record from option {FSAM-29} the system will set this value

to No. If No/null and the system wants to raise the fee it will

apply the system operational parameter SY of subsystem SD rules as

describe above. The financial user must set this value to Yes

once he/she as maintained or checked all fields of the record,

thereafter the fee raise program will use the record not applying the

system operational parameter SY. |

|

| Generate | A1 | Indicate whether a transaction must be generated for

this record, (Y)es or (N)o. If Yes the next field Transaction Type is mandatory. The relationship between fields Fee Adjusted and Generate fields: If Fee Adjusted is Yes

Then If Generate is Yes.

ElseThen The fee raise program will use the record to raise the fee.

Else

No fee will be raised by the fee raise program.

The fee raise program will apply rules as specified for the field Fee Adjusted.

|

| Transaction Type | N4 | Select the appropriate SD Transaction Type to be used

to generate the

transaction, as defined in option {FCSO-7},

for the SD subsystem. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Transaction Type

List Of Transaction Type |

| Field | Type & Length |

Description |

|---|---|---|

| Basis of Generation | A1 | The user can

define rules as

to when the event transaction/s must be generated. Generation can be done per (I)nstitution (C)ampus, (O)ffering Type, Block (A)nd Campus, (B)lock, (Q)ualification or (E)very Time and (D) for Qualification and Block. Basis of generation may not be O (Offering Type) for events 19 or 57. Basis of generation (D) Qualification and Block, (Q) Qualification and (A) Block And Campus is only applicable to event 03 and 20. If Basis of Generation is set to "D", the Database procedure will check if the combination of Qualification and Block has changed, if it does not exist a new event "03" or "20" will be raised. If the event has columns Generate Cancellation Transaction, Cancellation Transaction Type and Cancellation Credit Code, in other words, the event can do cancellation of fee transactions: Only

record/s where the Basis of Generation is equal to E (Every

Time) and the student cancel will use the values of the mention

fields and process cancel transaction on the student account.

The rest of the Basis of Generation codes will not do any cancellations regardless the values of the mentioned fields. |

| Test Period | A1 | The test period can be for (T)his year or (A)ll years.

In conjunction

of the basis of generation field above, testing will be done for the

period stated to determine if an event transaction must be generated. If the Basis of Generation is equal to E (Every Time) the system will not use this field. For the rest of the Basis of Generation codes This Year Will process the event fee transaction/s only once per academic year for the basis of generation.

All YearsWill process the event fee transaction/s only once in the student term at the client for the basis of generation.

|

| Field | Type & Length |

Description |

|---|---|---|

| Generate Cancellation Transaction | A1 | Indicate whether a cancellation transaction

must be generated for

this record, (Y)es or (N)o, when the student cancel application or

registration. If Yes then Cancellation Transaction Type and

Cancellation Credit Code is mandatory. Cannot set generate cancellation transaction to Yes if field generate is No Also see basis of generation rules above, relating to this fields. |

| Cancellation Transaction Type | N4 | Select the appropriate SD Transaction Type to be used

to generate the

cancellation transaction, as defined in option {FCSO-7},

for the SD subsystem. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Transaction Type

List Of Transaction Types |

| Cancellation Credit Sequence |

N11 | Enter the cancellation credit code according to which

the cancellation amount must be calculated, as defined in option {FSAM-31}. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Cancellation Credit Code

List Of Cancellation Credit Codes |

| Field | Type & Length |

Description |

|---|---|---|

| Cost Centre | A4 | This

is a not mandatory field. This field form part of a number of cost

centre options that lead to the income cost centre when fees are raised

on the student account. Cost Centres are define in option {FCSO-1} and link to a GLA in option {FCSO-6}. The fee raise program does not validate the cost centre, reasons are: It is a background program.

SD Fee transaction volumes are very high during registration period. Therefore cannot stop the registration process for invalid cost centre. The cost centre options that lead to the income cost centre are: The fee raise program will find the income cost centre as followed:

If a residence fee the first

place to look will be on the building code {SPCS-4}, if null, it

follow the same root as any registration fees:

For any registration fees this cost centre, if null The transaction type

credit cost centre for debit journals and debit cost centre for credit

journals. If null the system will create the student fee transaction

with a null cost centre.

It is thus very important that

the cost centre option that the system will choose is valid as well as

the account that follows the same root. Financial department must

validate this before the registration process. Cost Centre and

Account forms the GLA and invalid GLA's are reported by running option

{FGLPR1-3} and fix the errors.

The field has a <List of Values> function.The field has a Pop Up Menu that has the following: Description of the Cost Centre

List Of Cost Centres |

| Account | A8 | This is a not mandatory field. Accounts are define in option {FCSO-3} and link to a GLA in option {FCSO-6}. The same rules as for above cost centre applied to the account. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Account

List Of Accounts |

| Account Type | A4 | This

is a not mandatory field. This field form part of a number of Account

Type options that lead to the account type when fees are raised

on the student account. Account Types are define in option {FCSC-21} for the subsystem SD. No fees can be raised if the account type is null. The account type options that lead to the account type that will have the students fee transactions are: The fee raise program will find the account type as followed:

If there is a contract {FSAC-10} link to the qualification during registration then:

For the contractee and

contributing employer the fees raise program must use the account types

as define in the contract for the two parties.

For the student the following rules apply: If the contract definition has a account type for the student:

In

the case of events 03, 05 and 07 the fee raise program will use the

account type as define on the contract definition, if null or for the

rest of the events, it

follow the same root as any registration fees:

If a residence fee the first

place to look will be on the building code {SPCS-4}, if null, it

follow the same root as any registration fees:

For any registration fees:

The account type as on option {FSAM-4b2} if null, This account type. if null, The transaction type account type, If null, the system will not create the student fee transaction

with a null account type.

It is thus very important that

the account type options that the system will choose is valid. Financial department must

validate this before the registration process.

The field has a <List of Values> function.The field has a Pop Up Menu that has the following: Description of the Account Type.

List Of Account Types. |

| Field | Type & Length |

Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Block/Daily | A1 | Valid values B/D (Block/Daily). Residence fee can be raised per block or on a daily bases. Field is use by events 13 only. |

|||||||||||||||

| CT/CB Amount | N17.2 | The default amount to test CT/CB transactions for applicable for this combination. The following will only activate if the user insert or update this CT/CB Amount or the field is not null and the user press the <Next Field> function, the system pop-up the more required fields for the CT/CB Amount field:

These fields purpose are to validate if the fee structure CT/CB Amount and additional fields are on the student account and is equal to or greater than this CT/CB amount. If equal to or greater than this CT/CB Amount the system will allow registration and raise the fees. The system will look into the CT/CB Default account type and the account type that will be used to raise the fees. |

|||||||||||||||

| Use Event 05 CC | A1 | Valid values is Y/N (Yes or No). Indicate if the qualification cost centre must be used.

If (N)o or null, the

cost centre will be selected as describe above else this record cost centre will be used and overriding the

cost centre select as describe above . Field is use by events 01, 03, 07 and 55 only. |

|||||||||||||||

| Discount Code | A2 | A Discount Code as created in option {FSAM-6}. Field is use by events 05, 07 and 13 only. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Discount Code.

List Of Discount Codes. |

|||||||||||||||

| Royalty Code | A4 | If royalties are payable on this qualification /

subject. A Royalty Code as created in option {FSAC-5}. Field is use by events 05 and 07 only. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Royalty Code.

List Of Royalty Codes. |

|||||||||||||||

| Institute Code | A4 | If institute fees are payable on this qualification /

subject. A Institute Code as created in option {FSAC-7}. Field is use by events 05 and 07 only. The field has a <List of Values> function. The field has a Pop Up Menu that has the following: Description of the Institute Code.

List Of Institute Codes.

|

|||||||||||||||

| Down payment | N17.2 | The minimum amount or down payment that must be made by

the student for this qualification. Field is use by events 05 and 13 only. This field has the same function as CT/CB Amount and will be use in stead of CT/CB Amount if not null. |

|

This tab is a subset of the data as define in option {SPOPS-1} and only field Fee weight is updateable on this screen. The used is not allowed to insert or delete any records in this screen, this kind of maintenance can only be done in option{ SPOPS-1}, if permitted.

Only event 13 is using this block.

The fee amount formula for event 13 is the following

The base value (as define in block 1) time the residence fee weight (as define in tab 2) time the floor room fee weight (as define in this tab)

NB. A residence in tab 2 may have a number of records pending on the key of event 13. This blocks floor room fee weight is applicable to each of the tab 2 residence records:

Example of Event 13 fee amount:

Base value is tab 1 is 200.00

Has a key of Block Code then residence 100 will have a record for each block code that is define on the system.

| Block | Residence | Fee Weight | Fee Amount |

| 0 | 100 | 1.2000 | 240.00 |

| 1 | 100 | 0.8000 | 160.00 |

| 2 | 100 | 1.0000 | 200.00 |

Has five rooms in a single level residence.

| Residence | Floor | Room | Fee Weight | Fee Amount for Block 0 | Fee Amount for Block 0 | Fee Amount for Block 0 |

| 100 | 0 | 1 | 0.300 | 72.00 | 48.00 | 60.00 |

| 100 | 0 | 2 | 0.500 | 120.00 | 80.00 | 100.00 |

| 100 | 0 | 3 | 1.000 | 240.00 | 160.00 | 200.00 |

| 100 | 0 | 4 | 1.200 | 288.00 | 192.00 | 240.00 |

| 100 | 0 | 5 | 1.600 | 384.00 | 256.00 | 320.0 |

This screen will only display one of the Fee Amount columns. It display the values of the active record when the user has navigate to this tab.

All rooms in the residence will be displayed in room number sequence, showing the residence name, floor, room number and the number of places in the room.

The system does not prevent a student from being assigned to a room that is not normally used as a bedroom.

| Field | Type & Length |

Description |

|---|---|---|

| Residence | N4 | The residence code of the active record when navigated to this tab. The field has a Pop Up Menu that has the following: Description of the Residence Code.

|

| Floor | N4 | This is a display field only, as defined in option {SPOPS-1}. |

| Room | A7 | This is a display field only, as defined in option {SPOPS-1}. |

| Places | N5 | This is a display field only, as defined in option {SPOPS-1}. |

| Fee weight | N1.5 | The system will default the fee weight, as defined in option {SPOPS-1}.

When the weight is changed and <Next Field> is pressed, the new values will be displayed as whole units. The fee weight may only be updated if the Date Inactive > System Date. |

| Fee Amount | N15.2 | Display field and is calculated as describe above. |

| Processing Rules |

|

|---|---|

|

Fee Structure:

Download and Upload of Data 1.

Set up BATCH-7 for function ‘FSDU’. a.

Supply the directory on the file system. b.

The suffix must be ‘txt’. Do not use ‘csv’ as

the file then opens incorrectly in EXCEL. c.

System must be ‘FILED’.

2.

The C-programs to download and upload the fee

structure are linked to menu codes FSAMR2-17-23 and will be visible on USERS-1,

but these options are not available to the user to run from the menus, they

will not display. These C-programs can only be run from FSAM-1 and FSAM-29. Two

reasons for this: a.

To allow the user to still view the output from

BATCH-14. b.

The input parameters for these are customized on

FSAM-1 and FSAM-29 to only prompt the user for the applicable parameters and

not all available parameters 3.

Example for FSAM-1, FSAM-29 functions in an

analogous way. a.

Download of fee structure data:

i.

On the first tab, search for the applicable

year, click on the applicable event, and click on the second tab ‘Fee Values’.

ii.

Enter the parameters needed, if any (eg block

code). These parameters will be used as parameters for the download

functionality.

iii.

Click ‘Search’. (this step is not needed) 1.

Note the number of rows queried.

iv.

Click on the ‘Download Fees’ button. A popup

will be displayed, requesting the file name. The previous file name used, if

any, will be defaulted and will be cleared once the option is exited. The ‘x’

(close button) can be used at any time to cancel. Enter the filename WITHOUT

the extension, as the extension has been set up as ‘txt’ on BATCH-7. Click on

‘Run in Batch’.

v.

To view the results of the run, the user may use

the button ‘View Result of Last Run’. If the program is still busy running a

message will be displayed. 1.

At this point the user can close the popup by

clicking on the top ‘x’ button. The results of the run and the comma-delimited

file can be viewed / opened at any time in the following four ways: a.

If the user did not run another download report,

and did not exit the option, the user can click on the ‘Download Fees’ button

again, and then on the ‘View Result of Last Run’ button. b.

The user can exit the option and the run results

will displayed in the ‘Batch Jobs’ section of the main screen c.

Click on ‘More’ then ‘Batch’ at top of home

screen d.

Use BATCH-14. 2.

Once the download is finished, and the user views

the run results in any of the above ways, the user is routed to the batch

prompts / report run results screen.

3.

Two output files are created, the first a

summary of the parameters and number of records downloaded, and the second the

comma-delimited file. Each file can be viewed separately, one at a time. a.

There are two stylesheets available, the normal

‘TXT’ and also ‘TXT2XLS’. b.

The

default is ‘TXT’ to view the results in text format.

i.

Be careful to use ‘TXT’ if a very large amount

of records were downloaded.

ii.

Note the two tabs that will be opened with ‘TXT’,

the contents of the first tab (summary) will be like the following:

iii.

The contents of the second tab (comma-delimited

file) will be like the following:

c.

‘TXT2XLS’will open the file directly in EXCEL.

i.

Note, the first file does not need to be opened

in Excel (where the file name ends with TXT2XLS_1.xls), only open the second

file (where the file name ends with TXT2XLS_2.xls). Again, if the file is big,

rather use ‘Save’ first and then open it via Excel from where it was saved.

Once opened in Excel it will look like the following:

Select the first column, and then use ‘Data’, ‘Text to

Column” to start the ‘Text Import Wizard’ to set up the columns:

Tick ‘Delimited’, then ‘Next’:

Tick ‘Comma’ then ‘Next’:

It is important the set all columns, that are codes starting

with a ‘0’, as type ‘Text’, otherwise Excel will drop the leading zeros and the

data will end up invalid. This will apply to all columns except the numeric

columns such as transaction types, fee weight and amounts.

Example of the result:

Note the following file requirements: -

The first row has the column or attribute names

as set in the database. Do not change this line or delete it as it is used for

the upload. If it is incorrect the upload will not work. -

The second row is the descriptive column names.

This row will be ignored with the update (ie the second line in the upload file

will be ignored), so this line should not be deleted from the spreadsheet. -

The column xxxADFSEQ must be the last column and

must NOT be deleted by the user from the spreadsheet as it is needed as a

unique identifier for the row in the database. Do not change the value. -

Do not edit the ‘key values’ (eg block code,

offering type). -

If a new row must be created, insert it in the

spreadsheet with the value of the ADF sequence column as NULL. Ensure the

correct ‘key values’ are entered and are not duplicates. -

Columns may be deleted or moved in the

spreadsheet, except the ‘key’ columns that are used for the specific year and

event, for example in the above spreadsheet, the ILBTMONEY column can be

deleted, but not the ILBOT column. -

Rows may be sorted in any way and deleted or new

rows added. -

Data may be edited but bear in mind that all the

validations will be applied when the file is uploaded. No validations will be

performed within Excel. -

When finished save as ‘Text’ file:

To upload the file that was downloaded and edited: On FSAM-1, query the year, select the find, click on the ‘Fee Values’

tab. (the data queried does not need to correspond to the data in the file to

be uploaded). Query data if needed. If the file is saved in a local drive, it has to be transferred to the

server. Click on ‘Upload Fee File’ button. This will load the file from a local

drive to the server, to the directory as specified on BATCH-7 for ‘FSDU’. (If

the file has already been saved to the server in the directory as set up in

BATCH-7 this step can be ignored):

Use ‘Browse’ to find your file to upload to the server, the Directory on

Server will be the directory as set up on BATCH-7 for ‘FSDU’. Click on ‘Save File’.

Then use the Button ‘Process Fee Upload File’. The file name will be

pre-filled but remove the ‘txt’ extension, then select the ‘Run Type’ and click

on ‘Run in Batch’.

If the process is still busy running a message will be displayed:

The results of the run can be viewed in the same way as for the upload

program as explained above).

The first page of the output file will contain the parameters:

The results of the upload will be displayed from the second page of the

output file:

The Row number corresponds with the row number in the saved file and then

also in the Excel spreadsheet (excluding the two heading rows). This will

assist in tracing errors. Find the row in Excel where the row number is equal

to the row number in the output file plus 2. Errors will be displayed in the ‘Status’ column of the output file.

If any errors were found for any

row, NOTHING will be updated / loaded to the database. The summary at the end

of the output will show whether there were any errors. After the upload was successful, execute a ‘Search’ again to view the

applicable data, it should be in sync with the spreadsheet:

Residence Room Fee Values: Tab will only be available for events 13 and 32, if valid records were

queried on the second tab, and the user must highlight the line to indicate

which building to query when the user navigates to the tab ‘Residence Room

Fee’. To download room fee weights click on button ‘Download Room Fee Weights”:

To

upload a ‘Residence Room Fee Weights’ file to the server, use the button

‘Upload Fee File’ on the tab ‘Fee Values’, then navigate to the tab ‘Residence

Room Fee’ to upload the fees using button ‘Process Room Fee Weights Upload

File’. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 11-Mar-2007 | v01.0.0.0 | Amanda Nell | t133817 | New manual format. |

| 05-May-2009 | v01.0.0.1 | Ernie van den Berg | t157364 | Review the manual. |

| 14-Jan-2010 | v01.0.0.2 | Charlene van der Schyff | t160040 | Enhancement made to: Field Event Group1. Basis of Generation. Added additional Indicator for (D) Qaulification and Block for Events "03 and 20". |

| 01-Oct-2018 |

v04.1.0.0 |

Sthembile Mdluli |

t229515 |

ADF enhancement |