|

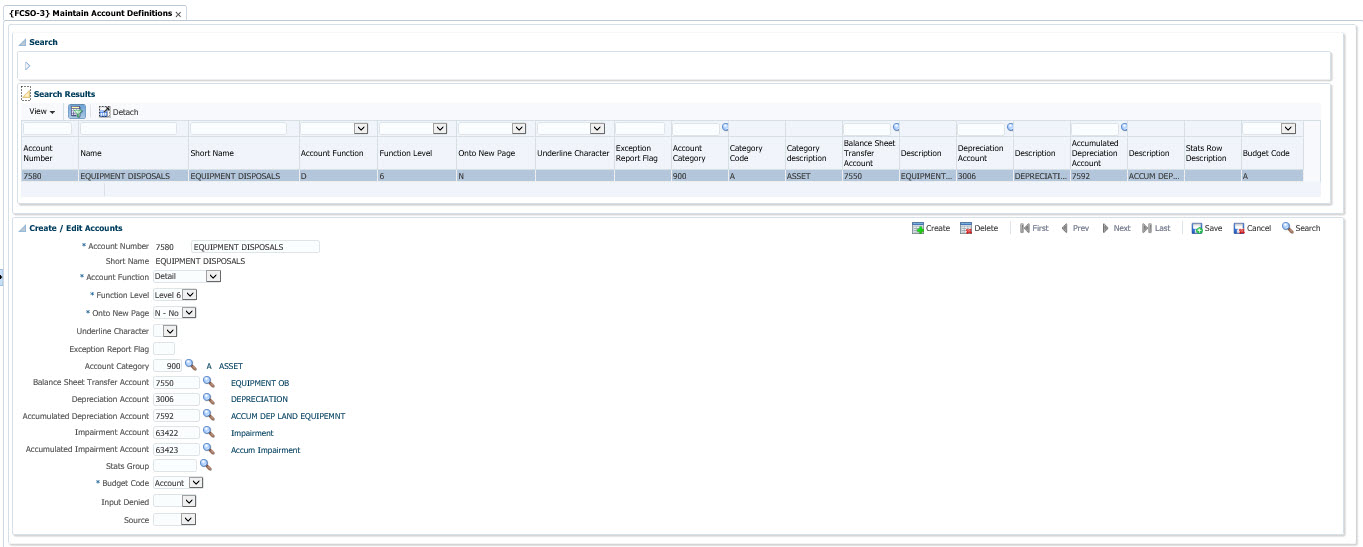

The account is the "lower" level of the GL-Allocation and contains the rules for accumulation, sub-totaling and totaling.

Therefore, defining accounts and

setting up the calculation rules and

levels of calculation require thorough planning beforehand.

Once again it is recommended that the responsibility for creating

accounts is delegated to one person within the institution.

Whilst the calculation rules are not limited by the system, the user should bear in mind that an over-complication of the calculation rules may result in extensive maintenance and an unnecessary load on computer resources. Furthermore, the user should take cognisance of the fact that reporting can be done at different levels and that accounts of "similar importance" should be on the same level. An example of a structure is attached as Example.

If Account Lists are used in the system by an institution, new accounts created in this option can automatically be added to the Account Lists by linking an Account Range on the Account List definition {FCSO-5}. Should an account be created that falls within the range on an account list, the account will be added to the account list.

The deletion of an account is controlled and cannot be done in this option. If an account code must be deleted, it can be done via {FCSM-22}.

| Field | Type & Length |

Description |

|---|---|---|

| Account Number | A8 | Unique code for this account. Less

characters than the eight specified may be used, usually not more than

four. Users should take

care in numbering the accounts because

calculations are done sequentially on this number. A list

of example

accounts is supplied with the system. The logical structure of accounts is:

|

| Name | A30 X 2 | Supply a suitable name for this account. Two lines of description are provided. |

| Short Name | A20 | The first 20 characters of the description (name). The name will default into this field and the user may change it as required. This name will appear on reports and query screens, and users should, therefore, ensure that it makes sense. |

| Account Function | A1 | This indicator determines the calculation function of

this

account, and should be read with the function level below. An example

is discussed below. The valid options are:

|

| Function Level | N1 | There are 1 => 9 accumulation levels available, and accounts with a zero in this field will be ignored in the calculation process. The Trial Balance Report, menu option {FGLOR1-1}, can be produced at specific levels and therefore users should take care that sub-total and total accounts of the same importance are at the same level. (Refer Report {FCSOR1-6} for examples of account function and function level). |

| Onto New Page | A1 | Should this account be printed on a new page during reporting? (Y)es or (N)o. |

| Underline | A1 | Should this account be underlined with one line (-) or with double lines (=) on reports. |

| Exception Report Flag | A1 | Enter marker for exception reporting. Part of the selection criteria in cost reporting refers to "exception" reporting (I)ncluded or (E)xcluded, and the user can specify the exception indicator to be included or excluded. The purpose and definition of the character used is user defined. |

| Account Category | N3 | The account category to which this account is linked. The system will display the description and the Account Category Type. This field should be left blank for (H)eader, (S)ub-total and (T)otal accounts. The user should note that an Account Category is linked to an Account Type, which is an indication whether this account is an (A)sset, (L)iability, (E)xpense or (R)evenue account. The Income and Revenue and Balance Sheet Reports ({FGLOR1-2} and {FGLOR1-3} respectively) will accumulate the values of such accounts according to this indicator and not on its position in the structure. |

| Balance Sheet Transfer Account | A8 | Supply the balance sheet transfer account to which the

account must transfer to at year-end. The rules applicable to this field are as follows :

|

| Depreciation Expenditure Account | A8 | Supply the expenditure account for depreciation. Only accounts, which are linked to the account categories less than 490 are allowed. |

| Accumulated Depreciation Account | A8 | Supply the account for accumulated depreciation. The account category of the Accumulated Depreciation Account must be between 900 and 909. |

| Impairment Account |

A8 |

Supply the impairment account.The

account

category of the Impairment Account must be less than 490. |

| Accumulated Impairment Account |

A8 |

Supply the impairment account.The account category of the Accumulated Impairment Account must be between 900 and 909. |

| STATS Row Code | N5 | Enter the STATS Rowcode to which this account should be

reported, if it can be directly allocated. For specific tables, the

account can be directly allocated. For other statements, like 4.4, the

system will use the percentages specified in Block 4 of the cost centre

to spread over PCS's. The valid Rowcodes are predefined in the system, and are made up as follows: for STATS Financial Statement 4.4 row 7, the Rowcode would be 40407; for Statement 4.10 row 16, it would be 41016, etc. The valid STATS Rowcodes can be printed through option {FCSOR2-2}. |

| Motivation | A2 | This is a display and query field only. The field is used by the Income and Expense Budgeting Subsystem and can only be set in option {MEBM-3}. |

| Status | A1 | Display field only. Is this account (A)ctive or (N)on-active? Will only display (N)on-active if all the Cost Centres linked to the above account are (N)on-active. An account can be set to inactive at any time on GLA level, and thereafter no transactions will be allowed against it. A Header, Sub-total or Total Account cannot be set to non-/active. The system will treat these Accounts as active except for option "Delete Account" {FCSM-22}, which will treat it as Non-active. |

| Budget Control | A1 | Indicates if budget control must be done on this

account,

(A)ccount or Account (C)ategory. The system will default the value from

the System Operation Definition. When the user executes <

HELP>, the valid values along with the explanation on the use of

these budget control indicators will appear in the form of a pop-up

screen. This indicator should be read with the indicator on the cost

centre. If the cost centre indicator is set to (N)o,

the system will ignore budget control for all accounts within this cost

centre. If Cost Centre budget control indicator is set to Account/Account Category, then budget control is done on the available funds for all Accounts where the Account Category of the account is in the account category range as defined on the budget code linked to the cost centre. Thus, users must ensure that the budget control indicators for these accounts are set-up correctly. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 27-Sep-2006 | v01.0.0.0 | Amanda Nell | t133471 | New manual format. |

| 10-Dec-2008 | v01.0.0.1 | Marchand Hildebrand | t152121 | Manual Corrections |

| 11-Jan-2010 | v02.0.0.1 | Ernie van den Berg | t162536 | Add a note on the new Account List Range function. |

| 28-Jul-2011 | v02.0.0.2 | Christel van Staden | f176283 | Account codes cannot be deleted from this option |

| 11-Nov-2015 | v04.0.0.0 | Marchand Hildebrand | t200729 | Convert to ADF (199727) |

| 26-Oct-2020 |

v04.1.0.0 |

Ndivhanga Mushando |

t247834 |

Add new fields 'Impairment' and 'Accumulated Impairment' |