Maintain Cost Centre Definition {FCSO-1}

The cost centre is the "highest"

level of the

GL-Allocation and as such it will have a critical influence on

reporting. Therefore, defining cost centres and setting up

the

consolidation rules or structures require thorough planning beforehand.

It is recommended that the responsibility for creating cost centres be

delegated to one person within the institution.

Whilst the consolidation

structures are

not limited by the system, the user should bear in mind that an

over-complication of these structures will result in extensive

maintenance and an unnecessary load on computer resources. Furthermore,

the user should take cognisance of the fact that two other structures,

namely "Departments" and "Fund Groups", are indirectly maintained and

therefore available. An example of a structure is attached as Example.

Fields in the

option:

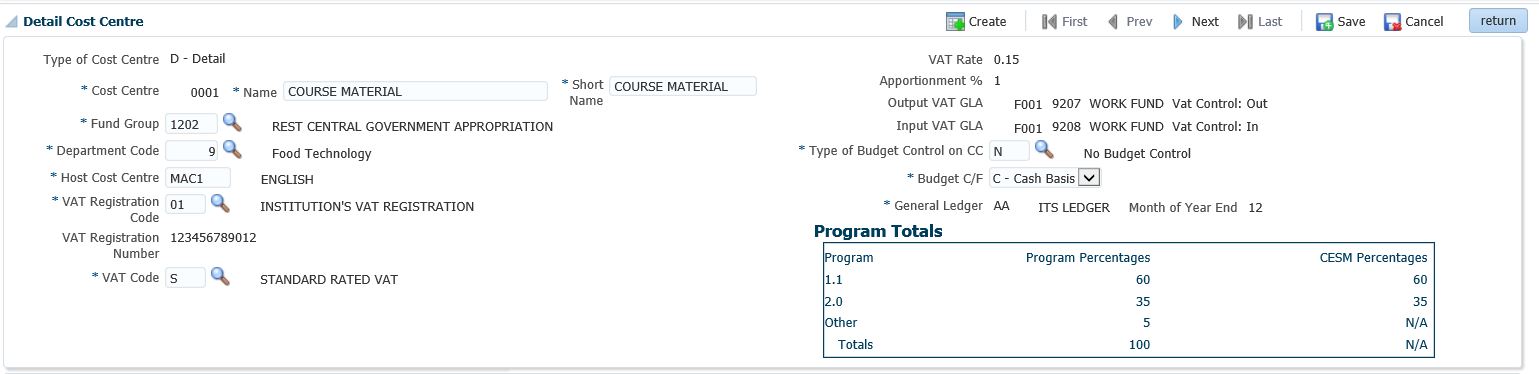

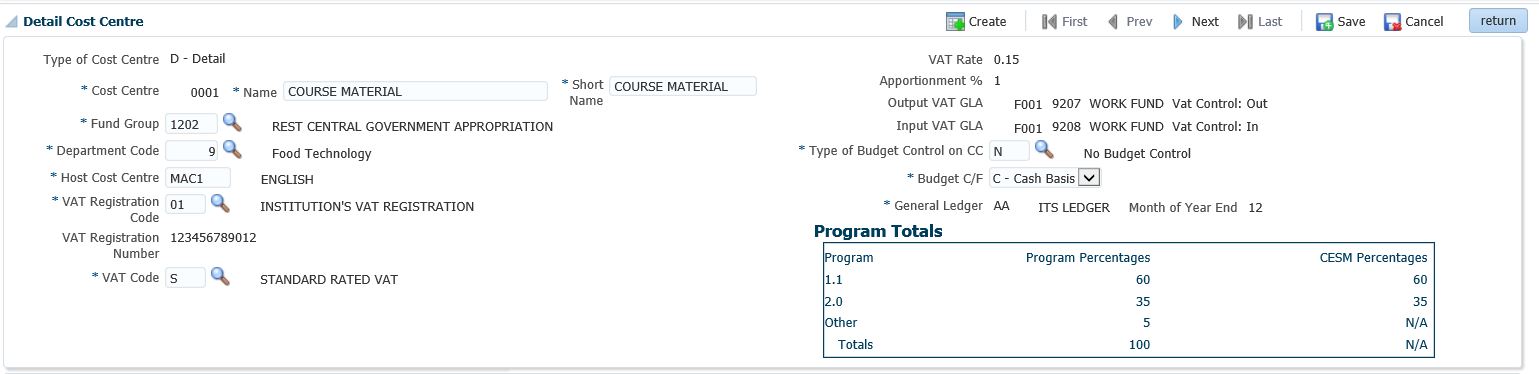

Panelbox: Detail Cost Centre

Example:

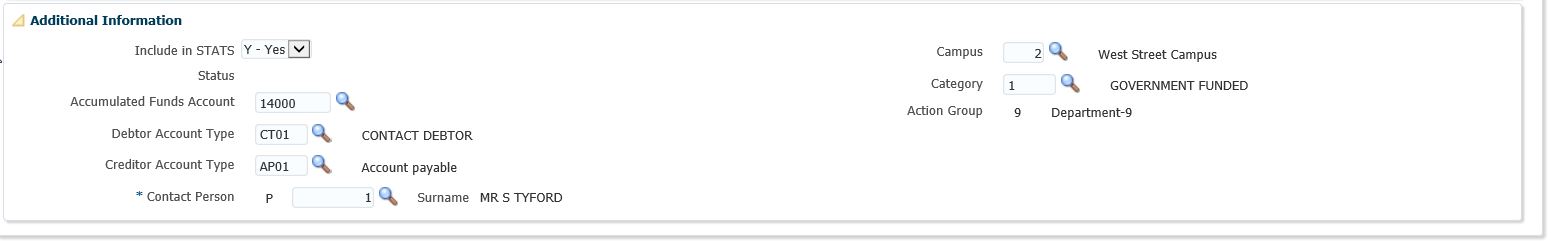

Panelbox: Additional Information

Field

|

Type & Length

|

Description

|

| Accumulated

Fund Account |

A8

|

Should the income and expense balance of the cost

centre not be transferred to the default accumulated funds account as

defined in {FCSM-1b1} with

the GL year-end

the user can define the accumulated funds account to be used on the

cost centre. The account entered, is the account number to which the

accumulative balance (balance of all accounts before the transfer

account) will be transferred if the default Accumulated Funds Account

should not be used. The Account Category of this account must

be

between 700 and 709. The year-end program will

validate

that the account is linked to an account category between 700 and

709. The transfer account is not required and if null the

default

accumulated funds account as defined in FCSM-1b1 will be used. |

| Debtor Account Type |

A4

|

Supply the Account Type for the sub-system Debtor if

applicable

for this Cost Centre. The Account Type name will default into the

description field. A <LIST> of Account Types, as defined

on menu

option {FCSC-21} for the

sub-system Debtor, is available. |

| Creditor Account Type |

A4

|

Supply the Account Type for the sub-system Creditor if

applicable

for this Cost Centre. The Account Type name will default into the

description field. A <LIST> of Account Types, as defined

on menu

option {FCSC-21} for the

sub-system Creditor, is available. |

| Contact Person |

A1

|

Indicate the type of contact person for the receipt of

Ledger

reports. The valid value for this field is (P)ersonnel. On entering

(P)ersonnel, supply the applicable number (N9) in the next field.

Labels, letters etc., for recipients of Ledger reports are printed on

menu option {FGLCOR1-1}. |

| Campus |

N2

|

Campus Code is used to link the Cost Centre to a Campus

and will be used to generate Cost reports per campus. Currently no

standard reports are using the above code. Campus Code is created with

option {SPCS-1}. |

Category

|

A4

|

Cost Centre Categories are defined in the menu option {FCSC-9}

"Maintain Cost Centre Categories". Cost Centre Categories are used for

reporting purposes but reporting is limited to Views and Summaries in

specific the view "M16 - GL and Commitments". |

Example:

Panelbox: Program Percentages Per Cost Centre

Field

|

Type & Length

|

Description

|

Cost Centre

|

A4, A6 for UK clients |

Defaults Detail Cost Centre Panelbox. |

Program

|

N2, N2, N1

|

The program is entered in three fields, i.e. the main

programme (1 to 13), the sub-programme (for all programmes except 2 and

3), and the sub-sub-programme (only for sub-programmes 5.2 and 6.4). In

cases where there are no sub- or sub-sub-programmes, zeroes must be

entered. The name of the (sub-)(sub-)programme will be

displayed once the complete code has been entered. |

Percentage

|

N5.1

|

Percentage of the expenses to be allocated to each

programme. The percentages should add up to 100%. |

Example:

Panelbox: CESM Percentages for Programs 1.1 and 2.0

Field

|

Type & Length

|

Description

|

Cost Centre

|

A4, A6 for UK clients |

Defaults from Detail Cost Centre Panelbox. |

Program

|

N2, N2, N1

|

The program is entered in three fields, i.e. the main

programme (1 to 13), the sub-programme (for all programmes except 2 and

3), and the sub-sub-programme (only for sub-programmes 5.2 and 6.4). In

cases where there are no sub- or sub-sub-programmes, zeroes must be

entered. The name of the (sub-)(sub-)programme will be

displayed once the complete code has been entered. |

CESM

|

N2

|

This value can be between 1 and 22.

|

Percentages

|

N5.1

|

Percentage of the expenses to be allocated to each

programme. The percentages should add up to 100%. |

Example:

Maintain Cosolidation Cost Centre & Major Allocations buttons:

Under the following two Blocks the user can link/unlink cost centres in a

hierarchy, for example, all cost centres representing departments

within one faculty can be linked to the cost centre which represents

the faculty. This can be done on a global basis or on an

individual

basis. The system will control that the cost centre to which

the

linking is done is a (C)onsolidation

cost centre, but a consolidation

cost centre can be linked to a "higher" consolidation cost

centre.

Before structures can be created here, the Consolidation Cost Centre,

to which other Cost Centres are to be linked, must first be queried on

block 1. This does not apply should the User only want to view existing

structures.

In Block 2 the user can enter the cost centre code and the system will

display the following:

- Description of cost centre

- Is this a (C)onsolidation.

(D)etail

cost centres are not allowed here

- Number of cost centres consolidating into this cost centre.

The system will then prompt the user with, "Do you want to do major

consolidations? (Y)es

or (N)o".

The

user can do one of the following:

- If the answer is (N)o

the user can do single

consolidations in the next Block after <NEXT

BLOCK> command:

- the system will display the primary cost centre from

Block 2

- enter the code of the cost centre to be consolidated

- system displays if this cost centre is (C)onsolidation or

(D)etail

cost centre

- system displays if this cost centre is (A)ctive or

(N)on-active

- If the specified cost centre is already consolidated to

this cost centre, the system will respond with:

"This consolidation

already exists, cannot consolidate again"

- If the answer is (Y)es

the system will

offer a menu of choices for multiple

consolidations. The menu

prompts the user as follows:

Supply the primary cost centre

code (Q = Quit):

An existing

(C)onsolidation

cost centre code should be entered, and if not the

system will display: "Illegal cost centre or not a consolidation cost

centre", and another chance will be offered to enter the correct

code. When a valid code is entered, the system will offer the

following choices:

- Cost Centres From => To:

If this option is

selected, the system

will request the start

and end

cost centre. If an existing consolidated cost centre

is

specified, the system will execute the request but the same

consolidation will not be

created more than once.

- Masked Cost Centres:

If this option is

selected, the system will request: Supply

the mask to be used (e.g. 4 9 ) (x = exit):

The above example means

that all cost centres with a 4 in the first

digit and a 9 in the 3rd digit will be used for

consolidation. Note should be taken that this facility offers

a powerful method of consolidation if the user has numbered his cost

centres in blocks. The same controls will be done and error

messages displayed.

- To delete a consolidation or "unlink"

one cost centre from another, the user can enter the consolidation cost

centre in Block 2. Go to Block 3. Query the consolidated cost centres.

Line up the cursor to the cost centre to be deleted. Issue

<DELETE RECORD> command, and <COMMIT> the

change.

WARNING: Users

should take care before changing the status of

a cost centre from a consolidation cost centre to a detail cost centre

or vice versa. The critical concept is that transactions are

carried only on a detail cost centre.

Changing a (C)onsolidation cost centre to a (D)etail cost centre is

allowed and the user should understand that no transactions before the

date of change will be available. The system will not allow a

(D)etail cost centre to be changed

to a (C)onsolidation cost centre,

until all the transactions of the cost centre have aged beyond the

period specified for retaining of transactions and the transactions

have been removed.

Panelbox: Consolidation Cost Centre

Field

|

Type & Lenght

|

Description

|

Type of Cost Centre

|

A1

|

Is this a (C)onsolidation

or a (D)etail

cost centre? Transactions

will

only be allowed against (D)etail

centres,

(C)onsolidation

cost centres being used only for grouping of cost

centres for various reporting purposes. A consolidation cost centre

can be changed to a detail cost centre, but the reversal thereof is not

possible. |

| Cost Centre Code |

A4 (A6 for UK Clients)

|

A unique code of this cost centre. Whilst

there is no intelligence in the code, the user could build some

structure into the code, resulting in ease of use and reporting. |

Cost Centre Name

|

A40

|

Supply the description of the cost centre. The first 20

characters will default to the "short name" which will be used for

reports and on screens. |

Short Name

|

A20

|

The first 20 characters of the above name will default

to

this field, but may be altered by the user if not satisfied with the

default name. |

General Ledger Code

|

A2

|

The "ledger" to which this cost centre belongs as

defined in option {FCSC-3}.

The system will display the description and

year-end cycle of the specified ledger. The

ledgers are defined in option {FCSC-3},

and the value of the (P)rimary ledger will default into this field. The field is protected against

update. Create a new cost centre if a "ledger" must be changed, and

transfer the old cost centre data to the new cost centre by journal.

This will ensure stable reporting.

On

<COMMIT>, the system will validate that the

year-end of

the cost centre and host cost centre is the same. If not, the

system will respond with: "CC

and host CC must belong to same ledger". |

Host Cost Centre

|

A4 (A6 for UK Clients)

|

Indicate to which cost centre the Revenue and Expense

or

Mandatory Transfer for the above cost centre should be transferred

during execution of the year-end program {FGLM-7}. The system will

display

the description of the host cost centre. The host cost centre must be

linked to the same general ledger code as the above cost centre.

Depending on the value of the Fund Group, the

system will default to the following:

- If the Fund Group code starts with a 2, 3,

4 or 5, the system will default its own value in this field.

- If the Fund Group code starts with a 1, the

system will default this field to a blank.

On <COMMIT> the system will validate that fund

group of

the cost centre and the host cost centre is the same. If not,

the

system will respond with: "Fund Group not the same - will result in

inter-fund transfer". |

Contact Person

|

A1

|

Indicate the type of contact person for the receipt of

Ledger

reports. The valid value for this field is (P)ersonnel. On entering

(P)ersonnel, supply the applicable number (N9) in the next field.

Labels, letters etc., for recipients of Ledger reports are printed on

menu option {FGLCOR1-1}. |

Person Number

|

N4

|

It indicates the Person Number

|

Campus

|

N2

|

Campus Code is used to link the Cost Centre to a Campus

and will be used to generate Cost reports per campus. Currently no

standard reports are using the above code. Campus Code is created with

option {SPCS-1} |

Type of Budget Control on CC

|

A1

|

Display field only. Is this cost centre (A)ctive or

(N)on-active?

Will only display (N)on-active if all the Accounts linked

to the above cost centre are (N)on-active. A consolidation cost centre

cannot be set to non-active. The system will treat the Consolidation

Cost Centre as active except for option "Delete Cost Centre" {FCSMN-9},

which will treat it as Non-active. No transactions will be allowed

against non-active cost centres. |

Budget C/F

|

A1

|

The Period or Year End Close of Procurement Management

System

will apply this rule for the carrying forward of available funds

between financial years (for more detail see {FPMM-11}).

The value

defaults from the System Operation Definition, menu option {FCSM-1},

and the allowed values are:

- (C)ash basis - the total unexpended budget is carried

forward

- (B)udget basis - only an amount equal to the

outstanding

commitment is carried forward

- (N)one - no unexpended moneys are

carried forward.

This option is

also dependent on the "Budget Control"

indicators in the sense that the calculation of the outstanding amount

will be at GLA level or Account Category level. The system will apply

the following rules:

- If the budget control indicators on the cost centre

and

account are set to (A)ccount/Account Category and (A)ccount

respectively, the balance will be calculated at GLA-level and the

amount carried forward will be posted to the same GLA in the new year

- If the budget control indicators on the cost centre

and account are set

to (A)ccount/Account Category and Account (C)ategory respectively, the

balance will be calculated at Account Category level and the amount

carried forward will be posted to the first GLA found in the specific

category in the new year.

|

Include in STATS

|

A1

|

Indicate if cost centre must be included in STATS

reporting system (Y)es/(N)o. |

Example(s):

Example:

Cost

Centre Consolidation Structure

Processing

Rules |

|

| |

No special processing rules |

See Also:

History Of Changes

| Date |

System Version |

By Whom |

Job |

Description |

| 25-Sep-2006 |

v01.0.0.0 |

Charlene van der Schyff |

t133469 |

New manual format. |

| 10-May-2006 |

v01.0.0.0 |

Amanda Nell |

t133469 |

Adding Example |

| 08-Dec-2008 |

v01.0.0.0 |

Marchand Hildebrand |

t152121 |

Manual Corrections |

| 22-Oct-2009 |

v02.0,0.0 |

Marchand Hildebrand |

t161514 |

Add Coset Centre Categories |

23-Jan-2019

|

v04.1.0.0

|

Tshidiso Dennis Koetle

|

T227042

|

Update Manual to 4.1

|