|

If PM cycle 12, then option {FGLP-3} "Post Procurement Management to General Ledger" will not allow the user to answer yes to the following question: "Is this the last Posting for Period / Cycle, If So the Procurement Management Subsystem cycle will be incremented on completion of this posting - Y / N " Instead the user must first run this option and the program will ask all the questions and increment the cycle of PM.

NOTE: This program will automatically generate yearend transactions. It is thus important for the following transaction type "EVENTS":

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| PRIMARY/SECONDARY LEDGER CODE I1 "ITS LEDGER" IS DUE FOR PM YEAR END, ANSWER THE FOLLOWING QUESTIONS: Are you sure that All Required Period End Processes have been Completed? (Y/N) : |

A1 | ||

| Do You want to Run the Program in (T)rail or (U)pdate Mode: | A1 | ||

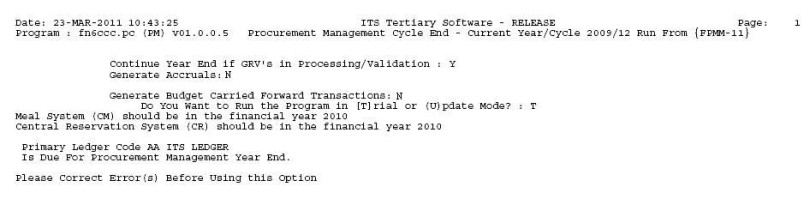

| Should the Year End Continue if GRVs in Processing or Validation Exists? (Y/[N]) | A1 | Default = (N)o. If (N)o and GRV documents exist with the status Processing or Validation the process will be aborted. if (Y)es, a warning message of exclusion will be displayed. |

|

| Do You Wish to Generate accruals (Y/N) : If (Y)es: Select: 1) Unpaid GRV's 2) Outstanding Commitments |

A1 | ||

| Accrual Asset Account Categories (Y/N) : | A1 | ||

| Generate Budget Carried-forward transactions (Y/N) : If (Y)es:

Expense greater than Budget (Default 0% press <RETURN>) Debit percentage (999.99) : NB. Zero % means do not carry forward the budget.

Current year cycle for Budget Carried Forward (99) : |

A1 N2 N6 N6 A1 N2 |

(The answer can be 1 => 12 or 14) (The answer can be 1 or 13) |

|

| NB: A)For foreign currency documents the program will use the currency rate as on the last day of the yearend. B)If the user answers the questions on this phase 1 incorrectly then ITS can reverse the GL journals on a users request, But the correct GL journals CANNOT be recreated even by ITS. COMMITMENTS WILL BE CARRIED FORWARD TO CYCLE XX : CYCLE XX is always the next cycle after the primary/secondary ledger year end. General Rules: Generate Accruals Unpaid GRV's Accrual all unpaid GRV or Supplier Returns where the Invoice or Credit Note quantity is less than GRV or Supplier Return. Financial calculation is using the GRV or Supplier Return unit price structure and the quantity difference between GRV or Supplier Return and Invoice or Credit Note. Using event CB and CC for the GL journals. Outstanding Commitments Accrual all outstanding commitments. Financial calculation is using the Order price structure and outstanding quantity. Using event CB and CC for the GL journals. Accrual Asset Account Categories The program using System Operational Definitions Codes AV and AW to determine the asset account categories. If the user answers No to the question "Accrual Asset Account Categories (Y/N)" then NO accrual GL journals will be processed for GLA's where the account is linked to asset account categories. |

|||

| The Budget Carried Forward rules: A budget control indicator is linked to each Cost centre and account. There are six possibilities: Rule # CC ACC Action 1 N A GLA is NOT used in Budget carried forward rules. 2 N C GLA is NOT used in Budget carried forward rules. 3 A C Budget carried forward per Account Category level. 4 A A Budget carried forward on GLA level. 5 C A/C Budget carried forward per Cost Centre for Account Categories 10 to 739. Categories 740 to 999 will use rules 3 and 4 to carry forward the budget. 6 S A/C Budget carried forward per Cost Centre for Account Categories 10 to 739 excluding Account Categories 310 to 329. Categories 310 to 329 and 740 to 999 will use rules 3 and 4 to carry forward the budget. A budget carried forward rule (C, B or N) is linked to each cost centre. There are three possibilities: C Cash Basis B Budget Basis N No Budget Carried Forward Data will be accumulated per Cost Centre, Cost Centre/Account (GLA) or Cost Centre/Account/Account Category depending on the Budget control indicator combinations. If Account categories 410 - 419 then cycle 13 is excluded. (C)ash Basis: The total unexpended budget is carried forward. |

|||

| For Revenue, Expense accounts the formula is: Unexpended Budget = Total Budget + Total Actual If Unexpended Budget < 0 Then Unexpended Budget = Unexpended Budget * Credit % Else If Unexpended Budget > 0 Unexpended Budget = Unexpended Budget * debit % (B)udget Basis: Only an amount equal to outstanding commitment is carried forward, if commitment is greater than zero. The formula is Commitment = Sum of outstanding Commitments If Commitment > zero If Actual + Commitment <= (Budget * -1) Then Unexpended Budget = (Commitment * credit %) * -1 Else Overspent = Budget + Actual + Commitment Penalty = Overspend * debit % Unexpended Budget = (Commitment - Penalty) * -1 |

|||

|

Journals will be processed as follows using events FQ and FT: If the unexpended budget amount is less than zero, then the GLA will be credited and budget control debited in the next year. If the current year must be reversed then the budget control will be credited and the GLA debited. For unexpended budget amounts greater than zero it is the opposite of the above. |

|||

|

The Carried Forward Standing Order rules: This will only be generated if PM cycle is in cycle 12. All Items for the Current Year of the standing order will be duplicated for delivery in the next Year. See manual of option {FPMO-1} for maintains on these newly created records Outstanding Commitments of the standing orders will be carried forward in the Outstanding Commitment Phase. |

|||

|

The Carried forward Outstanding Commitments rules: Outstanding Commitments of all the Commitment Documents (I, R & O%) will be carried forward, irrespective of the setting of the System Operational Definitions. Secondary Ledger Year End: The Items where the Expense GLA's Cost Centre is linked to a secondary ledger will be carried forward to the current year PM and the next cycle after the Secondary Ledger Year End Cycle. Primary Ledger Year End: All outstanding commitments are carried forward to the next year cycle 1 including secondary ledger outstanding commitments. . |

|||

|

The Carry Forward Creditor Balance rules: This will only be generated if PM cycle is in cycle 12. The program will calculate the balance of each Creditor and Account Type. If it is a Debit Balance it will Credit the current and Debit the next Year for the Creditor Account Type, or else Debit the current year and Credit the next Year. |

|||

|

The Update Creditor Financial Information rules: This will only be generated if PM cycle is in cycle 12. The program calculates the number of documents and the total value of Debit and Credit for the current year, excluding the records for Carry Forward Creditor Balance in cycle 12. Then update the fields Last Year's Values: # of Documents, Debit and Credit of option {FPMM-3b5} with the values of the above calculation. |

|||

|

The Increment the PM cycle rules: If the PM cycle is less than 12 then the program increments the PM Cycle by 1. Thereafter do only a PM post (FGLP-3} with the parameter No up to the next month or yearend. If the PM cycle is equal to 12 then the program increments the PM Year by 1 and sets the cycle to 1. Thereafter do only a PM post (FGLP-3} with the parameter No up to the next month end. |

|||

| Report {FPMMR1-21}, "Cycle And Year End Totals", will print control totals for reconciliation purposes. | |||

| Sort Order | Per | Comments |

|---|---|---|

|

The report of this program will print all the data used for the six phases namely: Accruals Generated Budgets Carried Forward Standing Order Carried Forward Commitments Carried Forward Carry Forward Creditor Balance Update Creditor Financial Information Increment the PM cycle |

| System Select | |

|---|---|

| No special system selection |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 29-May-2008 | v01.0.0.0 | Charlene van der Schyff | t145484 | New manual format. |

| 14-Jul-2009 | v01.0.0.1 | Charlene van der Schyff | t160159 | Insert image. No Meal system "CM" available for close. |

| 04-aug-2009 | v01.0.0.2 | Charlene van der Schyff | t160160 | Srelease needs task no. |

| 23-Mar-11 | v01.0.0.3 | Hermien Hartman | t172295 | Added Excluding of GRVs in processing or validation status when GRV Accrual is done. Updated report image. |