|

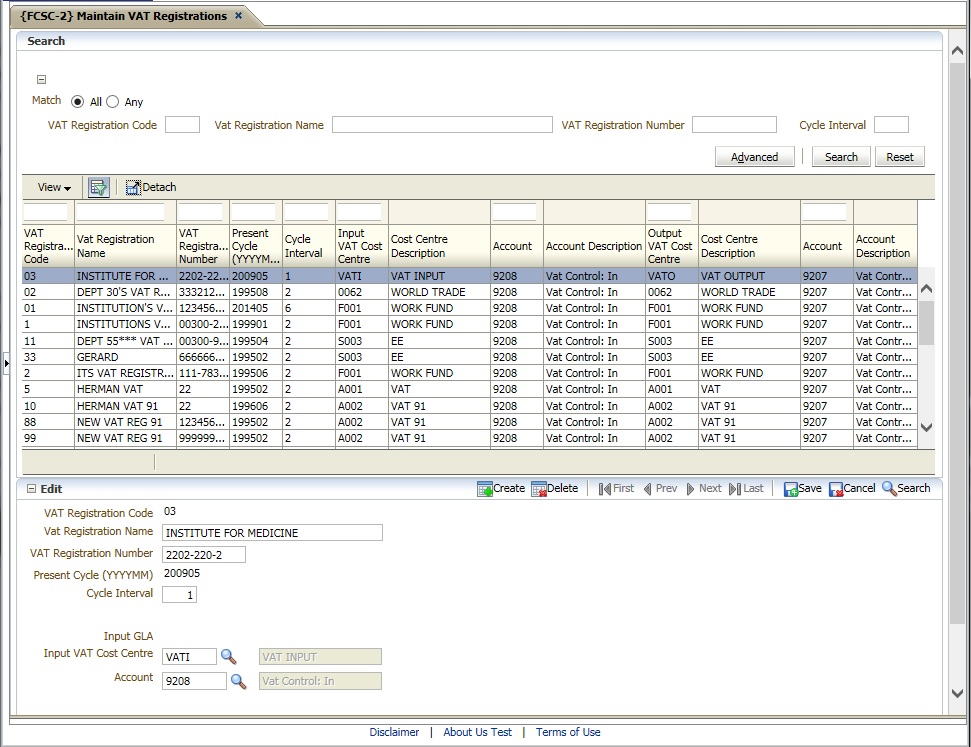

The option is used to define VAT / GST

registration. Value added tax (VAT), or goods and services tax

(GST) is a consumption tax levied on any value that is added to a

product. VAT / GST is an indirect tax, in that the tax is collected from

someone who does not bear the entire cost of the tax.

A VAT / GST registration is only required if the

institution or a business unit within the institution is registered for

GST or VAT. A registration is linked to a ledger and the system does

not allow multiple registration within a ledger.

| Field | Type & Length |

Description |

|---|---|---|

| VAT Registration Code | A2 | A unique code to identify the registration. |

| Name | A40 | Supply a suitable description for the Registration Code. |

| VAT Registration Number | A10 | The registration number allocated by the Receiver of Revenue. |

| Present Cycle | YYYYMM | This field cannot be updated once defined. This cycle will automatically increment by the Cycle Interval below whenever tax is reported, by executing menu option VAT 201 Return {FGLOR2-22}. |

| Cycle Interval | N2 | The reporting interval of the registration as per Receiver of Revenue. The system supports 1 (monthly), 2 (bi-monthly) and 6 (bi-annual) reporting. |

| Input VAT GLA | A4+A8 | Before the input and output GLA’s on a

tax registration can be entered a registration must first be created

without input and output GLA’s. The second step is to create a

cost centre linked to the registration. The third step is to create a

GLA that consist of the cost centre. The final step is to update the

input and or output GLA’s on the registration. Input relates to the tax incurred on the supply of goods and services that may claimed back as a deduction from the tax authority. Input transactions will be debited against this GL-Allocation. GL-Allocations are defined in option Maintain GL Allocation {FCSO-6}). |

| Output VAT | A4+A8 | Output relates to the tax charged in respect

of the supply of goods and services.The tax charged is collected from

the recipient of such goods and services by the vendor and is required

to be paid over to the tax authority. Output transactions will be

credited against this GL-Allocation. GL-Allocations are defined in option Maintain GL Allocation {FCSO-6}). |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 28-Jul-2014 | v04.0.0.0 | Marchand | t199718 | Convert form to ADF, new screen layout. |