|

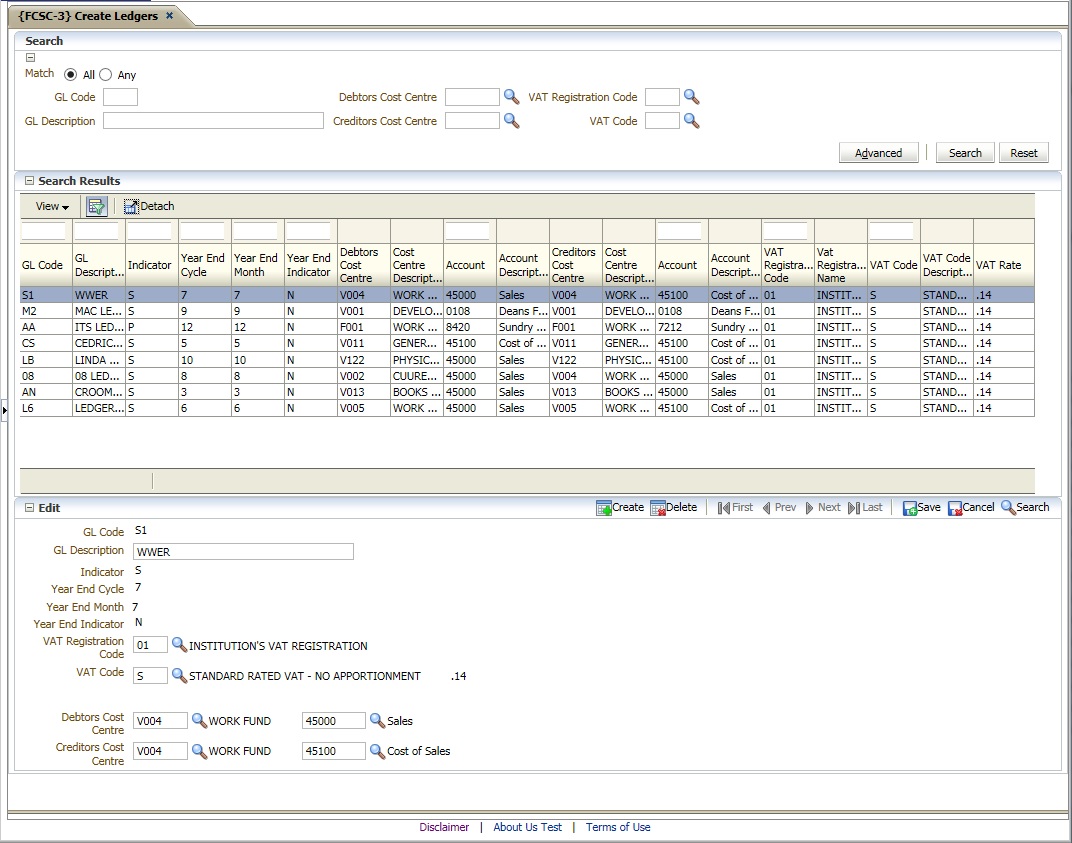

The system allows for multiple year-ends, and a specific year-end is linked to a "ledger". In this option users will define different ledgers, if required, and these ledgers will then be linked to cost centres.

All (D)etail cost centres must be linked to a ledger.

NOTE: The system will allow only one ledger per cycle.

| Field | Type & Length |

Description |

|---|---|---|

| GL Code | A2 | Supply a unique code for the Ledger. |

| GL Description | A40 | Supply a suitable description of this Ledger. |

| Indicator | A1 | Indicate whether this is the primary or a secondary ledger. Only one primary ledger and eleven secondary ledgers are allowed. |

| Year End Cycle | N2 | Enter cycle of year-end for this GL. Valid values are 1 - 12. |

| Year End Month | N2 | This value can be between 01 and 12, and the system will assume that the (S)econdary ledgers are "before" the (P)rimary ledger. Example: In 2006 the primary ledger will normally be specified as 12, and therefore the year-end is in December 2006. If a secondary ledger is specified as 08, the system will assume that the year-end of this ledger is August 2006. |

| VAT Registration Code | A2 | The Sale Tax registration code of the tax registration to which the ledger is linked. If the business units utilising the ledger is not registered for sales tax the field should not be completed. If completed the system assumes that the business unit is registered for sale tax and that the applicable sales tax legislation applies to the business units administrated through the ledger. |

| VAT Code | A2 | The default tax code, linked to a taxable supply indicator and rate, associated with the ledger. |

| Debtors GLA | A4 + A8 | The Balance Sheet GLA for debtors in this ledger. The system will use these GLA's to generate the required transactions during the year-end process between the different ledgers. This GLA is regarded in the commercial world as 'Inter-company transfer account'. |

| Creditors GLA | A4 + A8 | The Balance Sheet GLA for creditors in this ledger. The

system will use these GLA's to generate the required transactions

during the year-end process between the different ledgers. This GLA is

regarded in the commercial world as 'Inter-company transfer account'.

See note below. *Note: The Debtors and Creditors GLA fields can be left blank until GLA's are created, but users should take note that these GLA's are a prerequisite for the correct operation of the Year- end programmes. |

| Year End Indicator | A1 | Is this ledger due for a year-end? (Y)es or (N)o. The value of this field will be (N)o during the year. When the year-end of a specific ledger is reached, this indicator will be set to (Y)es to indicate that a year-end is outstanding for this ledger. When the user executes a period end, on menu option {FGLM-6}, the system will respond with a note explaining that one of the ledgers requires a "Year-end". The user can then proceed with the period end of the other ledger(s). As soon as the year-end for this ledger is executed, on menu option {FGLM-7}, the system will reset this indicator to (N)o. |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 24-Jul-2006 | v01.0.0.0 | Elsabe | t133457 | New manual format. |

| 29-Jan-2009 | v01.0.0.1 | Ernie van den Berg | t155140 | Review the manual |

| 09-Nov-2015 | v04.0.0.0 | Marchand Hildebrand | t199723 | Convert to ADF |