|

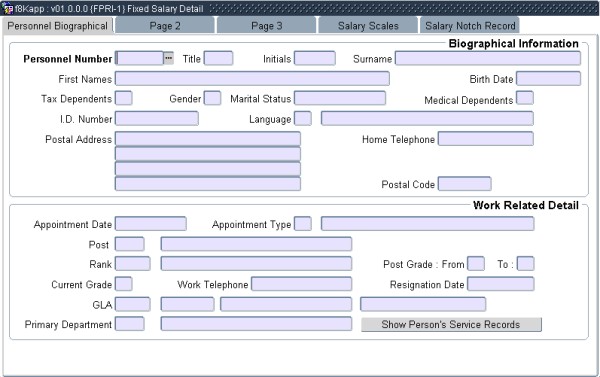

This program is used to maintain the personal salary information of personnel.

Five blocks of

information are available, but only certain data fields may be updated: the

non-updateable values are drawn from information maintained

in the Personnel System.

This option contains sensitive salary related information access to this option should therefore be granted selectively only to personnel who should have access to salary information.

The biographical information on this page is for display purposes only a list of values exists on the personnel number field from which to select a specific person.

| Field | Type & Length |

Description |

|---|---|---|

| Personnel Number | N9 | Personnel number. |

| Surname | A30 | Surname. |

| Initials | A6 | Initials. |

| First names | A40 | First Names. |

| Title | A4 | Title. |

| Date of Birth | DD-MON-YYYY | Date of Birth. |

| Tax Deductible Dependants | N2 | The total number of Dependants {PBOP-7}, indicated as Tax Dependants. |

| Gender | A1 | Gender. |

| Marital Status | A1 | Marital status. |

| Medical Dependants | N2 | The total number of Dependants {PBOP-7}, indicated as Medical Dependants. |

| I.D. Number | N13 | Identity Number. |

| Language | A1 | Home Language. |

| Postal Address | A80 | Postal Address lines 1 to 4. |

| Home Telephone Number | A10 | Telephone number. |

| Postal Code | A8 | Postal code. |

| Work Related Detail |

||

| Appointment Date | DD-MON-YYYY | The Appointment Date of the latest continuous service period. |

| Appointment Type | N2 | The Appointment Type {FPRG-10} of the latest continuous service period. |

| Post | A4 | The Post of the latest continuous service period. |

| Rank | N5 | The Rank of the latest continuous service period. |

| Post Grade From and To | N2 | The From and To grades linked to the Post {PACS-4} for the post of the latest continuous service period. |

| Current Grade | N2 | The Grade of the latest continuous service period. |

| Work Telephone | N10 | Work telephone number. |

| Resignation Date | DD-MON-YYYY | The Resignation Date of the latest continuous service period. |

| GLA | A4 + A6 | The Cost Centre and Account on the Post {PACS-4} for the latest continuous service period. |

| Primary Department | A4 | The Primary Department of the Post {PACS-4} for the latest continuous service period. |

| Show Person's Service Record | Button | This button will open the Service Records {PBOP-2} in view only mode, regardless of user access. The program will automatically return here upon exiting from the Service Records. |

|

The information on this page is primarily payroll related and is intended for display purposes. Some of the fields can be captured or modified: where applicable a list of values exists, containing the correct values to be used.

| Field | Type & Length |

Description |

|---|---|---|

| Salary Notch | N17 | The salary notch, as maintained in block 5. The applicable notch as per the cycle linked to event type 'C' on FPRM-2 will be displayed. |

| Reason for Notch Outside Scale | A80 | A free format field to allow for entering of the reason why

the salary notch is outside the boundaries of the personnel member's

personal salary scales. |

| Barrier Notch | N17 | The barrier salary notch, as maintained in block 5, on the system date. |

| Reason for Barrier Notch | A80 | A free format field to allow for entering of the reason why the salary notch is outside the boundaries of the personnel member's personal salary scales. |

| Weekly Rate | N17 | This field is reserved for possible future development. |

| Time Sheet Rate | N17 | The hourly rate for the person when the Time sheet Sub-system {FPRI-29} is used to generate earnings. |

| Pay Frequency | A1 | (M)onthly or (W) for Fortnightly. The Pay Frequency on the Appointment Type {FPRG-10} will default into this field when a new Service Record {PBOP-2} is created, but it may be updated here. |

| Pay Date | N1 | Salaries for personnel included in a single

Payroll Calculation (Number) may be paid over on different days during

the cycle. This field is used to group the personnel per day on which

salaries will be paid over. The following are sensitive to this field: Create File For ACB Tape {FPRN-7}, Print Payslips {FPRN-4}, Print Cheques {FPRN-6} Generate Payments {FPRN-5}, Tape Transfers {FPRNR1-21} and Bank Transfers {FPRNR1-22} are sensitive to this field. The Pay Date, on the Appointment Type {FPRG-10} will default into this field when a new Service Record {PBOP-2} is created, but it may be updated here. |

| Payroll Calculation Number | N1 | Personnel may be grouped into different Payroll Calculations, indicated by this field. The Full Salary Calculation {FPRN-2} as well as the bulk of the other programs in the Payroll System is sensitive to this field. The Calculation Number on the Appointment Type {FPRG-10} will default into this field when a new Service Record {PBOP-2} is created, but it may be updated here. |

| Increase Month | N2 | The month of the employee's annual increase. Only values from 0 to 12 are allowed. Automatic Increases {FPRN-1} will only include employees where the Increase Month is equal to the cycle for which it is executed. The field will default to the person's appointment month, but this may be changed. Note: A value of 0 in this field means that the system will never try to give an automatic increase to this person. |

| First Increase Month and First Increase Year | N2 + N4 | The Automatic Increases {FPRN-1} will exclude personnel if the First Increase Year and Month is after the cycle for which it is executed. The system will default to the appointment month and the year after the appointment year, but both these values may be changed. These fields are used when a person's increase month is not the same as his / her appointment month, or when the first increase month should be skipped when automatic increases are done. |

| Bonus Month | N2 | When a personnel record is created, the system will use Default Bonus Months {FPRM-5} to obtain a default value for this field

but it may be set to any value between 0 and 12. Note: A value of 0 in this field means that this person will never receive an automatic bonus. |

| Tax on Bonus | A1 | (A)nnual or (M)onthly. Bonuses for personnel members may be taxed either; monthly in advance, or annually in the cycle in which it is paid. The system defaults to (A)nnual. The system calculates tax on bonus at marginal rates, for example yearly tax on the normal salary and bonus earnings less the yearly tax on normal salary earnings alone.

|

| Marital Status | A1 | As entered in the Personnel Biographical Detail {PBOP-1}. |

| Spouse's Name | A40 | The name of the employee's spouse may be entered here. |

| Preferred Language | A1 | (E)nglish or (A)lternate. Advices to employees (such as payslips, IRP5 Certificates, etc.), may be printed in a language of preference; either (E)nglish or an alternate language. |

| Pay Point | A4 | The code of the Pay Point {FPRC-3} to which this person's payslip is to be sent. The name will be displayed. The <List of Values> function will show valid codes. |

| Stop Payment | A1 | Indicate by a (Y)es or (N)o whether payment should be

stopped for this employee during certain pay cycle(s), e.g. a lady who

will be taking maternity leave. The system defaults to “N”. If the answer is (Y)es, the following two fields are mandatory. |

| Start Cycle | YYYYMM or YYYYWW | The first pay cycle during which the above instruction will be effective. |

| End Cycle | YYYYMM or YYYYWW | The last pay cycle during which the above instruction will be effective. |

| Reason for Stop Payment | A2 | A Reason Code, defined on Notch Change / Stop Payment Codes {FPRC-4}, may be entered here. |

|

The information on this page is primarily payroll related and intended for display purposes. Some of the fields can be captured or modified where applicable, a list of values exists, containing the correct values to be used.

| Field | Type & Length |

Description |

|---|---|---|

| Please first see what FCSM-1 SOD "DE" is set to, Banking details may only be update on FPRI-1 or PBOP-13 | ||

| Method of Payment | A1 | Che(Q)ue, (C)ash (M) Bank Transfer or (T)ape Transfer. The next three fields are mandatory if the payment method above is Bank Transfer or Tape Transfer. |

| Bank Account Type | A1 | (C)urrent, (S)avings, (T)ransmission,

Tele(B)ank or C(R)edit Card. Note that, currently, only Current, Savings or Transmission accounts are acceptable for ACB transfers. |

| Bank Account Number | A24 | The employee's Bank Account Number. Leading zeros are not essential. |

| Bank Account Number Suffix | N4 | Enter a 4 digit number suffix for the Bank Account |

| Bank | N2 | Enter the Bank Number. |

| Branch Code | N6 | The employee's Bank Branch Code. The Bank Code and Description, as entered in Bank / Branch Detail {FPRC-1} will display. |

| Employee Account Holder Name | A50 | Employee bank account holder name. This field is used by "Generate Tax Certificates" {FPRT-1} |

| Employee Account Holder Relationship | N1 | Employee Account Holder Relationship. This field is used by "Generate Tax Certificates" {FPRT-1} The values for this field may only be: 1. Own; 2. Joint; or 3. Third Party |

| Block 2: Income Tax Related Detail | ||

| Receiver of Revenue | A4 | This field is mandatory. When an existing code is entered, as maintained in Receiver of Revenue Detail {FPRC-2}), the name is displayed. |

| Print IRP5 | A1 | The printing of a previously-printed tax certificate

may be suppressed by means of this non-mandatory indicator. It defaults to null (i.e. “print certificate”) but can be set to “N” (i.e. “do not print certificate”). |

| Income Tax Number | A20 | The employee's reference number with the above Receiver of Revenue. No validation is done on this field. |

| Tax Status | A1 | The system defaults to the (redundant) old South African values,

namely: “A” - Married Person;

“B” - Unmarried (Single) Person;

“C” - Married Woman. The default values may be left as is. The Marital Status, as defined in the person's biographical record, is also displayed for reference purposes. |

| Tax Table | A1 | The tax table, to be used in tax calculations for the individual, defaults for display purposes only. |

|

The salary scales applicable to this

employee may be queried in this block. The scales can not

be updated here, but are maintained with Individual Salary Scales {FPRI-3}.

| Field | Type & Length |

Description |

|---|---|---|

| Scale | N4 | The code of the salary scale applicable to the individual. |

| Previous scale | N4 | The code of the previous salary scale. Refer to Salary Scales Detail {FPRG-1} for more detail on this and the next three fields. |

| Start of Scale | N10 | |

| Increment | N10 | |

| End of Scale | N10 |

The scales for the employee's Rank as entered on the last Service Record {PBOP-2} are displayed here these would normally be the same as the personal scales.

| Field | Type & Length |

Description |

|---|---|---|

| Rank | N5 | The Rank of the latest continuous service period, as entered on the Service Record {PBOP-2}, of the employee. |

| Scale | N4 | The Salary Scale linked to the Rank in Rank / Salary Scale Combinations {FPRG-2}. |

| Previous scale | N4 | Refer to Salary Scales Detail {FPRG-1} for more detail on this and the next three fields. |

| Start of Scale | N10 | |

| Increment | N10 | |

| End of Scale | N10 |

The scales linked to the rank entered on the employee's post, in Posts {PACS-4} are displayed here.

| Field | Type & Length |

Description |

|---|---|---|

| Post | A4 | The Post of the latest continuous service period, as in the Service Record {PBOP-2}, of the person. |

| Rank | N5 | The Rank linked to the Post on Posts {PACS-4}. |

| Scale | N4 | The Salary Scale linked to the Rank in Rank / Salary Scale Combinations {FPRG-2}. |

| Previous scale | N4 | Refer to Salary Scales Detail {FPRG-1} for more detail on this and the next three fields. |

| Start of Scale | N10 | |

| Increment | N10 | |

| End of Scale | N10 |

|

General information

| Field | Type & Length |

Description |

|---|---|---|

| Personnel Number | N9 | Personnel Number. |

| Effective Date | DD-MON-YYYY | The date from when a notch is active or will be used in salary calculations. |

| Notch | N10 | The annual salary notch value. Due to access control, this field cannot be queried. |

| Appt Type | N2 | The Appointment Type {FPRG-10} of the employee, as at the Effective Date. |

| Reason for Adjustment | A30 | A free format field to allow the user to enter a reason for the notch (change). |

| Barrier Notch | N17 | This field represents the Barrier Notch to be applied for the specific person, if applicable. The program Automatic Notch Increases {FPRN-1} will not perform automatic increases beyond the barrier salary notch. Due to access control, this field is cannot be queried. |

| Note | A2 | A note code to describe the reason for a notch change, as defined in Notch Changes / Stop Payment Codes {FPRC-4} may be entered here. |

| Scale Cycle | N2 | The scale cycle used when validating salary scales. |

| Scale Code | N4 | If the notch entered falls within a valid salary scale, which is linked to the personal salary scales of the person, the scale code will display. |

| Backdated Date |

DD-MON-YYYY |

The date which the notch is

backdated to (i.e. if salary increases were granted with effect from

January 2015 but only implemented in July 2015, The effective date

would be 01-Jul-2013 and the Backdated Date would be 01-Jan-2015) |

| Pensionable % of CTC | N3.3 | The Pensionable percentage of the total Cost to Company Salary Package. Calculation method 'I' may be used to calculate Payroll Pensionable Salary transaction by applying this percentage to the Salary Notch Amount. |

| Total Package | A1 | This field indicates whether the notch record represents a TGP (Total guaranteed Package) value if it is set to 'Y', if set to 'N' it represents the Basic Salary value. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 05-Jan-2007 | v01.0.0.0 | Allie de Nysschen | t126911 | Update of date effective notch changes. |

| 27-Mar-2007 | v01.0.0.0 | Charlene van der Schyff | t134073 | New manual format. |

| 22-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing - Juliet Gillies. |

| 12-Oct-2009 | v01.0.0.1 | Goodman Kabini | t162423 | Add the new Description for Salary Notch on Block 1 Table. |

| 03-Feb-2010 | v01.0.0.2 | Goodman Kabini | t164600/ t163459 |

Add Employee Account Holder Name and Employee Account Holder Relationship fields on the Personnel Biographical - Page 3. |

| 30-May-2011 | v01.0.0.3 | Goodman Kabini | f172837 | Add more details about the Salary Notch Record in Block 5. |

| 14-Mar-2012 | v02.0.0.0 | Sister Legwabe | t181413 | Add details about Salary Notch Record in Block 5. |

| 27-Jul-2012 | v03.0.0.0 | Frans Pelser | t178590 | Reference to FPRG-10 |

| 05-Apr-2013 |

v03.0.0.1 |

Frans Pelser |

t189917 |

Backdate Date` |

| 13-Apr-2015 | v03.0.0.2 | Charlene van der Schyff | t206469 | Added item and details for Bank Account Number Suffix |

| 28-Oct-2016 | v03.0.0.3 | Sakhile Ntimane | t217815 | Added generate payments on pay date |

| 04-Sep-2017 | v03.0.0.4 | Sakhile Ntimane | t222983 | Add Pensionable % of CTC |

| 02-Sep-2020 | v04.1.0.1 | Kerrylee Naidoo | t245751 | Update new term for (W)eekly to Fortnightly |

| 29 Jun 2023 | v04.1.0.2 | Allie de Nysschen | t260995 | Add the new TGP Indicator to the Notch Record |