|

This option may be used to create the IRP5 / IT3A information for South African clients.

Note that this option does not create the IRP5 Tape, but only the data that will be used for the tape.

General information

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 | Supply Calculation Number (N1) or ALL. | A3 | |

| 2 | Start Employee Number. | N9 | |

| 3 | End Employee Number. | N9 | |

| 4 | Must A Tax Period End Be Forced For All Employees irrespective of whether this is the Last Month of the Tax Year or Not? (Y / N) | A1 | (Y)es or (N)o |

| Sort Order | Per | Comments |

|---|---|---|

| 1 | Personnel Number. |

| System Select | |

|---|---|

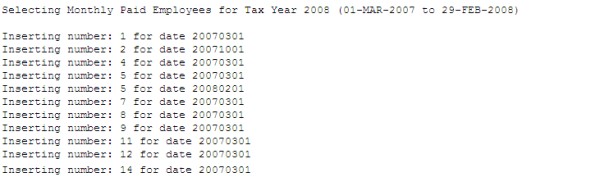

| 1 | Personnel members with transactions in

the salary transaction file for the specific tax year indicated

by event “R’ in the Run Cycle Control File {FPRM-2}. |

|

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 | Do you wish to generate IRP5s to produce a (T)est Tape, (L)ive Tape, or (N)o Tape (validation of data)? | A1 | The first time this option is run it should be run as a “No Tape” or a “Test Tape” in order to ensure that no data errors exist. |

| 2 | Must Certificates Be Generated Within Pay point? | A1 | (Y)es or (N)o. |

| 3 | Must the System perform a re-calculation if the tape has not yet been sent to the Receiver of Revenue? | A1 | (Y)es or (N)o. A re-calculation may be performed if the tape has not yet been sent to the Receiver of Revenue. |

| Sort Order | Per | Comments |

|---|---|---|

| 1 | Selected Sort Order. |

| System Select | |

|---|---|

| 1 | Personnel members for whom IRP5 Certificates should be generated. |

|

| Processing Rules |

|

|---|---|

| 1 | If any fatal data errors exist, the program will create a report with

error messages that require correction before an attempt is made to run this

option as a “Live” run. |

| 2 | When executed as a "No Tape", no IRP5 Data will be generated and will produce only a validation report as output. |

| 3 | When executed as a "Live Tape" or a "Test Tape":

|

| 4 | South African Institutions, which

implemented tax structured salary packages but which do not want to

split income related to retirement funding from income related

to non-retirement funding on tax box level when IRP5s are

generated, may do so by setting the Validation Type (T) Split SA

IRP5 RF per Tax Box to (Y)es. Validation Types may be set in the

Validation Control {FPRM-8}. The program currently does the split, except for a few institutions that are hard-coded into the program. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 02-May-2007 | v01.0.0.0 | Frans | t138771 | New manual format. |

| 21-Apr-2008 | v01.0.0.0 | Magda van der Westhuizen | t149068 | Images |

| 02-Oct-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing: Juliet Gillies. |

| 23-Apr-2014 |

v04.0.0.0 |

Frans Pelser |

t198746 |

FPRM-10 |