|

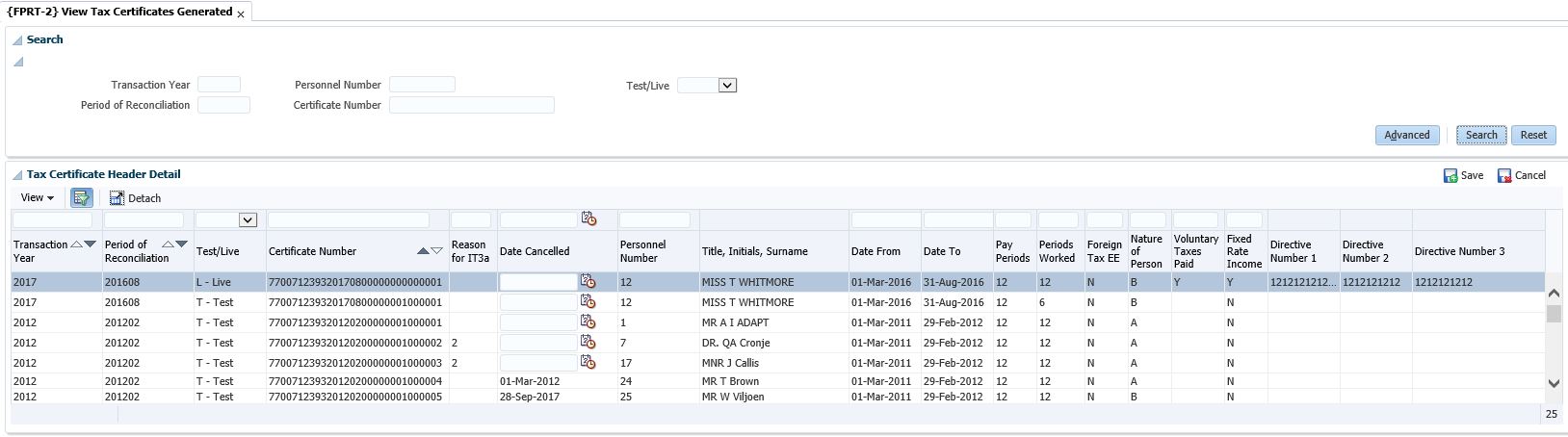

This option may be used to view the Tax Certificate

information for RSA clients. Limited changes to the Tax Certificate Header Record may be made.

| Field | Type & Length |

Description |

|---|---|---|

| Transaction Year | N4 (CCYY) | Transaction Year. |

| Period of Reconciliation |

A6 (CCYYMM) | Period of Reconciliation. |

| Test / Live | A4 | Test or Live. |

| Certificate No | N8 | Tax certificate number. |

| Reason for IT3a | N2 | Code in respect of the reason for the IT3a. This field may only be changed or updated if the information is created as an IT3A. The data is created as an IT3A when: No tax is deducted, as a result of no taxable income; or taxable income exists, but total income is below the tax threshold. |

| Date Cancelled | (DD-MON-YYYY) | Date on which IRP5 / It3a was cancelled. Receiver must be informed of this. This field can be updated: but if a date exists in this field, the information on the specific certificate will not be created on the file that is created for SARS. This will typically be used when a manual certificate issued. |

| Personnel Number |

N9 | Personnel Number. |

| Title, Initials, Surname |

A1 | Title, Initials, Surname |

| Date From | (DD-MON-YYYY) | Date as from which assessment was made. |

| Date To | (DD-MON-YYYY) | Date until which assessments were made. |

| Pay Periods | N7.4 | Pay periods on Tax Year. |

| Periods Worked | N7.4 | Pay Periods worked. |

| Foreign Tax EE |

(Yes / No) | Foreign Tax (Y/N) |

| Nature of Person | A1 | Nature of person defined by the receiver of revenue (A..F). |

| Voluntary Taxes Paid | (Yes / No) | Werethere voluntary tax contributions made for this period? (Yes or No) Update allowed. |

| Fix. Rate Income | (Yes / No) | This field indicates whether the tax amount

deducted was an advised amount or calculated according to standard tax

tables. Update allowed. Note: If this field is changed without determining the way tax was calculated, SARS may deem tax to calculated incorrectly as the rules regarding the way tax should be calculated is very specific as explained in the “EMP 10 Volume 46”. The ITS system does specific validations to ensure that this indicator is correct according to the way tax was calculated in Validate Payroll Transactions {FPRT-21} and Generate IRP5s and IT3a {FPRT-1}. |

| Directive Number 1 |

A13 | Directive number. Update allowed. |

| Directive Number 2 |

A13 | Directive number. Update allowed. |

| Directive Number 3 |

A13 | Directive number. Update allowed. |

| Directive Number 4 | A15 | Directive number. Update allowed. NB: SARS allows 5 Tax Directives, per Employee per Tax Year where Directive Type = Y – Lump Sum Directive and TY >=2022 |

| Directive Number 5 | A15 | Directive number. Update allowed. NB: SARS allows 5 Tax Directives, per Employee per Tax Year where Directive Type = Y – Lump Sum Directive and TY >=2022 |

|

| Field | Type & Length |

Description |

|---|---|---|

| Code | N4 | Tax Code as supply by SARS (see {FPRC-21}) |

| Tax Grouping | A80 | Tax Grouping. |

| Tax Code Description | A80 | Tax code description. |

| Amount | N15.2 | Total Amount reported in the reporting period for the Tax Code. |

| Retirement Fund Ind. | (Yes / No) | Is this transaction considered in order to calculate pension? (Yes or No). |

| Pension Clearance Number | A11 | Pension clearance number for pension / provident fund details, issued by SARS {FPRG-3} |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 28-Jan-2007 | v01.0.0.0 | Charlene van der Schyff | t134103 | New manual format. |

| 02-Oct-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing: Juliet Gillies. |

| 18-Oct-2010 | v01.0.0.1 | Goodman Kabini | t169958 | Change Tax Year to Transaction Year and add Period of Reconciliation field on Block 1: Table 1. |

| 06-Oct-2017 |

v05.0.0.0 |

Sthembile Mdluli |

t221664 |

Convert the image to the intergrator 5 system version. amend "Block 1 to Panel Box 1" |

| 13-Aug-2021 | v04.1.0.0 | Kerrylee Naidoo | t249965 | Enhancement to cater for 5 Directives |