|

This option enables the salary calculation to be repeated, for one person or for a few people, after the normal pay run has been done. It allows for the correction of erroneous input for an individual without repeating the entire pay run, resulting in significant savings in computing resources.

Pre-requisites to using this option :

If a full salary calculation for the cycle and calculation number of the person has been done; the execution of this option must be preceded by a Single Rollback and the deletion of the “C” (Salary Calculation) record, for the full salary calculation from the Event Logfile {FPRM-3}.

General information:

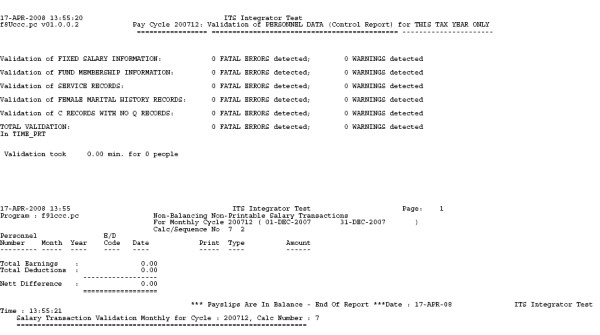

This

option is similar to the Full Salary Calculation {FPRN-2}, except

that salaries will only be calculated for the individual personnel as

in the user selection. The validation of payroll data will be

done

as in the Full Salary Calculation, but only for

individual personnel as in the user selection; it will not be done for all personnel

linked to the salary calculation number as set-up in the Run Cycle

Control File {FPRM-2}.

New payslips for these individuals can be printed via Print

Payslips {FPRN-4}.

This

option should not be used for answering salary queries, as the Pro-Forma

Payslip {FPRI-25} is provided for that purpose.

If

a “Late Rollback” has been performed with Rollback

Single Calculation {FPRN-23},

it will usually be followed by a “Late

Calculation” in this case the system will insert a “Z - Late

Calculation”

record into the Event Logfile {FPRM-3},

logging: the personnel number of the person for whom the action was

done, the date-time, and the User who performed the late calculation.

“Z - Late Calculation” records cannot be deleted by

the

user, these will remain as a permanent audit trail of such events, which

may be listed via Print Event Log Audit Trail {FPRMR1-2}.

It is not necessary (in fact it is impossible!) to delete the

“C” record in the Event Logfile before a late

calculation

is done. All that is required is to set the

“C”

record in the Run Cycle Control File to the correct cycle and calculation

number for the late calculation.

| Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 | Must a Full Calculation Report be Printed? [Y] | A1 | |

| 2 | Must a Referring Report be Printed? [Y] | A1 | |

| 3 | Must a Cumulative Tax Calculation be done? [Y] | A1 | |

| 4 | Supply Minimum Nett Pay to be Flagged On Payment Analysis [0]. | N12 | |

| 5 | If Cheques have already been Generated for this Cycle and Calculation Number, do you want to Proceed with Late Calculations? [N] | A1 | |

| 6 | Supply (Next) Employee for Salary Calculation or <Return> to Exit | N9 |

|

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 13 Dec 2006 | v01.0.0.0 | Frans | t109865 | Date Effective Dependants. |

| 10-Jan-2007 | v01.0.0.0 | Allie | t126911 | Date effective Notches. |

| 09 May 2007 | v01.0.0.0 | Allie | t141046 | Change validation payroll data. |

| 17-Apr-2008 | v01.0.0.0 | Magda van der Westhuizen | t149068 | Insert Images. |

| 23-Apr-2008 | v01.0.0.0 | Magda van der Westhuizen | t149068 | Change Heading. |

| 30-Sep-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual: Language Editing: Juliet Gillies |