Generate Payments {FPRN-5}

The generation of payments is a process that can

be performed only once per calculation number. No rollback or re-run of

this process is possible. This function is controlled by the

Generate Payments (“Q”) record of the Run Cycle Control File {FPRM-2}; “Q” record will be inserted by the system into the Event Log File {FPRM-3} when the option is executed.

Pre-requisites to using this option:

One Cashbook linked to the Payroll Sub system

- Before the first generation of payments is attempted, the user must make sure that the Cash Book Definition {FCSC-5},

for the Payroll System is complete, including the maximum amount for

which a cheque payment may be issued. The GLA linked here (Cost centre and Account) will be used as the Credit GLA.

- The following five transaction types must be defined in Maintain Transaction Type Definitions {FCSO-7}

of the Financial Code Structure Sub-system. These are to be linked to

the five events that have a bearing on salary calculations, thereby

allowing the generating program to take the actions as indicated below.

The Debit GLA (Cost Centre and

Account) linked to the specific transaction type will be used for the

Debit GLA.

- (Note: whereas code 993 must be used as indicated, the other codes

are the user's choice: the codes used here, therefore, serve merely as

examples):

- Event RS = PR - Salary Calculation.

- Transaction Type 994,

- A credit GLA must be supplied.

- Debits will be to the normal Expense GLAs.

- Credits will be deductions, and the nett credit will be to the Salary Control GLA.

- Event RQ = PR - Cheque Payments:

- A debit GLA must be supplied.

- Debit will be to Salary Control GLA.

- The credit leg of the transaction will be to Bank GLA, as specified in the Cash Book Definition.

- When

cheques are generated, the necessary inserts are done to the two payment

files. No Cash Book journal need therefore be created by the

generating program.

- Event RC = PR - Payroll Cash Payments:

- Debit- and Credit GLAs must be supplied.

- Debit will be to Salary Control GLA.

- Credit will be to Cash Control GLA.

- The user has two options regarding cash payments, viz.:

- The cash withdrawal can be made directly from the bank,

with an instruction that the amount be debited directly to the bank

account; in this case the user must pass a Cash Book journal to credit

Bank and debit Cash Control.

- Alternatively, a covering cheque could be sent with the

cash request, in which case the ITS Counter System will have

created the necessary transactions.

- Since the method chosen by the user is not known, the generating program can create no Cash Book Journal.

- Event RD = PR - Bank Transfers:

- Transaction Type 996

- Debit- and Credit GLAs must be supplied.

- Debit will be to Salary Control GLA.

- Credit will be to Transfer Control GLA.

- The nett amount will be debited directly and will appear on the

bank statement; the generating program will create a Cash Book journal

to debit Transfer Control and credit Bank.

- Event RA = PR - ACB Payments:

- Transaction Type 997

- Debit- and Credit GLAs must be supplied.

- Debit will be to Salary Control GLA.

- Credit will be to ACB Control Control GLA.

- The

net amount will be directly debited and will appear on the bank

statement; the generating program will create a Cash Book journal to

debit ACB Control Control and credit Bank.

- The same Transaction Type is used for Bond Payments via

ACB it will result in a Cash Book journal to debit Bond Control and

credit Bank.

Multiple Cashbooks linked to the Payroll Sub system

- The purpose of this development will be that different Payroll

Calc numbers may be paid from different bank accounts which results in

multiple cashbooks for the Payroll sub system. a Specific

calculation number may only be linked to one cashbook, however

multiple payroll calculation numbers may be linked to one Cashbook as

with the existing functionality.

- This will be local software development as the Creation of the

ACB File option has to be adjusted to work with multiple

Cashbooks and a new option must be created where a specific calc number

can be linked to a specific cashbook and transaction type.

Please contact Adapt IT should you want to use this kind of

functionality.

- Before the first generation of payments is attempted, the user must make sure that the Cash Book Definition {FCSC-5},

for the Payroll System is complete, including the maximum

amount for

which a cheque payment may be issued. All cashbooks to be used

must be created here. The GLA linked here (Cost centre and Account)

will be used as the Credit GLA.

- The following five transaction types must be defined in Maintain Transaction Type Definitions {FCSO-7}of

the Financial Code Structure Sub-system. These are to be linked to

the five events that have a bearing on salary calculations,

thereby

allowing the generating program to take the actions as indicated below.

The transaction types must be created here which be available on

the new local software program as an option to link the cashbook to a

specific transaction type and Calc number e.g. 993 - Cheque Generation

- New Local software program to link a specific Payroll calculation number to a specific cashbook and Transaction type.

Please note: The Debit

GLA (Cost Centre and Account) linked to the specific transaction type

will be used for the Debit GLA.

- (Note: whereas code 993 must be used as indicated, the other codes

are the user's choice: the codes used here, therefore, serve merely as

examples):

- Event RS = PR - Salary Calculation.

- Transaction Type 994,

- A credit GLA must be supplied.

- Debits will be to the normal Expense GLAs.

- Credits will be deductions, and the nett credit will be to the Salary Control GLA.

- Event RQ = PR - Cheque Payments:

- A debit GLA must be supplied.

- Debit will be to Salary Control GLA.

- The credit leg of the transaction will be to Bank GLA, as specified in the Cash Book Definition.

- When

cheques are generated, the necessary inserts are done to the two payment

files. No Cash Book journal need therefore be created by the

generating program.

- Event RC = PR - Payroll Cash Payments:

- Debit- and Credit GLAs must be supplied.

- Debit will be to Salary Control GLA.

- Credit will be to Cash Control GLA.

- The user has two options regarding cash payments, viz.:

- The cash withdrawal can be made directly from the bank,

with an instruction that the amount be debited directly to the bank

account; in this case the user must pass a Cash Book journal to credit

Bank and debit Cash Control.

- Alternatively, a covering cheque could be sent with the

cash request, in which case the ITS Counter System will have

created the necessary transactions.

- Since the method chosen by the user is not known, the generating program can create no Cash Book Journal.

- Event RD = PR - Bank Transfers:

- Transaction Type 996

- Debit- and Credit GLAs must be supplied.

- Debit will be to Salary Control GLA.

- Credit will be to Transfer Control GLA.

- The nett amount will be debited directly and will appear on the

bank statement; the generating program will create a Cash Book journal

to debit Transfer Control and credit Bank.

- Event RA = PR - ACB Payments:

- Transaction Type 997

- Debit- and Credit GLAs must be supplied.

- Debit will be to Salary Control GLA.

- Credit will be to ACB Control Control GLA.

- The

net amount will be directly debited and will appear on the bank

statement; the generating program will create a Cash Book journal to

debit ACB Control Control and credit Bank.

- The same Transaction Type is used for Bond Payments via

ACB it will result in a Cash Book journal to debit Bond Control and

credit Bank.

General information

- The generation program will verify that Transaction Types have been

linked to the events as above. If not, the program will terminate with

the message: “TTs are not linked to events or TTs incorrectly

specified”. In this case payments will not be generated, nor will a “Q”

record be created.

- When the option is executed:

- Payments will first be generated by pay point within pay date, as per the sort sequence entered in Institution Details {FPRM-1}.

A record will be generated in the Counter Sub-system for each person with

payment method che(Q)ue, with the print indicator set to null,

this indicates that this cheque has not yet been printed via Print Cheques {FPRN-6}.

- After payments have been generated, the appropriate Cash Book and GL journals will be created.

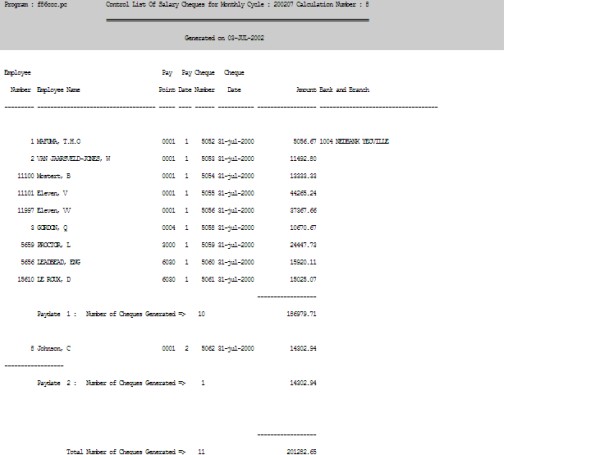

- A control list of generated payments per pay date is produced

(with sub-totals per pay date and report totals), as well as a control

report for the generated Cash Book and GL journals.

- The control report provides sub-totals per Transaction Type, allowing the following comparisons:

- The total of Transaction Types 993, 995, 996 and 997 will equal

the amount posted to the Salary Control GLA under Transaction Type 994

for the current pay cycle.

- The payments issued via the ITS Counter System will contra the amounts posted to the Cash Control account.

- The Cash Book journals will contra the amounts posted to the Transfer and ACB Control accounts.

Please note: The ITS Financial System has one

central table in which sequential payment numbers are generated

automatically. The Payroll, Counter and Accounts Payable

Subsystems share this table. When a sub-system accesses this

table, it “locks” the table until the particular program has

finished with the table, thereby denying access to either of the other two sub-systems.

Bearing in mind that Payroll and Accounts Payable payment runs could be

lengthy, it becomes essential that the generation of payments must be

scheduled between the users of these three sub-systems; this is in order to avoid

unexpected, extremely long response times, particularly for on-line

users of the Counter Subsystem.

| User Selection |

Prompt Text

* an item between square brackets [ ] is the default

answer |

Type

&

Length |

Comments |

| 1 |

Payroll Calculation Sequence Number. |

N2 |

|

| 2 |

First possible pay date. |

DD-MON-YYYY |

|

| 3 |

Second possible pay date. |

DD-MON-YYYY |

Must be completed if Pay Date > 1 {FPRI-1 (pg2)} |

| 4 |

Third possible pay date. |

DD-MON-YYYY |

Must be completed if Pay Date > 1 {FPRI-1 (pg2)} |

The generation program will verify the following:

- That Transaction Types have been

linked to the events as above. If not, the program will terminate with

the message:

- “TTs are not linked to events or TTs incorrectly

specified”.

- That all payments that are generated have

amounts less or equal to the Maximum Cheque Value as entered in the Cashbook Definition {FCSC-5}

In both cases payments will not be generated, nor will a “Q”

record be created.

| System Select |

|

| |

All personnel members with payment method

“Q” for the calculation number of the “Q”

record in Run Cycle Control File {FPRM-2}

|

Example:

Report 1

Example:

Report 2

History of Changes

| Date |

System Version |

By Whom |

Job |

Description |

| 10-Jan-2007 |

v01.0.0.0 |

Frans |

t130364 |

Obtain Cash Book GLA from Cash Book Definition. |

| 15-Apr-2008 |

v01.0.0.0 |

Magda van der Westhuizen |

t149068 |

Images. |

| 31-Jul-2008 |

v01.0.0.0 |

Allie |

t149673 |

Validate that cheques generated by the payroll do not exceed the max cheque

amount allowed by the Institution |

| 01-Oct-2008 |

v01.0.0.0 |

Magda van der Westhuizen |

t152258 |

Update manual: Language Editing: Juliet Gillies |

| 11-May-2012 |

v02.0.0.0 |

Frans Pelser |

t182888 |

Change cheque to payment |

| 01-Nov-2016 |

v04.0.0.0 |

Sakhile Ntimane |

t217833 |

Added a comment on pay date |

| 16-Nov-2021 |

V04.1.0.0 |

Allie de Nysschen |

T250122 |

Cater for Multiple Cashbooks to be linked to the Payroll subsystem. |