|

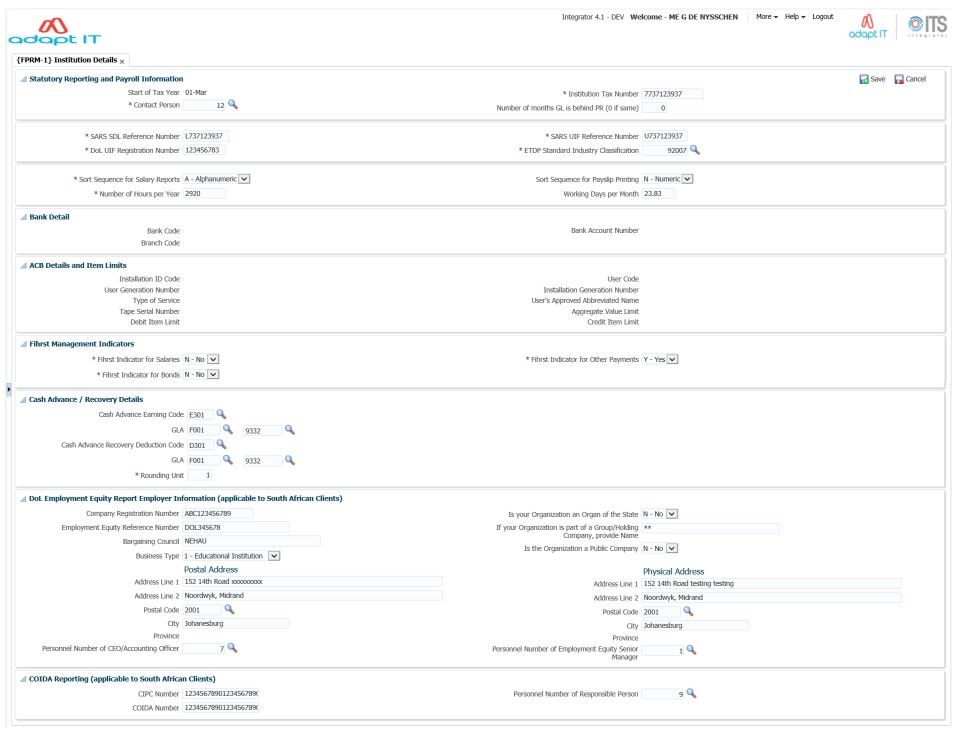

This option allows the

entering of information required for the control of the Payroll System

| Field | Type & Length |

Description |

|---|---|---|

| Start of Tax Year |

DD-MON | Supply the day in the year that the payroll tax period starts |

| Contact Person | N9 | The personnel number of the contact person for IRP5 tax certificate purposes. |

| Institution Tax Number | A15 | The Tax Number of an Institution as the Employer. |

| Number of months PR GL-Cycle is ahead of PR C-Cycle (0 if the same) | N99 | This indicates whether or not the Payroll finance cycle

and

the actual payroll cycle is in sync to ensure payroll postings is

posted to the correct Finance cycle. In cases where the Payroll finance cycle is not in sync with the payroll cycle this field cannot be 0. i.e. If the financial year starts in July and the payroll year in January then the financial year(cycle) is 6 months ahead of the payroll cycle and this value should then be 6. |

| SARS SDL Reference Number | A10 | Skills Development Levy reference number. This field is used by "Generate Tax Certificates" {FPRT-1} |

| SARS UIF Reference Number | A10 | Unemployment Insurance Fund reference number. This field is used by "Generate Tax Certificates" {FPRT-1} |

| DoL UIF registration Number | A9 | The UIF registration number of the

institution. This field is used by "Creation/Recreation of UIF File" {FPRN-28} |

| ETDP Standard Industry Classification | DROPDOWN | Standard

Industry

Classification Codes (SIC) are used to classify work establishments by

the type of activity in which they are primarily engaged. The purpose

being to promote comparability of establishments data. The SIC Codes

used in the education sector (ETDP) are:

used for ETDP SETA reporting {PMAIN-16}. |

| Sort Sequence for Salary Reports | A1 | (N)umeric or

(A)lphabetic Payslips, Cheques, the Coinage Analysis report, the Pay Distribution report and the Bank Transfer report are ordered in pay date sequence. Within this the order is by pay point or bank: and, where appropriate by payment method. The user can specify whether personnel should be listed in alphabetic or numeric sequence on these reports. |

| Number of Hours per Year | N4 | Supply the number of hours per annum for the calculation of hourly rate of pay. |

| Working Days per Month | N3.2 | Supply the number of average Working Days in a calendar

Month, example 21.67 This is used to calculate a pro-rata salary notch when an employee is in service for a partial month AND where the Salary Notch payroll transaction has been defined to calculate using Salary Calculation Method ‘7’ {FPRG-25 Query Calculation Methods} i.e. Salary Notch / 12 months / N2.3 value entered in field * working days in service. If this field is null, a pro-rata Salary Notch will be calculated using the Earning Code (Calc Method ‘7’) definition of either Notch /365 calendar days * calendar days in service OR Notch / 260 working days * working days in service |

| Field | Type & Length |

Description |

|---|---|---|

| Bank Code | N2 | The

code for the institution's bank, from which salary payments will be

done; the name will be displayed. Banks are defined in Bank /

Branch Detail {FPRC-1}. The field is a display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

| Branch Code | N6 | The

branch number of the institution's bank; the name will be

displayed. Branch detail is defined in Bank / Branch Detail {FPRC-1} The field is a display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

| Bank Account Number | N11 | The

Bank number that will be debited with salary payments (also via ACB

transfers). The field is a display only field - refer to the on-line documentation of the ACB System {FPRM-3} for more details. |

|

Field |

Type |

Description |

|

Installation ID

Code |

N4 |

The ID number as assigned by the

ACB. The field is a display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

User Generation Number |

N4 |

The first Live User Data Set

submitted must

commence with No. 0001: thereafter it must be 1 greater than

the last Generation Number of the User Data Set that was successfully

processed. The system updates this number after every run, except when a Test Tape was produced or if validation errors were encountered. The user will have to re-set this field in Maintain Cash Book Definition {FCSC-5} if the bureau rejects a live tape. The field is display only - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

Type of Service |

A10 |

ACB offers the choice of a

ONE-DAY, TWO-DAY

or FIVE-DAY service. The system defaults to “FIVE

DAY" The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

Tape Serial Number |

A8 |

This is the number by which the

institution

identifies the physical tape that is sent to the bureau; it will also

appear on the accompanying Tape Delivery Advice that is sent to the

bureau. The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

Debit Item

Limits |

N15.2 |

These fields represent the

maximum value of

entries homing to one account on any one day by the user, as agreed

with the bureau. In practice: if a user submits more than one

entry for the same Action Date against any one homing account

sequentially within a single Data Set, then the combined value of such

entries processed may not exceed these limits. Create File

for ACB Tape {FPRN-7} which generates the ACB tape will warn the

user if this limit is exceeded, thus allowing time to make special

arrangements. The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

User Code |

N4 |

Every user of the ACB facilities

is assigned a

User Code: this is the same as the installation ID Code, if the user

prepares the transfer tapes in-house. The field is a display

only field - refer on-line documentation of the ACB System {FRM-3} for more details. |

|

Installation Generation

Number |

N4 |

The first Live Tape submitted

must commence

with No. 0001: thereafter it must be 1 greater than the last

Generation Number of the tape that was successfully processed.

The system updates this number after every run, except when a

Test Tape was produced or if validation errors were

encountered. The user will have to reset this field in Maintain Cash Book Definition {FCSC-5} if the bureau rejects a live tape. The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

User's Approved,

Abbreviated Name |

A10 |

ACB assigns an approved,

abbreviated name to

every user at time of registration. The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

Aggregate Value Limit |

N15.2 |

This field represents the maximum

total debit

allowed against the user's nominated account number during any ten day

period, as agreed with the bureau. In practice, if the total

debits on a tape exceed this amount, the tape will be rejected unless

prior arrangements have been made with the bureau. Program {FPRN-7} which generates the ACB tape will warn the

user if this limit is exceeded, thus allowing time to make special

arrangements. The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

Credit Item Limits |

N15.2 |

These fields represent the

maximum value of

entries homing to one account on any one day by the user, as agreed

with the bureau. In practice: if a user submits more than one

entry for the same Action Date against any one homing account

sequentially within a single Data Set, then the combined value of such

entries processed may not exceed these limits. Create File

for ACB Tape {FPRN-7} which generates the ACB tape will warn the

user if this limit is exceeded, thus allowing time to make special

arrangements. The field is display only field - refer to the on-line documentation of the ACB System {FRM-3} for more details. |

|

Field |

Type & Length |

Description |

|

Fihrst Indicator for

Salaries |

Yes / No |

This indicates whether the

monthly Salary

Payments information is created using Fihrst interface {FPRT-1} |

|

Fihrst Indicator for

Bonds |

Yes / No |

This indicates whether the

monthly Bond

Payments information is created using Fihrst interface {FPRT-1} |

|

Fihrst Indicator for

other Payments |

Yes / No |

This indicates whether the

monthly Other

Payments information is created using Fihrst interface {FPRT-1} |

|

Field |

Type & Length |

Description |

|

Cash Advance ED Code |

A4 |

During every pay run the previous

month's

advance (if any) will be automatically deducted as a normal “Cash

Advance Recovery” transaction. Rounding up will then be done

if required, except in three instances,i.e.:

Simultaneously a “Cash Advance Recovery” advice is created which is valid only for the following pay cycle, as per the E/D Code and GLA specified below. This transaction lies at salary level “98”, with IRP5 Box “9999”, Calculation Method “3”. The Start Date is the first day of following payroll cycle and the End Date is the last day of following payroll cycle. The respective E/D Detail Report, Detail per Earning / Deduction {FPRNR1-6}, will contain full detail of the month's cash recoveries and advances. The Detail of Cash Advances serves as a “List of Cash Advances to be Deducted during following Pay Cycle”. The posting to GL occurs as usual. |

|

Cash Advance GLA |

A4 + A8 |

Cash advance cost centre and GLA. |

|

Cash Advance Recovery

Deduction Code |

A4 |

Cash advance recovery

ED

code |

|

Cash Advance Recovery GLA |

A4 + A8 |

Cash advance

recovery cost centre and GLA. |

|

Rounding Unit |

N3 |

This field need only be

entered by

those users who wish to round up their cash payments automatically on

an ongoing basis, in order to minimize the handling of small

denomination coins. Valid entries are the valid coin denominations for a particular country, up to the value “100”. The system defaults to “1”. If the value of this field is “1”, the next six fields can be left blank. |

|

Field |

Type & Length |

Description |

|

Company Registration

Number |

A18 |

The Company Registration Number

of the

institution. |

|

Employment Equity Number |

A30 |

The Employment Equity Number of

the institution. |

|

Bargaining Council |

A40 |

The name of the Bargaining

Council of the

institution |

|

Business Type |

A1 |

The Type of Business A List of Values exists with the following options: 1 – Educational Institution 2 – Private Sector 3 – National Government 4 – Local Government 5 – Non-profit organization 6 – State-Owned Enterprise 7 – Provincial Government Null |

|

Is your Organisation an

Organ of the State? |

A1 |

‘Y’es / ‘N’o |

|

If your Organisation is

a Group / Holding

Company, provide Name |

A40 |

If your institution is part of a

Group or

Holding Company, provide the name |

|

Is the organisation a

Public Company? |

A1 |

‘Y’es / ‘N’o |

|

Postal Address Line 1 |

A80 |

Line 1 of the Postal Address of

the institution |

|

Postal Address Line 2 |

A80 |

Line 2 of the Postal Address of

the Institution |

|

Postal Code |

N4 |

The Postal Address Postal Code A List of values is displayed with Post Codes as defined on {GCS2-7} |

|

City |

A30 |

Postal Address City |

|

Province |

A80 |

The Province Code and

Description, defined for

the Postal Code is displayed |

|

Physical Address Line 1 |

|

Line 1 of the Physical Address of

the

institution |

|

Physical Address Line 2 |

A80 |

Line 2 of the Physical Address of

the

institution |

|

Postal Code |

N4 |

The Physical Address Postal Code A List of values is displayed with Post Codes as defined on {GCS2-7} |

|

City |

A30 |

Physical Address City |

|

Province |

A80 |

The Province Code and

Description, defined for

the Postal Code is displayed |

|

Personnel Number of CEO

/ Accounting Officer |

N9 |

The Personnel Number of the CEO /

Accounting

Officer A List of Values is displayed with all in-service personnel as defined on {PBOP-1} The Title, Initials and Surname of the Personnel Number selected is displayed |

|

Personnel Number of the

Employment Equity

Senior Manager |

|

The Personnel Number of the

Employment Equity

Senior Manager A List of Values is displayed with all in-service personnel as defined on {PBOP-1} The Title, Initials and Surname of the Personnel Number selected is displayed |

|

Field |

Type & Length |

Description |

| CIPC Number | A20 | Companies and Intellectual Property Commission Number (Registration of Companies, Co-operatives and Intellectual Property Rights) |

| COIDA Number | A20 | Compensation for Occupational Injuries and Diseases Act Number allocated by the department of Labour. |

| Personnel Number of Responsible person | N9 | The Personnel Number of the person responsible for the COIDA submission. |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 16-Apr-2007 | v01.0.0.0 | Charlene van der Schyff | t134088 | New format update |

| 15-Jan-2008 | v01.0.0.0 | Frans | t138771 | Proofread and Correct |

| 11-Aug-2009 | v01.0.0.1 | Charlene van der Schyff | t161012 | Edit language obtained from proof read language Juliet Gillies. |

| 03-Feb-2009 | v01.0.0.2 | Goodman Kabini | t164600/ t163459 |

Add the two SDL Reference and UIF Reference Number fields with its description in the table including the new picture for block 1. |

| 21-Nov-2017 |

v05.0.0.0 |

Sthembile Mdluli |

t221977 |

int 05 new image

updated |

| 11-Mar-2020 | v4.1.0.0 | Philip Patrick | t241695 | Included ETDP Standard Industry Classification and revised screenprint for menu option. |

| 01-Oct-2020 | v04.1.0.1 | Kerrylee Naidoo | t241338 | Enhacment to Manual for EE reporting |

| 17-Nov-2020 | v04.1.0.2 | Kerrylee Naidoo | t246629 | Update manual to include correct link |

| 19-Apr-2021 | v04.1.0.3 | Kerrylee Naidoo | t249357 | Update new working days per month |

| 16-Jun-2022 | v04.1.0.4 | Allie de Nysschen | T255455 | New COIDA reporting |

| 15-Apr-2025 | V4.1.0.5 | Allie de Nysschen | T271814 | Enhancement to control GL Payroll cycle |

| 23-Sep-2025 | V4.1.0.6 | Elsabe Marggraf | F273822 | Wording for Number of Months to reflect PR GL-cycle and C-cycle |