|

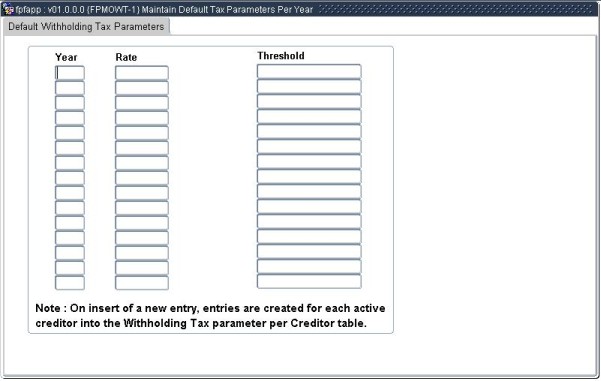

The default Withholding Tax Rate and Threshold for the Year are set up and maintained in this option.

Should a institution elect to apply withholding tax on payments made to suppliers or goods and srevices the SOD code - QA shoudl be set to (Y)es and a transaction type must be set up to be used to process the withholding tax when the payment program {PFMOPD-1} is run and withholding tax is appicable SOD code - QA s

On insert of a new entry in this option a record is created in the Maintain Withholding Tax per Creditor table {FPMOWT-2}, for each active creditor.

@Critically important information (delete if not applicable).

Processing Rules for this Block (delete if not applicable).

| Field | Type & Length |

Description |

|---|---|---|

| Year | N4 | Enter the Withholding Tax Year to which the defaults apply. The system uses the document dateto determine the Tax Year and subsequent Tax Rate to deduct withholding tax therefor a record must exist here for every year in for a a creditor to which the refernce date refer. |

| Rate | N3.2 | Enter the Withholding Tax Rate for this Tax Year, valid between 0.00 and 100.00. |

| Threshold | N17.2 | Enter the minimum Payment, Order or Contract Amount from which to start deducting Withholding Tax, for the specified year. |

|

| Examples | |

|---|---|

| If 10 000.00 is the threshhold, and the payment amount is above the threshhold, the payment will be subject to Withholding Tax. |

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 19-Jan-2011 | v01.0.0.0 | Hermien Hartman | t170695 | New manual. |