|

Short Overview

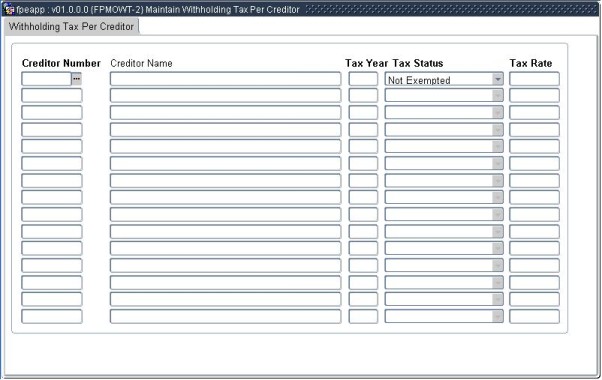

This option is used to maintain the annual withholding Tax Rate and Tax Status per Creditor.

Prerequisites

This option contains a record for all active creditors according to the tax setup per year in {FPMOWT-1}.

The Tax Rate and Status can be changed as required per Creditor.

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Number | N9 | Enter the Creditor Number from the list of values. Creditor codes are defined in the option Creditor Definition {FPMM-2}. |

| Creditor Name | A40 | Displays the Creditor Name. |

| Tax Year | N4 | Enter the Witholding Tax Year. |

| Tax Status | A1 | Use the <LOV> to enter the Withholding Tax Status: (P)ermanently exempted, Annuall(Y) exempted or (N)ot exempted. On update of this field, the Tax Rate will be set to 0.00. If the Creditor has a record for the previous tax year, the Status will default to that year's status, otherwise it will default to (N)ot Exempted. If the Status is (P)ermanently or Annuall(Y) exempted, the Tax Rate is set to 0.00 and is not updateable. |

| Tax Rate | N3.2 | The Tax Rate may be between 0.00 and 100.00. |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 20-Jan-2011 | v01.0.0.0 | Hermien Hartman | t170695 | New manual. |