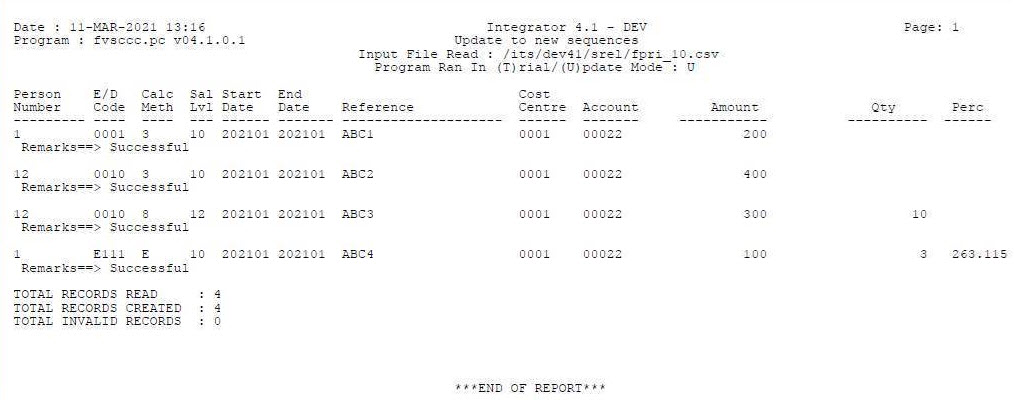

Output: |

This

option may be used to load Individual Earnings/Deductions {FPRI-2} from a comma-delimited file.

This

program allows the importing of Individual Transactions with Calculation Methods

3 (Advised amount), 8 (Qty x Amount) and E (Overtime hours)

Calculation

Method 3 (Advised Amount)

·

Column 10

(Mandatory), the value (amount), written to Field 1

·

Column

11, null

·

Column

12, null

Calculation

Method 8 (Qty x Amount)

·

Column 10

(Mandatory), the rate/amount (that will multiplied by the Quantity), written to

Field 1

·

Column

11, null

·

Column 12

(Mandatory), the quantity, written to Field 5

Calculation

Method E

·

Column 10

(Optional, required if maximum overtime rate is to be used by defining a

threshold), written to Field 1

·

Column 11

(Optional, Reference Salary level)

·

Column 12

(Mandatory), the quantity, written to Field 5

·

Please

Note: The population of Field 6 (Rate %), is retrieved from the ED Code

definition {FPRG-6}

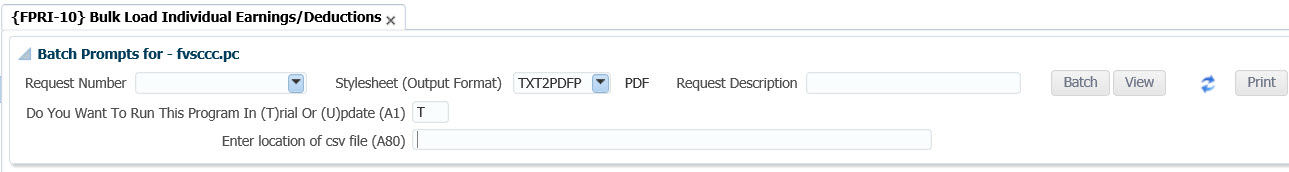

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 | Run the program in (T)rial or (U)pdate Mode. | A1 | |

| 2 | Enter the Location of the CSV File. | A80 | The name and path of the CSV file to be uploaded. The file should exist on the Application Server. |

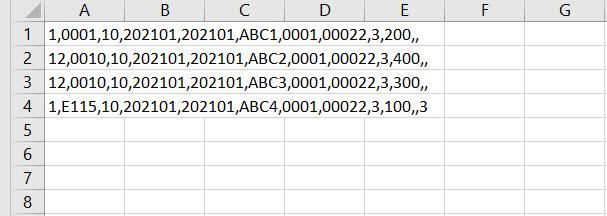

| 1 | Personnel Number | N9 | |

| 2 | Earning/Deduction Code | A4 | |

| 3 | Salary Level | N3 | |

| 4 | Start Cycle | Format YYYYMM or YYYYWW | |

| 5 | End Cycle | Format YYYYMM or YYYYWW | |

| 6 | Reference | A20 | |

| 7 | Cost Centre Code | A6 | |

| 8 | Account Number | A8 |

|

| 9 | Calc method | A1 | Calc method 3, 8 and E |

| 10 | Amount (Field 1) | N17.2 |

Column 10 will contain the value

(amount) that will be written to Field 1

|

| 11 | Reference Salary Level (Field 3) | N2 |

Column 11 will contain a Reference

Salary Level that will be written to Field 3

|

| 12 | Quantity (Field 5) | N10 |

Column 12 will contain a Quantity

that will be written to Field 5

|

|

| Processing Rules |

|

|---|---|

| 1 | If Cost Centre Code is omitted from the file, |

| 2 | If Account Number is omitted from the file, the same rules as above will be followed. |

| 3 | Data in the file will be validated for the following

|

| 4 | If an Individual Earning/Deduction for a personnel member

for the same Earning/Deduction Code and Salary Level where the

Start and End Dates overlap with the record in the comma-delimited file already exists, the existing record will be replaced with the new record. |

| 5 | Multiple transactions may exist in the file for the same

Employee Number: Start Cycle, End Cycle and ED Code, however the Salary Level for each transaction must be specified in the file. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 28-Aug-2008 |

v01.0.0.0 | Frans Pelser | t151242 | Bulk late rollback and late Calculations. |

| 16-Feb-2010 | v01.0.0.1 | Goodman Kabini | t164998 | Add the lengths of the fields for a layout of the comma delimited file including the image of the report. |

| 14-Jun-2013 | v02.0.0.0 | Donald Lamola | t191632 | Add Amount Level field. |

| 12-Mar-2021 | v04.1.0.0 | Kerrylee Naidoo | t248852 | Enhancement to manual to include calc method 8 and E |