| Field |

Type

&

Length |

Description |

Depreciation Type

|

A1

|

Depreciation can either be calculated

for Financial reporting refer to as standard depreciation or Tax

reporting refer to as tax depreciation. Only standard

depreciation will be posted to the General Ledger, tax depreciation is

only calculated for Tax reporting purposes, should Tax reporting be

applicable to the institution.

|

Method

|

A1

|

Assets can be depreciated on a

straight-line basis of reducing balance method. |

Factor

|

N3.2

|

The factor is only used with the reducing balance

method and accelerate the write-off charge. |

| Tax

Depreciation Rate |

N15.2 |

The Tax Depreciation Rate linked to this asset if

applicable. Default Tax Depreciation Rates may

be defined for asset types in {ACS-2} that will

default when asset Depreciation Attributes are defined for an

asset. |

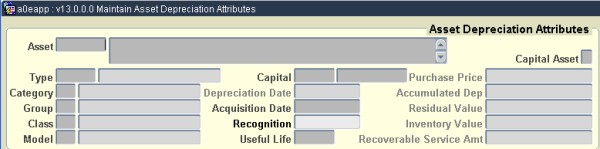

| Useful Life |

N3 |

The Period over which an asset is expected to be

available for use by an institution. |

| Effective

date |

DD-MON-YYYY |

This date is from which the depreciation rate will

apply. This will default from the Date Aquired in {AOPS-1}. |