|

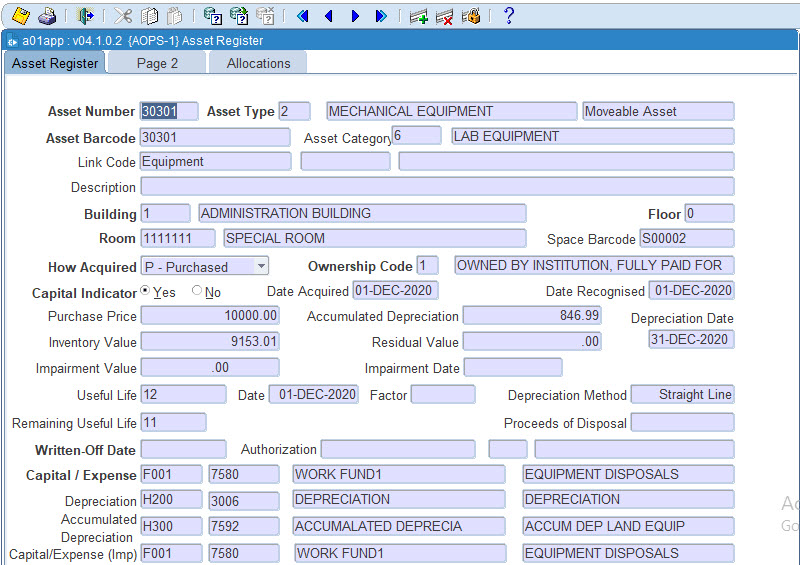

The Asset Register is a register of

assets under the control of the institution containing information on

the each asset. The option allows the user to define,

maintain and query assets.

Import and Export of CSV (Comma Delimited Values) into and from Excel is available on this option.

| Field | Type & Length |

Description |

|---|---|---|

| Asset Number | N7 | A number to uniquely identify an asset. Pop up Menu - available on field Asset Number.

|

| Asset Type | N4 | The Asset Type of the asset as defined in {ACS-2}. Assets are grouped together by Asset Category and Asset Type. Asset categories are defined in {ACS-1} as IMMOVABLE or MOVABLE and linked to an Asset Type in {ACS-2}. If the Asset Category is IMMOVABLE only Asset Types where the Asset Class is Land, Land Improvements or Buildings may be linked to the Asset Category. The option displays the Asset Type Description, Asset Category, Category Description and Category Group (MOVABLE / IMMOVABLE) for the Asset Type entered. |

| Asset Barcode | A6 | The barcode, the number on the bar-code label. On insert the asset number will default, the number is updateable should the asset barcode be lost for any reason and a new bar code be affixed to the asset. Asset Bar code numbers should be entered provided that the barcode number is not already used on another asset. |

| Asset Category | N2 |

The option displays the Asset Category, Category Description of the asset category linked to the asset type linked to the asset. |

| Linked Code | A1, 7, A30 | The field is used to link an asset to Land, Land Improvements or Buildings. On insert of an asset the asset class will display in the first field i.e. Land, Land Improvements or Building, indicating to the user the class of asset to be linked to the asset. Depending on the class of asset the list of value will display the code and description of the class of asset to be linked to asset. |

| Asset Description | A250 | A description of the asset should the asset type not sufficiently describe the asset. |

| Building / Floor / Room | N4, N2, A7 | When a MOVABLE asset is entered the asset location must be entered as defined in the Space Inventory System. Only MOVABLE assets require a space location. The location of the asset, the building name and space bar code as defined in the Space Inventory System is displayed for the location entered. |

| How Acquired | A1 | This field is used to indicate

how the asset was

acquired, and is used

mainly for STATS reporting purposes. The field will default to "P" to

indicate that it was purchased. The field is updateable by the user

provided that the asset has not been recognized. The

following values are allowed:

|

| Ownership Code | A1 | The Ownership Code and description will be displayed as defined in {ACS-3}. |

| Capital Indicator | A1 | A (Y)es or a (N)o must be entered here. Only assets indicated as (Y)es will be included for STATS reports, and should reconcile with the amount in the Capital Accounts in the General Ledger. This field is updateable only if the asset is not recognised. |

| Date Acquired | DD-MON-YYYY | The date on which

the asset was acquired by the

institution. This can be the date the asset was received, invoiced or paid depending on the institutions policy. The

system defaults system date when an asset is defined. If the date is not within the circle {FCSM-2} code AT, the warning message will appear, but the warning will not prevent the user from saving the changes. |

| Date Recognised | DD-MON-YYYY | The date on which the asset was taken into use by the institution and may differ from the acquisition date. This date will be used as the date to start the depreciation calculation. Assets may not be deleted once an asset is recognised and {AMNT-1} must be used to write off an asset. |

| Purchase Price | N15.2 | Displays the asset purchase price as entered on the Asset Value Attributes screen. The purchase price of an asset may be made up of either Invoices, Payments and Journals or any combination or part thereof. The purchase price of an asset can also be created by entering a Fair Value (MA) record. |

| Accumulated Depreciation | N15.2 | Displays the Accumulated Depreciation value for the asset. Depreciation accumulates on the asset every time depreciation is run for the asset. |

| Inventory Value | N15.2 | Displays the Inventory Value of the asset. An assets inventory value is calculated by subtracting the Accumulated Depreciation from the Purchase price of the asset. |

| Residual Value | N15.2 | The estimated value for which the asset could be sold in an open market transaction at the end of the useful life of the asset. The remaining value of an asset after it has been fully depreciated. This value is used in the depreciation calculation. |

| Depreciation Date |

DD-MON-YYYY | Displays the date on which last depreciation run was done for the asset.

This field is not updateable. |

| Useful Life | N4 | The Period in months over which an asset is expected to be useful by an institution. |

| Date | DD-MON-YYYY | This date from which the current useful life of the asset applies. |

| Factor | N5 | Displays the depreciation factor used when applying the reducing balance method to accelerate the write-off charge. |

| Depreciation Method | A30 | Displays the depreciation basis applied on the asset. Assets can be depreciated on a straight-line basis of reducing balance method. |

| Remaining Useful life | N15 | Displays the remaining useful life of an Asset |

| Written-Off Date | DD-MON-YYYY | The date the asset was written off. Assets are written off through {AMNT-1}. |

| Authorization | A20 | A reference entered when an asset is written-off. These fields are displayed from {AMNT-1} and the user cannot change the field in this option. |

| Written-Off code | A4 | A code indicating the reason for the disposal i.e. damaged, stolen etc. This code is displayed from {AMNT-1} and the user cannot change the code in this option. |

| Description | A30 | This description is displayed from {AMNT-1} and the user cannot change the description in this option. |

| Capital / Expense | A4 + A8 | If a capital asset the GLA

(cost centre and account) against which the asset will be capitalized

else if a non- capital asset the GLA against which the item was

expensed. For recondition and control purposes capital assets current year expenditure and the capital assets balance are separated through using different accounts. The capital account must be defined with an account category in the range 900 - 909 and the current year expenditure in the range 890 - 899. The expenditure account is linked to the capital account on the account definition {FCSO-3}. When the GL Year-End is performed the current year expenditure balance is transferred to the assets capital or balance account. The result is that in the New Year the asset capital account reflects the balance as at year end as reconciled to the asset register. No balance is carried forward on the current year expenditure account which reflects the current year capital asset acquisition and can be reconciled with asset acquisition report for the year. The capital account definition includes the accumulated depreciation and depreciation accounts which will default to those fields when the asset capital GLA is entered on an asset. The cost centre and/or account will default from the asset type of the asset {ACS-2} but can be changed by the user. If the cost centre and/or account is null on the asset type definition the user must enter the capital cost centre and /or account. The user will only be able to link Invoices, Payments and Journals to form the assets Purchase Price value where the expense GLA on the journal/document match the Capital GLA linked to the asset expense GLA. The capital / expense GLA must be valid for the year of the subsystem 'AT'. |

| Depreciation | A4 + A8 | The GLA to

be used for the depreciation expense of the asset. If the Capital Indicator is Non-Capital the depreciation GLA is set to null and is not updateable.

|

| Accumulated Depreciation | A4 + A8 | The GLA to

be used for the accumulated depreciation balance of the asset. If the Capital Indicator is Non-Capital the accumulated depreciation GLA is set to null and is not updateable.

The accumulated depreciation GLA must be valid for the year of the subsystem 'AT'. |

| Capital / Expense (imp) |

A4 + A8 |

If a capital asset the GLA

(cost centre and account) against which the asset will be capitalized

else if a non- capital asset the GLA against which the item was

expensed. For recondition and control purposes capital assets current year expenditure and the capital assets balance are separated through using different accounts. The capital account must be defined with an account category in the range 900 - 909 and the current year expenditure in the range 890 - 899. The expenditure account is linked to the capital account on the account definition {FCSO-3}. When the GL Year-End is performed the current year expenditure balance is transferred to the assets capital or balance account. The result is that in the New Year the asset capital account reflects the balance as at year end as reconciled to the asset register. No balance is carried forward on the current year expenditure account which reflects the current year capital asset acquisition and can be reconciled with asset acquisition report for the year. The capital account definition includes the accumulated depreciation and depreciation accounts which will default to those fields when the asset capital GLA is entered on an asset. The cost centre and/or account will default from the asset type of the asset {ACS-2} but can be changed by the user. If the cost centre and/or account is null on the asset type definition the user must enter the capital cost centre and /or account. The user will only be able to link Invoices, Payments and Journals to form the assets Purchase Price value where the expense GLA on the journal/document match the Capital GLA linked to the asset expense GLA. The capital / expense GLA must be valid for the year of the subsystem 'AT'. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Asset Number | N7 | Displays the asset number queried in block 1 |

| Remark | A30 +A250 | These field may be used for any additional remarks on the asset |

| Date Processed | DD-MON-YYYY | This field will default from system date and time. This will be the date the asset was captured into the system. |

| Last Survey Date | DD-MON-YYYY | The date on which the asset was last surveyed. This date can be entered manually. If an asset survey was done with the scanner and the data is downloaded to the Asset System, this field will be generated with the date on which the data was downloaded. If you moved an asset via the Asset Web or {AOPS-2} the system will update this field with the system date |

| Survey Type | A1 | This field refers to the

previous field,

Last Survey Date. If the survey date was typed in, the user should

enter a "M" in this field. If the data is downloaded from the scanner,

the field will be set to "S". If you moved an asset via the Asset Web

or {AOPS-2} the system will update this field with

"M" |

| Replacement Value | N15.2 | The value to replace the asset. An asset cannot be recognised if the asset Replacement

Value has not been entered. |

| Last Update of Replacement Value | DD-MON-YYYY | Whenever the Replacement Value is updated, either directly or via option {AOPS-4}, the date is displayed. |

| Replacement Date | DD-MON-YYYY | An estimated future date near or at the end of the assets useful life when the asset will be replaced. |

| Tax Depreciation Rate | N6.3 | The Tax Depreciation Rate linked to this asset will be displayed, if applicable. Tax Depreciation Rates are linked to assets in the Depreciation Attributes screen available on drilldown on the asset number in this application. Default Tax Depreciation Rates may be defined for asset types in {ACS-2} that will default when asset Depreciation Attributes are defined for an asset. |

| Date Tax Depreciation Rate | DD-MON-YYYY | Date Tax Depreciation Rates are linked to assets in the Depreciation Attributes screen available on drilldown on the asset number in this application. The date will be display in the application. |

| Main Asset Number | N8 | An asset can consist of a number of parts, which may be

purchased separately. These parts may be created as separate

assets in the asset register and linked together using one

of the

asset numbers. The main asset number is the asset number used

to

link the separate asset parts together. An asset can be delinked from its main asset by clearing the "Main Asset Number" field.

|

| Person Responsible | N9 | This is the person responsible for the asset. The person name is displayed for the person type and number as entered by the user on the asset. The person name and number are updateable provided the asset is not a part of a main asset. If the asset is a part of a main asset these fields can only be queried. |

| Person Allocated | N9 | This is the person to whom the asset has been allocated. The person name is displayed for the person type and number as entered by the user on the asset. The person name and number are updateable provided the asset is not a part of a main asset. If the asset is a part of a main asset these fields can only be queried. |

| Condition | A1 | A condition code, as defined in {ACS-4}, may be entered here. The condition description will be displayed. The condition code is mandatory if the Asset Class is Building, Land and Land Improvement. |

| Custodian Department | N4 | The custodian department primarily responsible for the asset.. |

| Maintenance Contract | A10 | This field can be entered if the asset is under maintenance contract. A maintenance contract number as created in {MNT-5} can be entered. The name of the contractor will be displayed. |

| Model Number | A15 | Enter the model number of the asset. This field is useful for assets of high value where maintenance contracts may be applicable. |

| Chassis No/ VIN | A15 | This field is used when the asset is a motor vehicle. Enter the chassis/VIN number of the vehicle |

| Serial Number | A40 | Enter the serial number of the asset. This field is useful for assets of high value where maintenance contracts may be applicable. |

| Engine Number | A15 | This field is used when the asset is a motor vehicle. Enter the engine number of the vehicle. |

| Registration Number | A15 | This field is used when the asset is a motor vehicle. Enter the registration number of the vehicle. The Vehicle Booking System makes use of this field, when displaying the registration number of the vehicle. |

| Club | A5 |

The code of the club, as created in {CLMNT-1}, if this asset is allocated to a club. The description of the club is also displayed. |

| Impairment |

A4 + A8 |

Impairment

GLA (cost centre and account) is used to record the debit leg of

impairment transactions on the financial statements. This fields

defaults from the setup on {FCSO-3}, the impairment account must be linked to the Capital/Expense Account on {FCSO-3} The impairment GLA must be valid for the year of the subsystem 'AT |

| Accumulated Impairment |

A4 + A8 | Impairment GLA (cost centre and account) is used to record the credit

leg of impairment transactions on the financial statements. This fields defaults

from the setup on {FCSO-3}, the Impairment Account must be linked to

the Capital/Expense Account on {FCSO-3} The Accumulated Impairment GLA must be valid for the year of the subsystem 'AT |

|

If this Block is not completed, the system will assume that the asset should be allocated to the same department(s) as the space in which it is housed. It is possible, however, to allocate an asset to any particular department or departments by using this Block. The Asset Number will be displayed if the previous Block has already been completed.

| Field | Type & Length |

Description |

|---|---|---|

| Department Code | N4 | The Department Code, as defined in the General System. The Department name will be displayed. |

| Percentage | N3.1 | The percentage of the utilisation of the Asset that

should be allocated

to this department. If one department uses an asset only, the

percentage is 100. A check that percentages add up to 100 is done

before STATS reports are produced. |

| Year | YYYY | The departmental allocations can be entered and stored per year. This is a display field, to indicate to the user the year for which this allocation was done. Only the present HEMIS year's value set on {STMNT-1} for table sequence 5, will be displayed. |

|

The user need not supply the information in this Block and the next one. When STATS Reports are produced, the system will determine which assets need to be allocated to PCS Programs and CESM-Categories. In these cases, the assets will be allocated according to the allocation of the building space in which they are housed.

Should the user wish, however, to allocate the asset to a different program, entering the particulars in this Block can do it. When STATS Reports are produced, the system first checks whether this Block contains any information, in which case it will be used; otherwise the allocation of the building space will be used.

This Block is normally entered after the asset has been queried in Block 1. The Asset number will be displayed, and the user may supply the following information:

| Field | Type & Length |

Description |

|---|---|---|

| Program Allocation | N2, N1, N1 | The program is entered into three fields, i.e. the main

program (1 to

11), the sub-program (for all programs except 2 and 3) and the

sub-sub-program (for sub-sub-programs 5.2 and 6.4 only). In cases where

there are no sub- or sub-sub-programs, zero's must be entered. The name

of the sub-sub-programs will be displayed once the complete code has

been entered. |

| Percentage | N3.2 | The percentage of the utilisation of this asset to be allocated to this program. |

| Year | YYYY | The departmental allocations can be entered and stored per year. This is a display field, to indicate to the user the year for which this allocation was done. Only the present HEMIS year's value will be displayed |

|

The allocation of assets to CESM-Categories is handled via subjects, by using the corresponding allocations of subjects in the Academic Structure. The use of this Block is similar to that of the Program Block above, except that the Subject Code from the Academic Structure is used rather than the Program number.

| Field | Type & Length |

Description |

|---|---|---|

| Subject Code | A7 | An academic subject code as defined on the academic structure for the STATS reporting year. The list of values will list the subject code and description. |

| Percentage | N3.2 | The percentage of the utilisation of this asset to be allocated to this subject. |

| Year | YYYY | The STATS reporting year to which the subjects and percentages apply. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 23-Aug-2007 | v02.0.0.0 | Elize de Swardt | t137484 | New manual format. |

| 23-Jan-2007 | v02.0.0.0 | Amanda Nell | t146713 | Add new images |

| 04-May-2009 | v02.0.0.1 | Marchand Hildebrand | t158353 | Manual Review |

| 20-Feb-2012 | v02.0.0.2 | Elize de Swardt | t178727 | Correction to Account Categories , add links |

| 25-FEB-2012 | v02.0.0.3 | Jabu Mokonene | t189087 | Correction on a word form to from on block 1 field Inventory Value. |

| 12-Sep-2013 | v03.0.0.0 | Raymond Schoonraad | t190188 | Add CSV import export |

| 05-May-2015 | v03.0.0.1 | Mmasadi Matseke | t203661 | Change the image on Block 1, page 2 to add Custodian Department field. |

| 04-Jan-2015 | v03.0.0.2 | Thabang Nyatlo | t210663 | Update image for Asset Register that includes a new field called Remaining useful life . |

| 16-Jan-2016 |

v03.0.0.3 |

Thabang Nyatlo |

t210916 |

This field will display the numeric value of proceeds of disposal |

| 25-Jan-2021 |

v04.1.0.0 |

Ndivhanga Mushando |

t247834 |

Add new fields 'Capital/Expense (imp)' on Block 1 Page 1, 'Impairment' and 'Accumulated Impairment' on Block 1 Page 2. |