|

| Field | Type & Length |

Description |

|---|---|---|

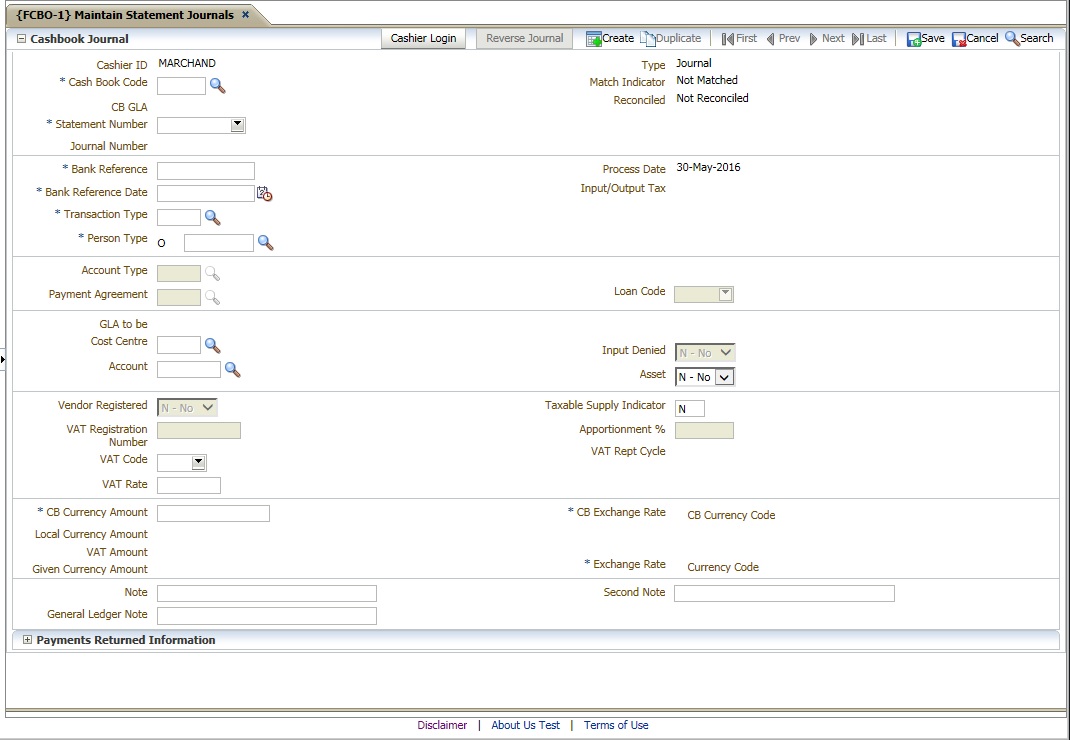

| Buttons | ||

| Cashier Login | Users with access to cash book options are allowed to query cash book transactions but to process a transaction the user must be a cashier that is logged on. | |

| Reverse Journal | Allows the cashier to reverse a cash book journal. |

|

| Duplicate Record | Allows the cashier to duplicate a cash book journal. | |

| Panel Box: Cash Book Journal | ||

| Cashier | A20 | Displays the cashier id of the cashier logged in on the option. |

| Cash Book | A5 | The cash book code of the cash book being maintained. The list of values displays the code, description, cash book GLA and currency of the cashbook. The user can search on the code and description on the lov. |

| CB GLA | Displays the cash book GLA as defined in {FCSC-5} "Maintain Cash Book Definition" | |

| Bank Statement Number | N6 | The bank statement number on which the the transaction occured. |

| Journal Number | N7 | The unique transaction number, which is allocated programmatically when a journal is created. |

| Document Type | A1 | Indicates if the record related to journal, deposit or payment. |

| Match indicator | A1 | Indicates if the transaction has been matched on a bank statement. |

| Reconciled | A1 | Indicates whether the bank statement on which this transactions appears has been reconciled. |

| Bank Reference | A12 | The reference number of the transaction as it appears on the bank statement. |

| Bank Reference Date | (DD-MON-YYYY) | The transaction date as it appears on the bank statement. |

| Transaction Type | N4 | Journal processing is driven by the transactions type. The transaction type indicates the person type and other subsystem is affected by using the transaction type. The transaction type also determines which of the fields that follow are required and / or updateable and whether the journal relates to input or output for VAT / GST purposes. The transaction types are defined in {FCSO-7}. |

| Person Type | A1 | Depending on the transaction type definition, one of the following values will be displayed:

|

| Person Number | N9 | The person number field is mandatory if the person type of the transaction is (S)tudent, (D)ebtor, (C)reditor, (P)ersonnel and (A)lumni. For person type (O)ther, this field is not mandatory, but a number can be used if the person was created on the system and has a biographical record. |

| Process Date | (DD-MON-YYYY) | The date the journals was processed.On creating a journal the date will default to system date and is not updateable. |

| Input / Output | A1 | Indicates if the journals relates to input output for VAT / GST purposes. |

| Account Type | A4 | The account type will default from the transaction type, but can be updated by the user if so defined on the transaction type definition. The account type field is mandatory if the person type of the transaction is (S)tudent, (D)ebtor or (C)reditor. For (P)ersonnel and (O)ther, this field is also mandatory if the card indicator on the transaction type definition is (Y)es. If this indicator on the transaction type definition is (N)o, an account type is not needed. If person type is (S)tudent, (C)reditor or (D)ebtor, a list of valid account types for that person type will be available. It will also show the balance for the account type / payment agreement combination for (S)tudents. The user will only be able to process a transaction on one of these valid account types or the default account type defined for the student debtor subsystem. The program will validate that the subsystem / account type combination is valid and active. |

| Payment Agreement | A4 | When a transaction is processed for person type (S)tudent, the user will have to enter a payment agreement for the transaction. A list of valid values for the specific student will be available from which to choose. This is a mandatory field for person type (S)tudent unless the transaction is processed against the default account type, in which case the field will be null. |

| Loan Code | N5 | The staff loan code or student loan code, if applicable, can be entered here. For staff debtors, the cumulative principal repayment and the reducing principal (outstanding amount) {FARPD-2b2} will then be updated with the amount of the payment. It is essential that the account type used be linked to a category “S” (Staff Loans) otherwise the user will not be allowed to enter a loan code. For student loans, the real payment amount, as indicated on the amortisation schedule {FBLO-22b4}, will be updated with the payment amount when the next amortisation calculation is run. Again it is essential that the account type used be linked to a category “L” (Student Loans) otherwise the system will not allow the user to enter a loan code. |

| Bank Statement Debit/Credit indicator | Debit/Credit | The indicator defaults from the transaction type definition and is not updateable. |

| Cost | A6 | The cost centre to be debited or credited. The cost centre and account is not updateable if the person type above is Student, Creditor or Debtor or where an account type is used. |

| Account | A8 | The account to be debited or credited. The cost centre and account is not updateable if the person type above is Student, Creditor or Debtor or or where an account type is used. |

| Input Denied | A1 | The indicator defaults from the account definition. If the journal relate to a taxable supply on the input side and and the indicator is (Y)es, GST / VAT will not be processed when the journal is saved. The journals will be marked as input being denied. |

| Asset Y/N | A1 | If the journal relates to the sale or purchase of an asset the indicator should be set to (Y)es. The indicator will be used to identify capital items for GST / VAT reporting purposes. The value defaults according to the asset categories as defined on the SOD codes AV and AW. |

| Vendor Registered | A1 | Vendor registered only applies to SA clients registered for VAT where the journal relate to input. In order to claim the input VAT on the journal the field vendor registered must be set to (Y)es. If the field is "Y" the cashier will be required to enter the vendors VAT registration number. This forces the cashier to enter a VAT registration number where input tax will be claimed. |

| VAT Registration Number | A12 | If the field vendor registered is set to (Y)es, the cashier

must enter a VAT registration number. The program will validate that

the number is a valid VAT number applying the SARS modules check. |

| Vat Code | A2 | |

| Vat Rate | N4.2 | The VAT percentage linked to the VAT code will default but can be updated by the user. It is the user's responsibility to ensure the VAT rate is correct on commit of the transaction. |

| Taxable Supply Indicator | A1 | Taxable supply indicator is used to classify a transaction in

terms of its treatment for VAT / GST purposes. The taxable

supply indicator is linked to the GST / VAT code and by selecting

a GST / VAT code the taxable supply indicator is set.

The concept of supply is integral to the application or VAT / GST and

can be broken down into:

|

| VAT Apportionment % | N3.3 | Where a journal is directly attributed to

the making of a taxable supply there is no apportionment and the

apportionment is 100% rate = 1, however if the journal relate to

the making a mixed supplies which cannot directly

be attributed to the making of a taxable

supply, apportionment applies and only a portion of the input tax

can be claimed. Tthe portion that can be claimed is referred to a apportionment. Apportionment rates to be applied should be obtained from the local tax authority. Apportionment is only applicable if the journal relate to input. The apportionment rate defaults from the rate definition but it is the cashier’s responsibility to ensure the GSWT / VAT apportionment is correct on commit of the transaction. The rate is entered a fraction i.e. 75 % - 0.75 |

| VAT Report Cycle | N6 | Displays the VAT Report Cycle. When a transaction is reported in a VAT report the transaction is flagged with the report year and cycle it was reported in. |

| CB Currency Amount | N15.2 | The transaction value in cash book currency (the amount as it appears on the bank statement). |

| Local Currency Amount | N15.2 | The CB currency amount converted in the currency of the institution. |

| Vat Amount | N15.2 | The VAT amount, if VAT is applicable will display. |

| Given Currency Amount | N15.2 | The value of the transaction, in a given currency. Given currency value is the value of the transaction in the currency of the Debtor / Creditor after converting the Cash book amount received to local currency and the local currency value to the debtor / creditor currency. |

| CB Rate | N5.3 | The cash book currency exchange rate. |

| CB Currency Code | A3 | The currency code of the cash book. The cash book currency defaults from the cash book definition and cannot be updated. |

| Given Currency Rate | N5.3 | The exchange rate of the currency the Debtor / Creditor is defined in. |

| Currency Code | A3 | The currency code of the currency the person, Debtor / Creditor, is defined in. The code defaults from the persons biographical definition and cannot be updated. |

| Note | A40 | A note for the subsystem transaction may be entered. If the debtor / creditor is a (S)tudent, the note will default from the transaction type note, but may be updated. |

| General Ledger Note | The debtor number and name will default to this field but may be updated by the user. This note will be entered in the General Ledger. | |

| Second Note | A second note field can be entered for the transaction. This field can be updated after the transaction was saved. If th field is entered, it will print on the transaction list. If null, the GL Note will print on the transactions list ({FCBOR1-6}. | |

| Panel Box: Payments Returned Information | ||

| Set R/D Indicator on Student | A1 | If an R / D cheque is processed this indicator may be set to (Y)es. |

| Cheque Number | A16 | If a cheque was returned from the bank, the cheque number of the returned cheque can be entered here. |

| Branch | A11 | The branch code of the returned cheque can be entered here. |

| Cheque Date | (DD-MON-YYYY) | The date of the returned cheque can be entered |

|

| Processing Rules |

|

|---|---|

| Students linked to a status with action 'S'- "Suspend Printing". | The creation of payments to students or monies received for students, where the student is linked to a financial status with the action S-“Suspend Printing” can be prevented by setting the SOD “CL-CB:- Students linked to a status with action 'S' “ ans / or or "C7 - CB Receive money for students with action 'S' " to “Y” else the cashier will receive a warning that the student is linked to a status code with action 'S'. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 22-Jan-2007 | v01.0.0.0 | Charlene van der Schyff | t133569 | New manual format. |

| 06-Dec-2008 | v01.0.0.0 | Charlene van der Schyff. | t151710 | Edit language obtained from proof read language Juliet Gillies. |

| 03-May-2012 | v03.0.0.0 | Segagaripe Phoshoko | t177368 | Re-writing cash book journal form into a big screen. |

| 19-Aug-2013 |

v03.0.0.1 |

Christel van Staden |

t189700 |

Proof read |

| 03-Sep-2013 |

v03.0.0.2 |

Christel van Staden |

t189862 |

Add SOD C7 for subsystem CB |

| 30-May-2016 | v04.0.0.0 | Marchand Hildebrand | t194630 | Convert to INT 4 |

| 16-Jun-2016 | v04.0.0.1 | Marchand Hildebrand | t205772 | Add SOD CL for subsystem CB |