This option is applicable to South African clients only and is used to generate the data required for reporting, when generating the COIDA: Generate the Return of Earnings Form, {FPRY-9} required for the annual submission, to the Compensation Fund, Department of Employment and Labour.

Setup Requirements:

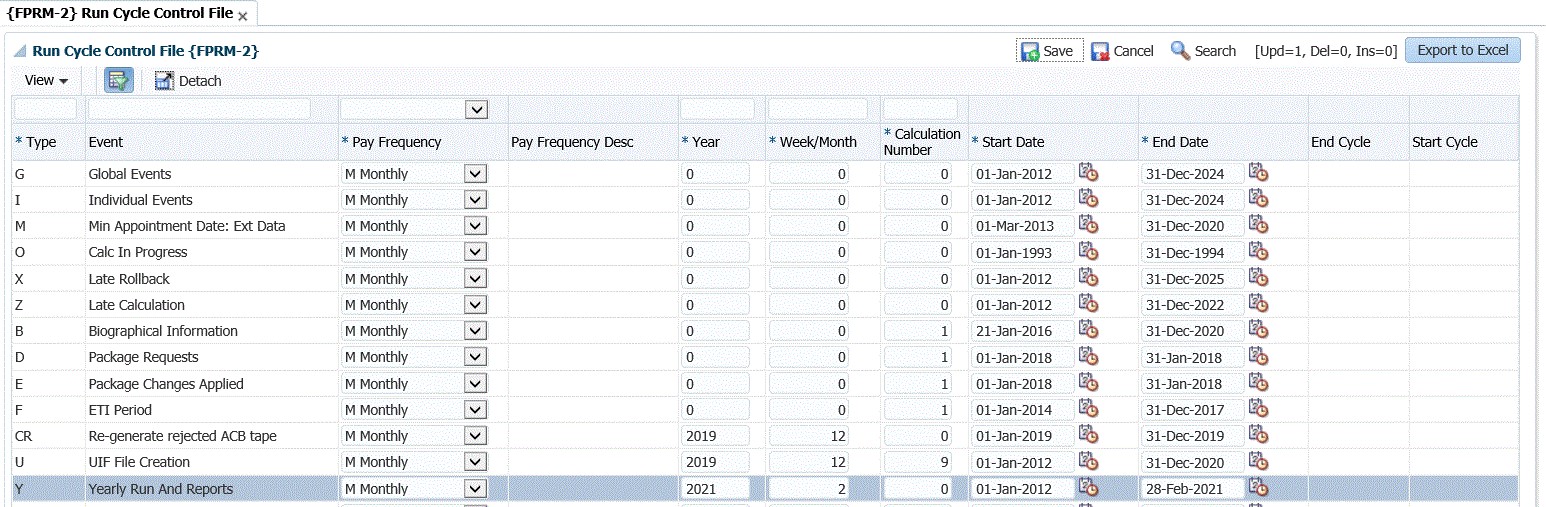

The COIDA period is determined by the date set on event 'Y' 'in {FPRM-2}.In order to select the detail for the year the date should be set to the last cycle of the COIDA reporting year. The COIDA reporting year runs from March to February.

In the example above COIDA reporting will be generated from cycle 202003 to 202102.

The generation of COIDA earnings is based on the setup of ED Codes in {FPRG-6} where the include for WCA indicator is set to 'Y'.

Please note:

In order for an employee to be included in the reporting, there must be salary transactions for a cycle within the reporting period, with transaction/s where the WCA indicator is set to 'Y'es i.e. COIDA earnings must exists for the person, within the reporting period and the person must be in service for this period.

To Report Directors:

The generation of the COIDA Annual Earnings Form 0used for submission is run from {FPRY-9}; the data used for reporting must be generated first, by running {FPRY-8}.

Thereafter a detailed report used for the verification can be generated from {FPRY-10}.

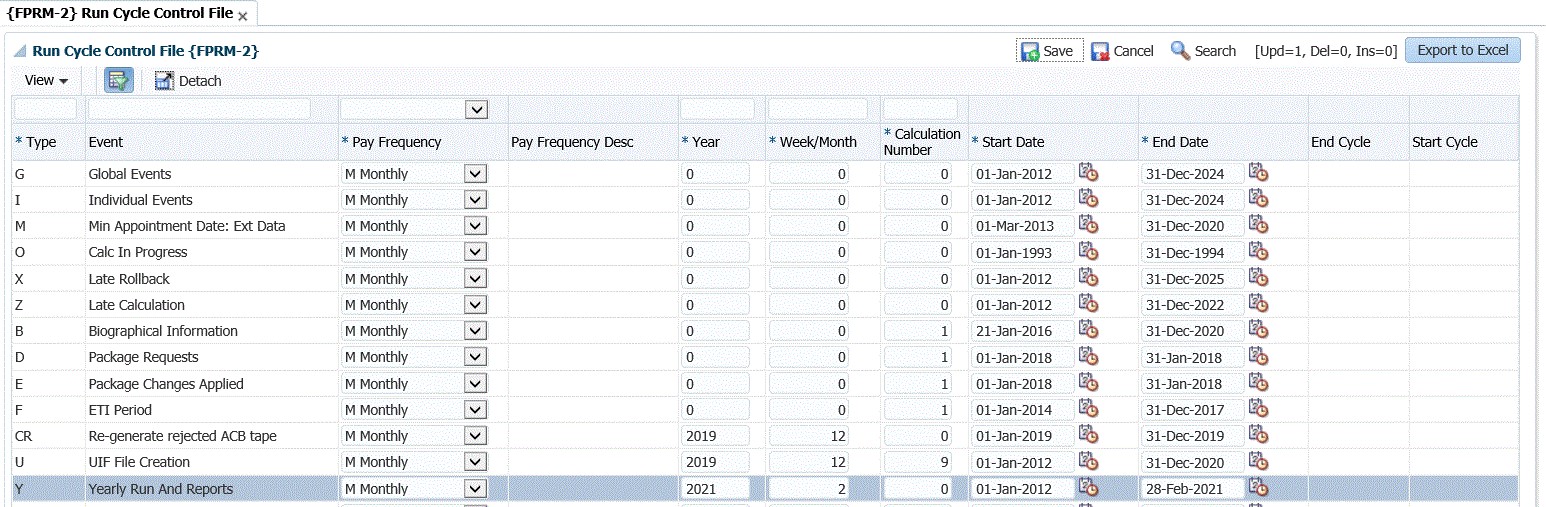

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| 1 |

COIDA Threshold for Reporting Year (e.g. 484200) | N6 | This is the legislated COIDA Threshold Amount for the reporting Period. COIDA Contributions are mandatory, for all personnel where the annual COIDA Earnings (as defined in the ACT) are less than/ equal to this amount. |

| 2 | Maximum Annual Earnings for Voluntary Contributions (e.g. 4084200) | N6 | COIDA contributions are mandatory for personnel whose COIDA

Earnings are equal or less than the legislated Threshold amount. HOWEVER, the institution may also cover personnel earning above the legislated Threshold Amount, this is voluntary. Supply the upper Threshold that the Institution is calculating contributions on i.e. If COIDA is only calculated up to the Threshold amount for all personnel, this would be the Threshold amount. If COIDA is being calculated for personnel earning above the Threshold amount, provide the maximum COIDA Earnings, personnel may earn, when calculating COIDA for example 999999999 If This should be the Upper income threshold all personnel earning more than this threshold do not have to pay any contributions towards WCA/COIDA, however Voluntary contributions may be made should the Institution choose to do so. |

| 3 | Supply ED code for Payments | A4 | A LOV will allow the user to select the correct ED code. This is the ED code used to calculate COIDA contribution. |

| 4 | Supply the projection % | N3 | This % represents the expected salary increase for the next COIDA reporting period. |

| 5 | Supply the Personnel Indicator for Directors | A2 | A LOV will allow the user to select the correct Personnel Indicator. |

| 6 | Enter the first of max 10 ED codes for Free Food and Quarters cash value | A4 | A LOV will allow the user to select the correct ED code. |

| Sort Order | Per | Comments |

|---|---|---|

| As per user selection. |

| System Select | |

|---|---|

| 1 | The system will select data as setup per event 'Y' |

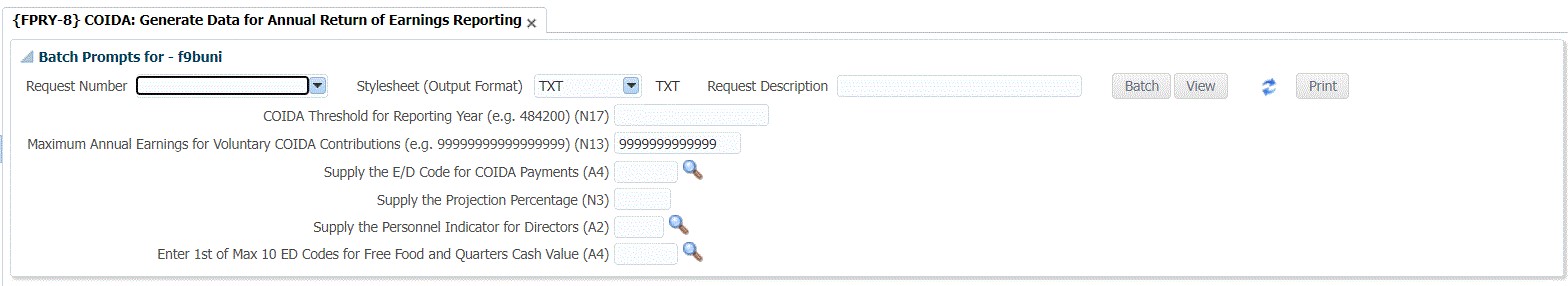

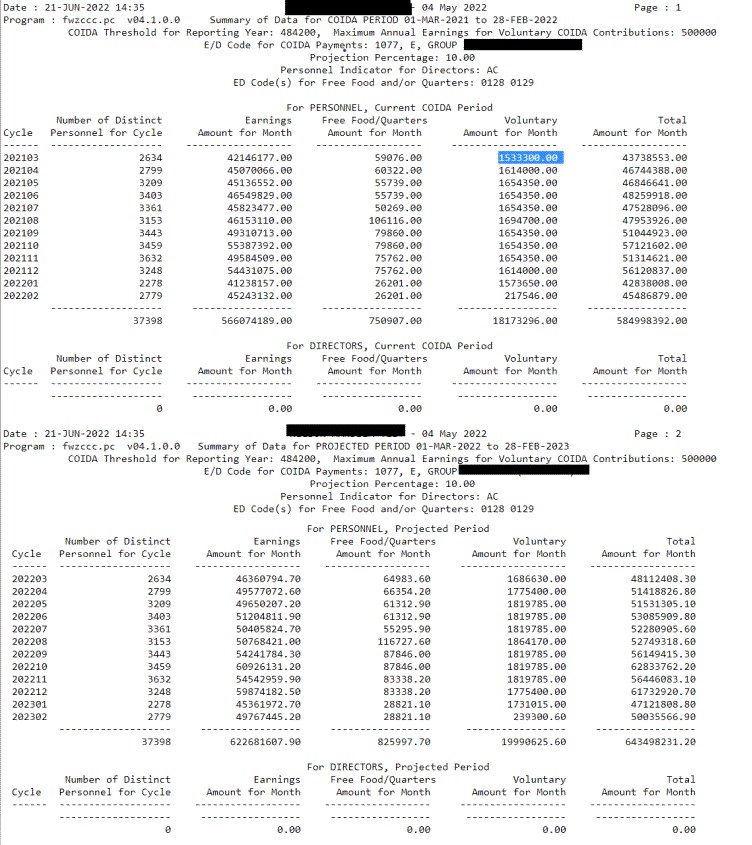

Example:

Processing Rules

| Processing Rules |

|

|---|---|

| 1 | The COIDA income will be annualized and compared to the lower and upper limit to determine whether earnings will be reported as COIDA earnings or Voluntary earnings. |

| 2 | Annualization will work similar to annualization for tax, if a person is in service for the full period the income for the month will be multiplied by 12 to calculate an annual amount. |

| 3 | If a person is not in service for the full period annualization will work on actual days in service. |

| 4 | ED code earnings marked as (Include for WCA) must exists for the specific cycle for the person to be reported in that cycle. |

| 5 | COIDA earnings are reported as a summed amount for all personnel per cycle either as COIDA earnings or Voluntary. |

| 6 | Free food and Quarters are reported as a summed amount separately per cycle. |

| 7 | COIDA earnings for personnel and Directors are reported separately. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 08 Jun-2022 | v04.1.0.0 | Allie de Nysschen | t255455 | New COIDA reporting Development |

| 21 jun 2022 | v04.1.0.1 | Allie de Nysschen | t249600 | Enhance Batch prompts |