|

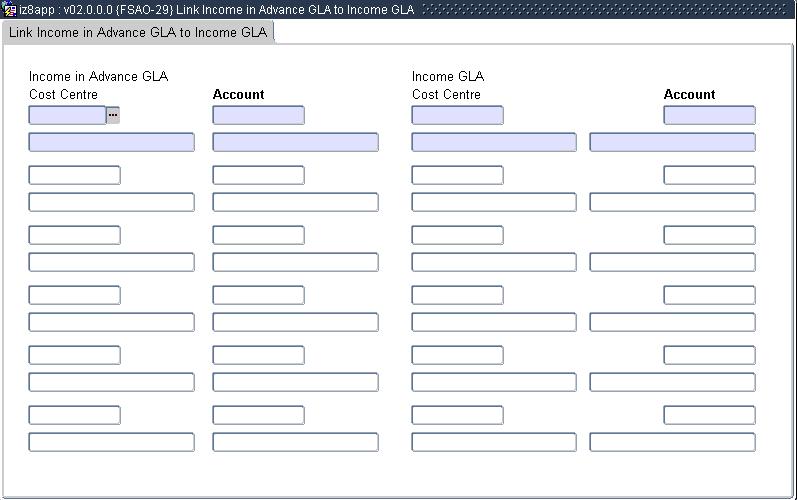

Define a strucure to indicate an income GLA for every income in advanced GLA if student income must be accrued.

|

Example |

Income in Advance Cost Centre |

Income in Advance

Account |

Income Cost Centre |

Income Account |

|

1 |

NULL |

NOT NULL |

NULL |

NOT NULL |

|

2 |

NULL |

NOT NULL |

NOT NULL |

NOT NULL |

|

3 |

NOT NULL |

NOT NULL |

NOT NULL |

NOT NULL |

| Field | Type & Length |

Description |

|---|---|---|

| Income In Advance GLA | ||

| Cost Centre | A6 | If entered by the user it must be a valid detail cost centre on {FCSO-1}. The cost centre may not be linked to a ledger that is not the primary ledger. Only cost centres linked to the primary ledger can be used for consumption. A list of valid cost centre codes is available. The cost centre description is displayed. Can be null, but if null, a second record where this field is null may not exist. All additional records must contain a value. |

| Account | A8 | This field cannot be null and must be a valid detail account on {FCSO-3}. A list of valid account codes is available. The account description is displayed. |

| Income GLA | ||

| Cost Centre | A6 | If entered by the user it must be a valid detail cost centre on {FCSO-1}. The cost centre may not be linked to a ledger that is not the primary ledger. Only cost centres linked to the primary ledger can be used for consumption. A list of valid cost centre codes is availble. The cost centre description is displayed. Can be null, but if null, the income in advance cost centre must also be null. |

| Account | A8 | This field cannot be null and must be a valid detail account on {FCSO-3}. A list of valid account codes is available. The account description is displayed. |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 17-Sep-2010 |

v02.0.0.0 | Christel van Staden | t169772 | New manual. |