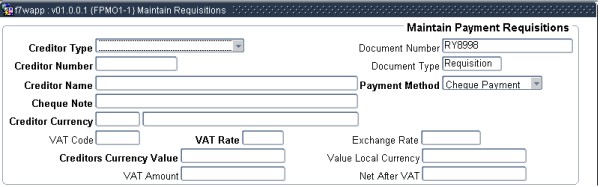

Maintain Cheque Requisitions

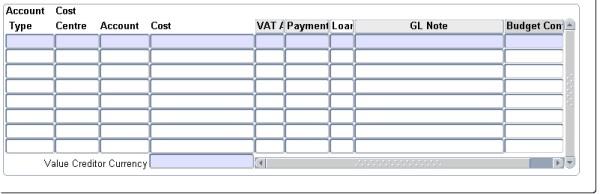

The option consists of two blocks. In Block 1 the user enters the payment detail of a cheque request. Block 2 to is used to enter the item detail of the cheque request. The screen can only be accessed from the item type field or expense GLA fields using the pop up menus on these fields on a requisition document.

Cheque Item Block 1

This block is used to enter the payment detail of a cheque request.

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Type | A1 | The user must enter the type of creditor for which the cheque is requested. If the person is not defined on the system, the user must use the person type Other. If the person type (S)tudent, (C)reditor or (D)ebtor is selected the issue of the cheque will result in a transaction on the account of the student or debtor / creditor in the subsystem of the person type. If the person type is (S)tudent, (P)ersonnel and (O)ther and a meal account type is entered on the financial item detail block the issue of the cheque will result in a transaction in the meal system. Any person type (O)ther / Person Type will default the name and address of the person type and number into the cheque request. |

| Creditor Number | N9 | Completion of this field is mandatory for all person types except person type (O)ther. The system will check that the code is valid and defaults the name and address into the request. The system checks the validity of the code on entering of this field, displaying "Invalid number while debtor = Student, Personnel, Creditor, Debtor, Alumnus or Other Payments" if code is invalid. |

| Creditor Name | A36 | The creditor's name will default in this field,

but the name on the cheque may differ from the "creditor's" name. Pop Up Menu - available on field creditor name.

|

| Cheque Note | A30 | The note entered here will be displayed on the cheque. |

| Creditor Currency Code | A3 | The currency code of the cashbook defaults into this field but is updateable by the user if the persons currency is not local currency. |

| VAT Code | A2 | The VAT code may be entered for this transaction. Pop Up Menu - available on the field VAT Code.

|

| VAT Rate | N3.2 | If the cheque payment is subject to VAT, the rate to be applied to the payment. A default VAT rate defaults from the VAT code if the VAT code is entered. VAT rate is mandatory. |

| Creditor Currency Value | N15.2 | The cheque value in the creditor's currency. |

| VAT Amount | N15.2 | The calculated VAT amount. |

| Value in Local Currency | N15.2 | The amount to be printed on the cheque. This amount should balance with the amounts debited to different GL-Allocations in Block 2. |

| Net After VAT | N16.2 | The amount after VAT will be displayed and is not updateable by the user. |

Example:

|