|

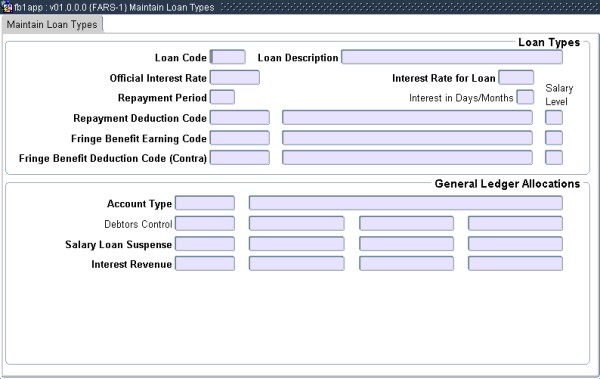

This option allows the user to create and maintain as many staff loan types as are required, as follows:

| Field | Type & Length |

Description |

|---|---|---|

| Loan Code | N4 | A unique code to identify this loan |

| Loan Description | A30 | A mandatory description for this loan type |

| Official Interest Rate | N3.2 | The default interest rate that currently applies to this type of loan, as prescribed by the Receiver of Revenue. This mandatory value can be overridden at individual level in Maintain Loan Details {FARS-2} in respect of a tax directive. |

| Interest Rate for this Loan | N3.2 | The default interest rate for this type of loan as currently

applied by the institution to its staff members; this will typically be

lower than the Official Interest Rate above. This mandatory

value can be overridden at individual level in Maintain Loan Details {FARS-2}. Note: If the loan rate equals or exceeds the official rate, no fringe benefit transactions will be generated for the ITS Payroll System by Generate Staff Loan Payroll Transactions {FARS-5}. |

| Repayment Period | N3 | The standard repayment period in months for this loan type. This mandatory value can be overridden at individual level in Maintain Loan Details {FARS-2}. |

| Interest in Days or Months | A1 | (D)ays or (M)onths This field is only applicable the first time interest is calculated for the loan code. If set to (D)ays, the number of days from the date of approval of the loan to the interest calculation date will be calculated and interest levied accordingly. Thereafter all interest will be calculated on a monthly basis. |

| Repayment Deduction Code | A4 | This optional code must be an active Deduction Code with a valid Tax Code as per Earning/Deduction Detail {FPRG-6} in the ITS Payroll System. The field is used when Payroll Deductions are to be generated for Staff Loans. The Deduction should be set up so that it does not influence tax. |

| Salary Level | N2 | This value is mandatory if a Repayment Deduction Code was entered: it defines the salary level for the Payroll Transaction. |

| Fringe Benefit Earning Code | A4 | This optional code must be an active Earning Code with a valid Tax Code as per Earning/Deduction Detail {FPRG-6} in the ITS Payroll System. The field is used to indicate the value of the "Fringe Benefit" for Staff Loans, that is, where the Official Interest Rate is higher than the Interest Rate for this Loan (Type). The Earning should be set up so that it increase the taxable income. |

| Salary Level | N2 | This value is mandatory if a Fringe Benefit Earning Code was entered: it defines the salary level for the Payroll Transaction. |

| Fringe Benefit Deduction Code (Contra) | A4 | If a Fringe Benefit Earning Code was entered, this field may

be entered. It indicates the Deduction Code that will be used as a

"Contra" transaction. It should be a valid Deduction Code with a

valid Tax Code as per Earning/Deduction Detail {FPRG-6} in the ITS Payroll System. The Deduction should be set up so that it does not influence the taxable income. |

| Salary Level | N2 | This value is mandatory if a Fringe Benefit Deduction Code (Contra) was entered: it defines the salary level for the Payroll Transaction. |

| Account Type | A4 | The account type applicable to this loan as defined in Maintain Account Type Definitions {FCSC-21} that is valid for the subsystem ‘AR’ and linked to the ‘AR’ category (S)taff Loans. |

| Debtors Control | A4 + A8 | The control GLA of the account type as entered in Maintain Account Type Definitions {FCSC-21} will be display. |

| Salary Loan Suspense | A4 + A8 |

As applicable to this loan. |

| Interest Revenue | A4 + A8 | As applicable to this loan |

|

| Processing Rules |

|

|---|---|

| 1 | If the default value in the

Official Interest Rate or the Interest Rate for this Loan is

updated, the system will check all individual loan details in

Maintain Loan Details {FARS-2b2} and automatically set the

corresponding value equal to the new values, if the old value

for the individual was equal to the old default value. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 15-Jan-2007 | v01.0.0.0 | Frans | t129600 | Only ED's with Tax Boxes allowed |

| 11-Apr-2007 | v01.0.0.1 | Charlene van der Schyff | t133687 | new manual format. |

| 06-Jul-2009 | v01.0.0.2 | Charlene van der Schyff | t158351 | Edit language obtained from proof read language Juliet Gillies. |