|

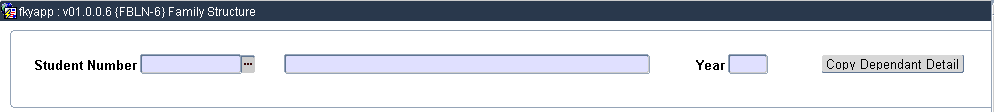

The family structure is captured and

maintained per student per year. Once the family stucture is

completed, the NSFAS means test can be performed. The means test is

calculated according to the NSFAS supplied formula, using the

applicable values from FBLN-1 to 5 in conjunction with the information

captured for the student on the family structure.

| Field | Type & Length |

Description |

|---|---|---|

| Student Number | N9 | Student number |

| Year | N4 | Year |

| Copy Dependant Detail | On click of this button, a new window will open

whereby all family members can be copied from one year to another

(click on copy all button) or family members can be copied individually

from one year to another by indicating which members must be copied

(tick box under copy and click on copy button) |

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Member Number | N2 | Enter the family member number |

| ID Number | A15 | Enter the family member ID number |

| Dependant Name | A40 | Enter the family member name |

| Relation | A5 | Enter the relationship. |

| Dependancy Reason | A30 | Enter a reason why this member is dependant. |

| Member Status | A1 | Indicate whether the family member is a tertiary student or not or deceased. Valid values: Y - Tertiary Student N - Non Tertiary Student D - Deceased |

| Income Type | A4 | The user will be able to choose from a list of values as maintained in {FBLN-4}. |

| Income per Year | N17.2 | Enter the income of this dependant. A system oprational definition must be set on {FCSM-1} for code 'MI' and subsystem 'BL'. If set to (Y)es, a validation will be done to ensure that the family income for at least one family member must be greater than zero. |

|

The calculation is done using the NSFAS means test.

TOTAL COST (A)

Estimated cost as maintained in {FBLO-4}

RECOMMENDED NSFAS AWARD = TOTAL COST (A) less TOTAL DEDUCTION (B).

If it is indicated in the type of residence field that

the student qualifies for a residence allowance (that is accommodation

not for the

institution’s account, thus the cost is not part of the estimated

cost and has not yet been taken into consideration) the

relevant accommodation

allowance will be added.

The user can only update the area code and the type of residence for the student in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Postal Code |

N4 | Postal code of student residencial area |

| Type of Residence Allowance |

N1 | The residence allowance is also determined by NSFAS

and must be updated on a yearly basis from a file that will be supplied

by NSFAS. This is done by running {FBLN-24}. Valid values for this field as defined by NSFAS

|

| The rest of the fields are display only fields. | ||

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 16-Oct-2006 | v01.0.0.0 | Amanda Nell | t133712 | New manual format. |

| 19-Sep-2007 | v01.0.0.1 | Charlene van der Schyff | t156162 | Proofread by ITS system owner not done. |

| 15-Dec-2010 | v01.0.0.2 | Christel van Staden | t170168 | Add family member status |