|

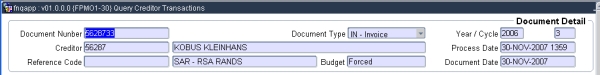

This option allows for the query of ALL CREDITOR DOCUMENTS;

| Field | Type & Length |

Description |

|---|---|---|

| Document Number | A15 | A unique number for this document. Pop up Menu - available on field Document Number.

|

| Document Type | A2 | Display the document type. The following document types

exist.

|

| Creditor and Name | N9 | The creditor related to this document, creditor codes are defined in option {FPMM-2}. |

| Financial Year/Cycle |

YYYY/MM | Displays the year and cycle of the document. When a document is created the year and cycle defaults from the current PM subsystem year and cycle. |

| Process Date |

DD-MM-YYYY HHMM | The default of this field is the current system date. |

| Document Date | DD-MM-YYYY | The document date as per original document. |

| Reference Code | A15 | A reference for any relevant information concerning a document. |

| Budget | Valid values are Sufficient, Forced or

Insufficient. This field value only comes into operation once

the document is committed. The following describes each value: Sufficient

The status during

creation of the record and before budget control was

done

OR

if budget control

was done and the GLA has sufficient funds then this

field will be "S".

Forced

A

user has forced budget control that where funds were not sufficient

during the budget control. A report of all forced records can

be

printed using option {FPMOR2-30}.

Insufficient

The program has

done budget control, the GLA has insufficient funds and the user did

not override the insufficient funds, the program will set this field to

insufficient. The user must remove insufficient funds record

or change

the expense GLA to a GLA that has sufficient funds.

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Originating Documents | ||

| ToD | A2 | Valid values are (O)rder/(G)RV if the Type of Document is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. |

| Document | A15 | The document number for the type of document specified in the previous field from which information was copied. |

| ToD | A2 | Valid values are (O)rder/(G)RV if the Type of Document is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. |

| Document # | A15 | The document number for the type of document specified in the previous field from which information was copied. |

| Description | A4000 | The

item description. Pop up Menu - available on field Item Detail.

|

| Unit | A8 | An eight-character description, e.g. Kg, Litre,

etc. |

| Unit Price | N15.4 | The currency value of one unit. |

| Financing | A1 | The financing flag indicates the

relationship/partnership of

the GLA's financing the item. The system supports the following

relationships:

|

| Paid/Received | A1 | The paid receive flag indicates the method by which the

item

will be received or paid. The system supports the following methods:

|

| Retain | A1 | Valid values are

(P)artial, (Y)es or (N)o. This field indicates the retain status of the items namely (N)o for all items not retained (P)artial for some of the items retained (Y)es for all the items retained. |

| Quantity | N10.3 | The number of units that must be paid or taken credit for. Unit can be up to 3 decimals. |

| Cost | N15.2 | Net total cost of the item in foreign currency. |

| Line Total | N15.2 | Net total for the item in local currency. |

|

| Field | Type & Length |

Description |

|---|---|---|

| IDT | A1 | Item Detail Type. Valid values are "M", "A", "U" or V. The field is not accessible to the user and the program will populate this value for the line. The following is a description of the values:

|

| GL Note | A30 | An optional note to accompany the GL-transaction. |

| Cost Centre/ Account |

A4/ A8 |

The GLA that will fund for the

expense Pop up Menu - available on field Cost Centre.

|

| Retain Status | A1 | Valid values are

(P)artial, (Y)es or (N)o. This field indicates the retain status of the items namely (N)o for all items not retained (P)artial for some of the items retained (Y)es for all the items retained. |

| Percentage | N3.2 | Displays the %split if the financing method is Percentage. This value indicates the funding contribution of a GLAto the item. This value range is between .0001 and 100.00, but the total of all item detail type "A" records for the line number cannot be more than 99.99 |

| Account Type | A4 | Display the Creditor Account Type as defined in option {FCSC-21} for the subsystem PM. |

| Budget Status | A1 | Valid values are Sufficient, Forced or

Insufficient. This value of the field is set when budget control is performed which happen on commit of a document. The following describes each value: Sufficient

The status during

creation of the record and before budget control was

done

OR

if budget control

was done and the GLA has sufficient funds then this

field will be "S".

Forced

A

user has forced budget control where funds were not sufficient

when budget control was performed. A report of all forced records can

be

printed using option {FPMOR2-30}.

Insufficient

The program has

done budget control, the GLA has insufficient funds and the user did

not override the insufficient funds, the program will set this field to

insufficient. The user must remove insufficient funds record

or change

the expense GLA to a GLA that has sufficient funds.

|

| Quantity | N10.3 | The number of units that must be paid or taken credit

for. Unit can be up to 3 decimals. If this is an item detail type "A" record and the distribution is "P" or "C" then the system will not allow any values into this field. An invoice can pay more units than the quantity order, if the item is not GRV'ed, A invoice quantity is only allwed to exceed the order quanity once thereafter is is not allowed. All other original document quantities cannot be more than the original document quantity.

|

| Cost | N15.2 | Cost is entered if the paid received method of

the document Monetary. Cost is the total VAT inclusive cost

value

before trade discount for the record in the creditor currency. The

syetm will adjust the value entered should the VAT indicator be set to

VAT exclusive on the item unit price. |

| Item Detail Total | N15.2 | Displays the Item Detail Total of the Item Detail Type, VAT inclusive, for this record, in local currency,. The calculation for Item Detail Total of this record is given currency of this record multiplied by currency rate. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 4-Dec-2007 | v01.0.0.0 | Kobus Kleinhans | t152121 | New manual format. |

| 26-Aug-2013 | v02.0.0.0 | Kenneth Bovula | t192621 | Increase the reference number length to 15 characters. |