|

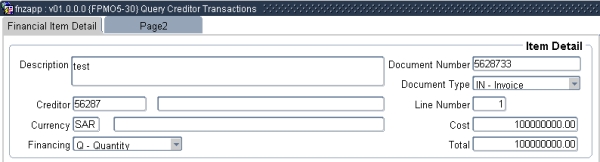

This applications is common to the applications in the PM - Accounts Payable module. This applications are normally not directly accessible from a menu but from Pop Up Menus on related fields in Accounts Payable options.

| Field | Type & Length |

Description |

|---|---|---|

| Description | A4000 | Displays the item description of the document being maintained or queried..

|

| Document Number | A15 | Displays the document number of the document being maintained or queried. |

| Document Type | A2 | Displays the document type of the document being maintained or queried |

| Creditor and Name | N9 | The creditor must be defined on option {FPMM-2}, TAB - Creditor Detail. |

| Line Number | N5 | The item Line Number, running sequentially from 1 onwards and is controlled by the system. The field is not accessible to the user |

| Currency and Description | A3 |

|

| Financing | A1 | The financing flag indicates the

relationship/partnership of

the GLA's financing the item. The system supports the following

relationships:

|

| Cost | N15.2 | Diosplays the item quantity multiplied by the VAT inclusive unit price of the item in creditor currency. |

| Total | N15.2 | Displays the VAT inclusive Item Total for this record, in local currency. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Cost Centre and Account | A4 + A8 | The GLA that funding the expense, the cost centre and account name will be displayed. |

| Quantity | N10.3 | The number of units that must be paid or returned for credit. Unit can be up to 3 decimals. |

| % Split | N3.2 | This will only be used if the financing method

is "Percentage". This value indicates the

funding partner contribution to the item partnership. This value

range is between .0001 and 99.99, but the

total of all

item detail types for the item must alwyas add up to 100.00

|

| Account Type | A4 | The account type on which the line will be processed.

Accounts type are linked to control accounts and which will determine

the control account to which the line will be processed. Account Types

are defined in option

{FCSC-21}. A list of values of creditor account types are available on the field..

|

| % App | N1.2 | Value range of this field is 0 to 1.000.

|

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will default the reference code, as entered on the document detail screen plus the order number and creditor name into this field, depending on values available. The user can update. |

| Cost | N15.2 | The system calculations are as follows for each distribution and item detail type: Financing Method "Quantity" If VAT is inclusive

Financing Method "Percentage" If VAT is inclusive

Financing Method "Cost"

|

| IDT | A1 | Item Detail Type. Valid values are "M", "A", "U" or V. The field is not accessible to the user and the program will populate this value for the line. The following is a description of the values:

|

| Sequence | N10 | A unique sequence number, allocated by the

system during commit, for an item detail type "M" or "A"

record. The

VAT records (item detail type "V") for an item detail type "M" or "A"

record will have the same sequence number as in the "M" or "A" record. Second Originating Document information This is a display field only during creation of a document and cannot be changed by the user. |

| User | A8 | The User that entered the transaction. |

| Process Date | DD-MON-YYYY HHMI | The processed date will be displayed. The field is not accessible to the user. |

| Budget Indicator | A1 | Valid values are Sufficient, Forced or

Insufficient. This field value only comes into operation once

the document is committed. The following describes each value: Sufficient

The status during

creation of the record and before budget control was

done

OR

if budget control

was done and the GLA has sufficient funds then this

field will be "S".

Forced

A

user has forced budget control that where funds were not sufficient

during the budget control. A report of all forced records can

be

printed using option {FPMOR2-30}.

Insufficient

The program has

done budget control, the GLA has insufficient funds and the user did

not override the insufficient funds, the program will set this field to

insufficient. The user must remove insufficient funds record

or change

the expense GLA to a GLA that has sufficient funds.

|

| Budget User | A8 | User that performed the Budegeting Function. |

| Audit Date | DD-MON-YYYY | The date this record was printed on an audit report. This date will be null up to the point where the audit report {FPMMR1 1} was run with the parameter reprint (N)o. The field is not accessible by the user. |

| Post Date | DD-MON-YYYY HHMI | The date this record was posted to the General Ledger. This date will be null up to the point where the post report {FGLP-3} was run. The system will default 01-JAN-1980 into this field if the records are not allowed to post to the General Ledger. The field is not accessible to the user. |

| Year/Cycle | YYYY/MM | Displays the year and cycle of the document. When a requisition document is created the year and cycle defaults from the current PM subsystem year and cycle. If the user is linked to the restriction FPFD then the user is allowed to change the year to the next year using the "Document Detail" application. |

| Trade Discount | N15.2 | Displays the total Trade Discount value of the Item Detail Type for this record, in foreign currency. The calculation for Trade Discount of this record is cost of this record multiplied by Trade Discount Percentage divided by 100. |

| Given Currency | N15.2 | Displays the total Given Currency Value of the Item Detail Type for this record, in foreign currency. The calculation for given currency of this record is price/cost minus Trade Discount, both of this record. |

| Local Value | N15.2 | Displays the total value before VAT of the Item Detail Type for this record, in local currency. The calculation for local currency of this record is item detail total minus VAT, both of this record. |

| Process Date | DD-MON-YYYY HHMI | The processed date will be displayed. The field is not accessible to the user. |

| VAT | N15.2 | Displays the total VAT value for this record of the Item Detail Type, in local currency. The calculation for VAT of this record is Item Detail total of this record multiplied by VAT rate divided by (1 plus VAT rate). |

| Total | N15.2 | Displays the Line Total of the Item Detail Type, VAT inclusive, for this record, in local currency,. The calculation for Item Detail Total of this record is creditor currency of this record multiplied by currency rate |

|

Processing Rules for this Block (delete if not applicable).

| Field | Type & Length |

Description |

|---|---|---|

| Originate from | ||

| Document Number | A15 | The document number for the type of document specified in the previous field from which information was copied. |

| Document Type | A2 | Valid values are (O)rder/(G)RV if the Type of Document is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. |

| IDT | A1 | Valid values are "M", "A", "U" or V. The

field is not accessible to

the user and the program will populate this value for the

line. The

following is a description of the values:

|

| Line Number | N3 | |

| Sequence | N10 | |

| Document Detail | ||

| Document Number | A15 | |

| Document Type | A2 | |

| IDT | A1 | Valid values are "M", "A", "U" or V. The

field is not accessible to

the user and the program will populate this value for the

line. The

following is a description of the values:

|

| Line Number | N3 | The item Line Number, running sequentially from 1 onwards and is controlled by the system. The field is not accessible to the user |

| Sequence | N10 | A unique sequence number, allocated by the

system during commit, for an item detail type "M" or "A"

record. The

VAT records (item detail type "V") for an item detail type "M" or "A"

record will have the same sequence number as in the "M" or "A" record. |

| Cancellation Detail | ||

| Cancelled | A1 | Valid values are (Y)es or (N)o. |

| Cancel Date | DD-MON-YYYY | The date when this item was cancelled. |

| Cancel Reason | A6 | A valid cancel reason code and the description will display, as defined in option {FPMC-8}. If the above cancelled field is (Y)es a reason code will be displayed, otherwise this value will be null. |

| Cancel User | A8 | The User that cancelled this line. |

| Payment Detail | ||

| Payment Type | A2 | Valid values are:

|

| Payment Document | A15 | Document number against which this line was paid. |

| Payment Date | DD-MON-YYYY | The date of the payment document. |

| Additional Information | ||

| Transaction Type | N4 | The Transaction Type code, as defined in option {FCSO-7}, used to process the document. |

| Control GLA | A4/A8 | Dispalys the creditor control GLA used to process the line on the document |

| Job Number | N9 | Job numbers are defined under option

{FJCO-1}. If

entered,

the GLA of the job number will be the default for the expense GLA field

of this Block.

|

| VAT 201 Cycle | YYYYMM | The VAT report cycle as allocated by the option {FGLOR2-22} VAT 201 Return. The field is not accessible to the user. |

| Store | A2 | Store Code for store items. |

| VAT Indicator | A1 | Valid values are Father, Childless. The field

is

not accessible to the user and the system will allocate a value to the

field as follows: (F)ather The VAT rate and the apportionment percentage is greater than zero for Item Detail Type "M" or "A" record. (C)hildless The apportionment percentage is zero for Item Detail Type "M" or "A" records. |

| Asset Invoice | A1 | Valid values are (Y)es

or (N)o.

The system

will set this indicator to (Y)es

if the expense GLA is

linked to the asset account category as defined on the system

operational definition codes AV and AW, both on subsystem CS, else

(N)o. These

values can be either between 410 and 419 or 890 and 899,

i.e. expenditure on fixed assets.

|

| Approval Type | A1 | Indicates the method of approval (U)ser or System(M) |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 03-Dec--2007 | v01.0.0.0 | Kobus Kleinhans | t144148 | New manual format. |

| 13-Mar-2009 | v01.0.0.1 | Kobus Kleinhans | t152121 | Proofread System Owner. |