Query Tax Codes {FPRC-21}

Tax Certificates are generated

with totals per Tax Code as prescribed by the various Receivers of Revenue

of each country.

Tax Codes are assigned to Salary Transactions during the Full Salary

Calculation {FPRN-2} or the Single Salary Calculation

{FPRN-3}, as entered per Global Earning /

Deduction Detail {FPRG-7} or Individual Earnings

/ Deductions {FPRI-2}.

Note that the following additional codes also display in this screen.

Tax Code “9999” (Non IRP5 Total) used for transactions that are not reported on the Tax Certificate.

For South African Clients:

1. Tax Code "9998" used for Retirement Fund Reform calculation, introduced with effect from 1st March 2016. This Tax Code is programmatically converted to the applicable code during the Full Salary Calculation or the Single Salary Calculation process, depending on whether the Retirement Fund is Pension, Provident or R.A., when used in conjunction with Calculation Method 'X' {FPRG-25}

2. Reason Codes why no PAYE has been deducted from an employee which are reported on IT3a Tax Certificates.

For Ghana Clients

1. Tax code '13' is used for Overtime Payments. This is used to automate the calculation of PAYE on Overtime Payments. A different tax rate is applied for each of the following catergories; 'J' Junior, 'S' Senior, 'N' Non Resident which is used by calc method 'i' to determine the calculation path.

Fields in the option:

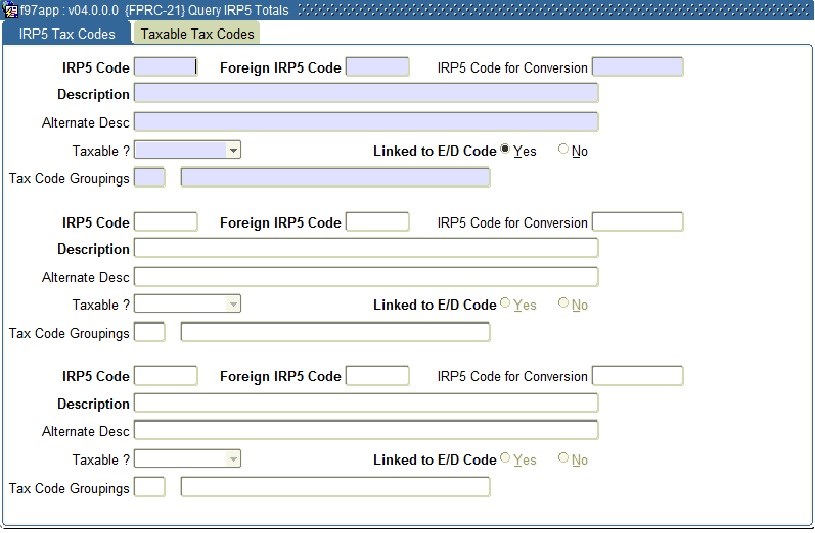

Panel Box 1:

Block

Description

This Block cannot be

updated by the user and displays the following information:

|

Field |

Type |

Description |

|

IRP5 Code |

N4 |

This is the tax box code as supplied by the Receiver of Revenue.

|

|

Foreign IRP5 Code |

N4 |

This tax box is RSA specific and is supplied by SARS (RSA). This

tax box refers to income received whilst working outside the borders of the RSA. |

|

IRP5 Code for Conversion |

N4 |

This is the Tax Code that will be used for reporting purposes on

the Tax certificate generated. |

|

English Description |

A80 |

This is the English description for the specifc

tax box. |

|

Alternate Description |

A80 |

This is the alternate languge

description for the specific tax box. |

|

Taxable/Non-Taxable |

A1 |

Is this tax box taxable Yes or No |

|

Linked To E/D Code? |

A1 |

May this tax box be linked to an ED code. |

|

Tax Code Groupings |

A2 |

This indicator groups tax boxes into the correct grouping for exampl Normal Income, allowances, lumpsums,

tax deductions etc. These groupings determine both the printing order on

tax certificates as well as tax calculations. |

Example:

|

|

Processing |

|

|

|

This screen is populated by AdaptIT and no field on this

screen can be maintained by the user. |

See

Also:

- Procedures:

- None

History of Changes

|

Date |

System Version |

By Whom |

Job |

Description |

|

17-Oct-2006 |

v01.0.0.0 |

Amanda Nell |

t134030 |

New manual format. |

|

17-May-2007 |

v01.0.0.0 |

Allie de Nysschen |

t134030 |

New Development |

|

14-Aug-2009 |

v01.0.0.1 |

Charlene van der Schyff |

t161012 |

Edit language obtained from proof read language Juliet Gillies. |

|

09-Dec-2015 |

v03.0.0.0 |

Sakhile Ntimane |

t209237 |

Adding new field and updating image |

|

30-Jan-2017 |

v04.0.0.0 |

Sakhile Ntimane |

t219225 |

Change image to Integrator4. |

|

09-Oct-2017 |

v05.0.0.0 |

Sthembile Mdluli |

t220368 |

Convert image to intergrator 5. Panel Box 2 information is excluded in INT 5. |

| 06-Mar-2020 | v04.1.0.0 | Kerrylee Naidoo | t236853 | New tax calculation for Ghana clients for Overtime Payments |