|

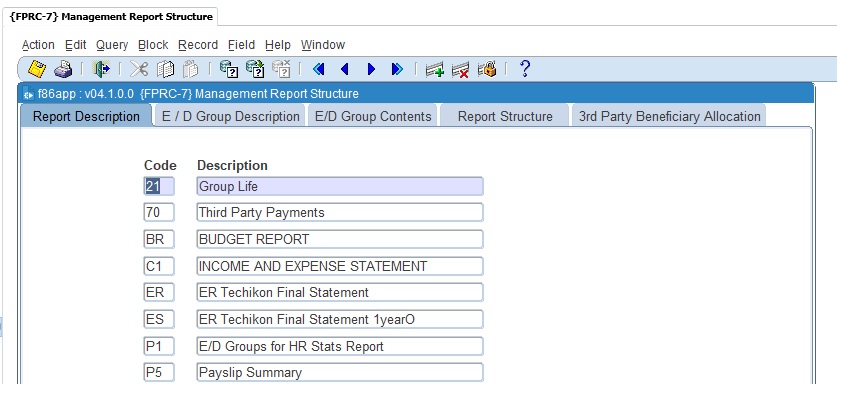

This menu option allows the user to define structures for printing a Management Report {FPRNR2-22}. It is also used to define the Commission Percentage to be deducted from a 3rd Party Payment and to define the GLA into which the Commission when deducted must be posted.

The concept is simple: the standard

Payroll reconciliation reports are oriented towards individual earnings

or deductions: however, management has a need for flexible reporting on

salary expenditure, with earnings and deductions being grouped

together in various ways for various reports. The user must

therefore, be able to define:

-

a heading or description for each report

-

a description or name for the various Earning / Deduction groups

-

the contents of each Earning / Deduction group

-

the structure of each report, i.e. the various groups that will belong

to a particular report.

- report code linked for 3rd

Party Payment

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | A unique two-character code for each report. |

| Description | A35 | Supply a suitable description for the report e.g. “Council's Contributions”. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Group Code | N4 | A unique code for each group. |

| Description | A35 | Supply a suitable description for the Earning / Deduction group e.g. “Pension Funds”. |

|

In this Block, the user

defines

which Earnings / Deductions belong to each group as defined in Block 2:

| Field | Type & Length |

Description |

|---|---|---|

| Group Code | N4 | One of the codes as defined in Block 2. When the code is entered, the description is displayed. |

| E/D Code | A4 | A valid Earning / Deduction Code {FPRG-6}. When

the code is entered, the

description is displayed. There is no limit to the number of Earning / Deduction Codes that can be linked to a group. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | A code as defined in Block 1. When the code

is entered, the

description is displayed. The <LIST> command

will show valid

codes. |

| E/D Group Code | N4 | A code as defined in Block 3. When the code

is entered, the

description is displayed. There is no limit to the number of Earning / Deduction Groups that can be linked to a report. A particular group can be used in more than one report. The user should note that nothing prevents an Earning or Deduction from being used in more than one group: this means that it is possible to link an Earning / Deduction code twice to the same report. The Management Report Structure {FPRCR1-21}, which prints the structure of a report based on the information in the foregoing Blocks, is useful for identifying such duplications of transactions. |

|

| Field | Type & Length |

Description |

|---|---|---|

| ED Group | N4 | List of value will include all Group codes as defined

in Block 3. When the code is entered, the

description is displayed. If user execute a general query the program will display all the Group Code define on block 3 |

| ED Code |

A4 | List of value will include ED Codes and description

from block 3. When ED Group is entered, this field will display all ED

Code linked to the ED group selected above If user execute a general query the program will display all the ED Code linked to ED Group as define on block 3 |

| Commission to be Deducted | N6 | Enter commission (N6) Reduce the 3rd party payment amount by a commission percentage where commission is earned for the collection and payment of monies owing. The deduction calculation will be done on {FPRN-30} |

| GL Cost Center | A6 | List of Value will include cost centre and description as defined on {FCSO-1}. When the code is entered, the description is displayed. |

| GL Account | A8 | List of Value will include cost centre and description as defined on {FCSO-3}. When the code is entered, the description is displayed |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 17-Oct-2006 | v01.0.0.0 | Amanda Nell | t134034 | New manual format. |

| 13-Aug-2009 | v01.0.0.1 | Charlene van der Schyff | t161012 | Edit language obtained from proof read language Juliet Gillies. |

| 12-Oct-2012 | v03.0.0.0 | Frans Pelser | t185565 | E/D Group made N4 |

| 10-Jul-2017 | v03.0.0.1 | Sakhile Ntimane | t222536 | Third Party Payment via ACB Tape |

| 20-Mar-2020 | v04.1.0.0 | Nomhle Lubisi | t242048 | Added the 3rd Party Beneficiary Allocation block and new screen print for INT4.1 |